Scott Melker: Bitcoin shows bullish signs, but low volume raises caution flags

Bitcoin recently flashed some key bullish indicators, but low volume suggests that big traders are still cautious.

Bitcoin is finally showing some bullish signs. On Thursday, April 18, Scott Melker, known as The Wolf Of All Streets to his many followers, pointed out that Bitcoin (BTC) closed above the 50-day simple moving average with a strong candle. While the price corrected to $84,349, it is still above the 50-day SMA level of $84,202.

This action hasn’t happened since February 3, indicating a potential positive shift in momentum. However, other indicators raise doubts. For one, while Bitcoin is trading above the 50-day SMA level, it is still below the 50-day exponential moving average, which is at $85,328.

Low volumes mean bad news for Bitcoin

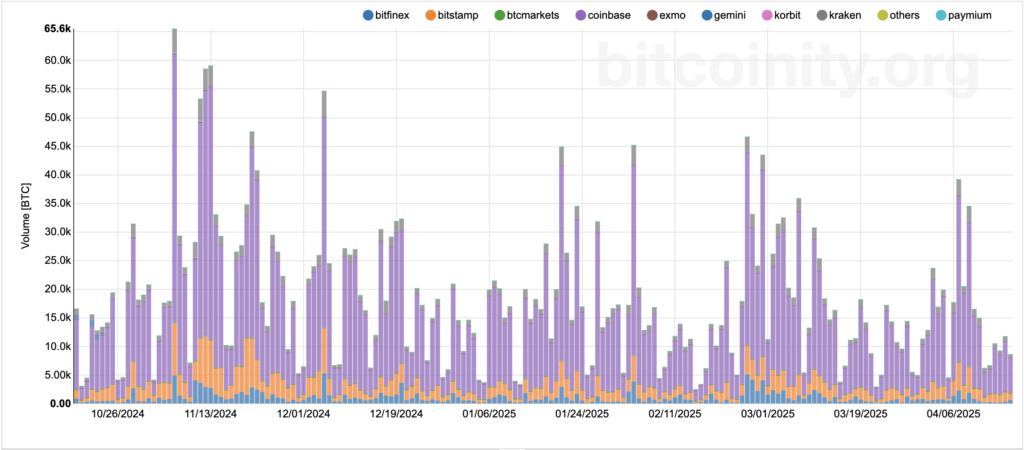

The token broke through this level several times over the past week but was unable to sustain the momentum. At the same time, Melker points out that low trading volume suggests that buyers are still reluctant to join the market.

For instance, trading volume on major exchanges amounted to about 8,000 BTC on April 17, significantly down from last week’s levels. On April 9, for example, trading volume on major exchanges was around 26,000 BTC.

This suggests that investors are likely waiting for positive macro news, which has been lacking in recent weeks. Notably, the ongoing trade war with major U.S. partners is causing fears over a potential economic recession. At the same time, the Federal Reserve is slow to add support, fearing that U.S. tariffs, especially on China, would give rise to domestic inflation.

In any case, Bitcoin will face resistance at the $85,000 level, which corresponds to a long-term descending channel forming from its January all-time high. And if volumes continue to decline, the asset risks falling to the channel’s midline at around $75,000.