Sei price may crash 22% and then rebound

Sei price continued its strong downtrend today, June 17, as the ongoing crypto crash accelerated.

Sei (SEI) token dropped to $0.1660, its lowest level since April 17, and is now down more than 40% from its May high. From its November 2023 peak, the token has plunged by over 77%.

Despite the bearish price action, Sei’s underlying fundamentals remain solid. According to data from DeFi Llama, the network’s total value locked has reached an all-time high of over 3.08 billion SEI, up significantly from 715 million at the start of the year.

Most decentralized applications on the Sei network have seen growing adoption. Yei Finance, a lending platform modeled after Aave (AAVE) has accumulated over $295 million in assets, while Takara Lend has secured $51 million.

Sei’s stablecoin supply has also continued rising this year. It has over $200 million in stablecoins, up from $1.2 million in March. Most of the stablecoins in the ecosystem are USDC, which has an 83% market dominance.

Sei’s decentralized exchange volume has remained steady over the past few months. Protocols built on Sei handled over $640 million in May, up from $612 million in April and $407 million in March. Key DEX platforms on Sei include Sailor, Dragon Swap, Uniswap, and Jelly.

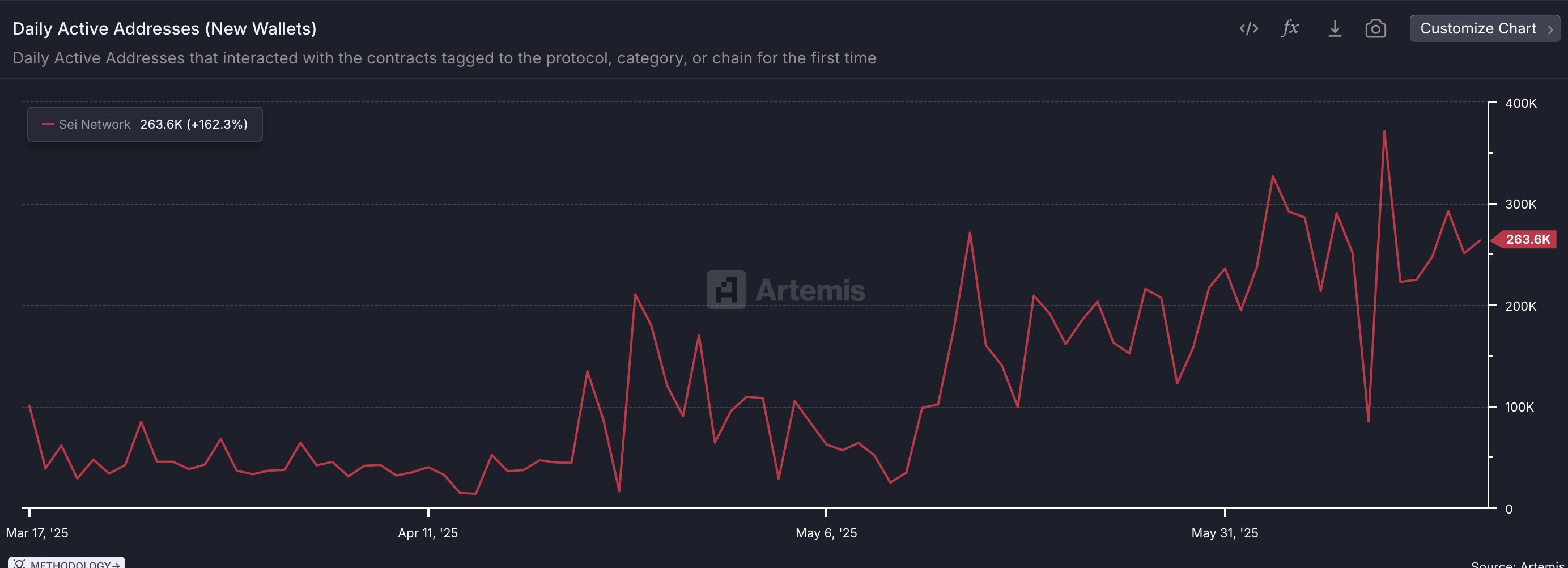

Additional data shows that more users are joining the Sei network. As the chart below shows, the daily active addresses has risen to 263.6k from 61,000 in March. Also, data shows that transacting users have jumped in the past few months.

Sei price technical analysis

The daily chart shows SEI has been trending sharply lower since its May 11 peak of $0.2747. The decline has accelerated alongside broader crypto market weakness.

Price has now fallen below all major moving averages, while the MACD and Relative Strength Index are both pointing downward, indicating bearish momentum.

SEI is currently approaching a potential double-bottom formation around the $0.1295 level, its lowest swing from April 8. If this support holds and the pattern completes, a rebound could target the neckline resistance at $0.2800.