Sei spikes 25%, breaks key resistance as bulls eye $0.50

Sei, the layer-1 blockchain for high-frequency crypto trading, saw its native token’s price jump more than 25% in the last 24 hours.

On Sept. 25, Sei (SEI) rose from an intraday low of $0.366 to hit a high of $0.471 earlier in the day across major exchanges.

This is the highest level the token has been since June 12, with its market capitalization leaping to $1.6 billion, positioning it as the 59th largest digital asset globally, according to CoinGecko data.

The price surge came alongside a 187% rise in its daily trading volume, currently hovering around $523 million. Further, Coinglass data shows that SEI’s daily open interest was up 34.4% to $170.3 million when writing, pointing to heightened investor activity fueling SEI’s ongoing rally.

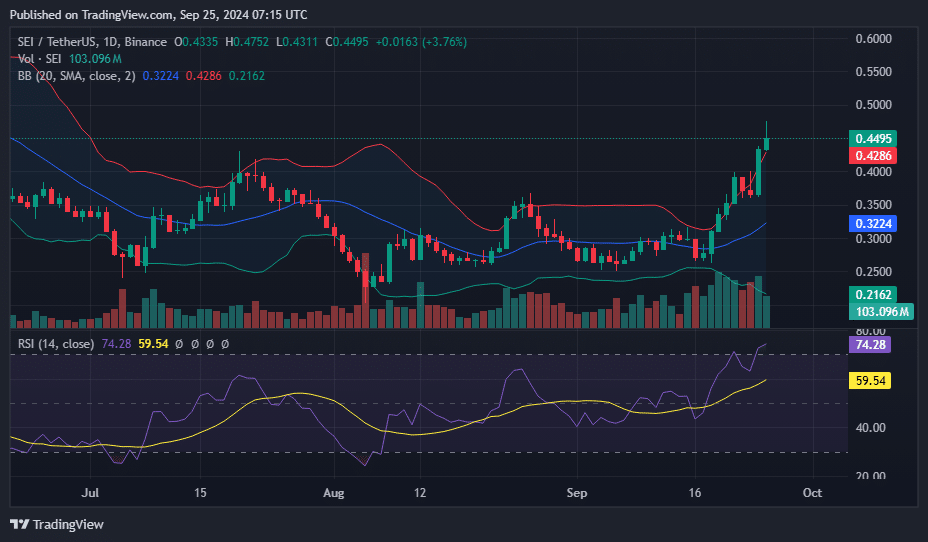

On the 1-day chart, SEI had broken out of a falling wedge pattern, a technical setup that typically signals further upside potential.

It has also broken the upper Bollinger Band, which stands at $0.4503, indicating that upward momentum remains strong.

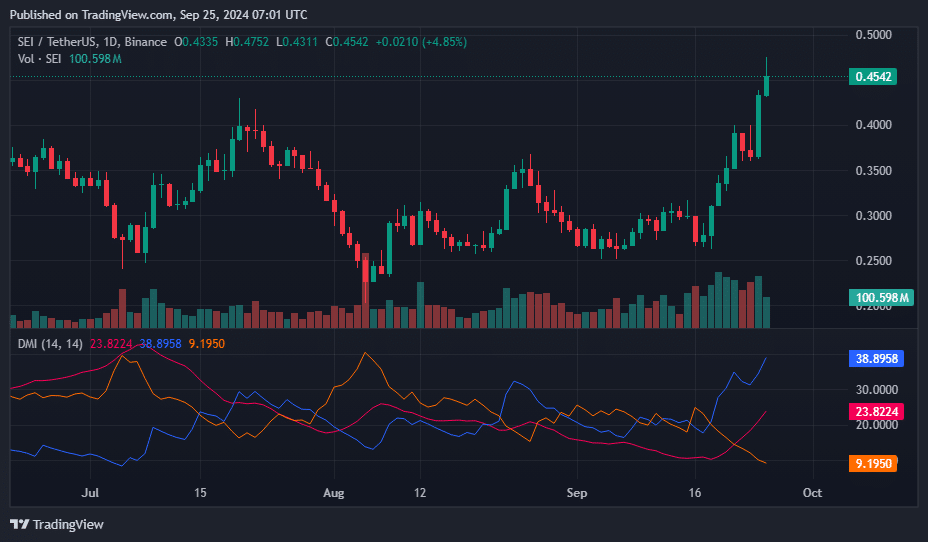

The Directional Movement Index shows increasing bullish momentum, with a rising +DI and a falling -DI, indicating reduced selling pressure. At the same time, the Average Directional Index is climbing, suggesting that the previously weak bullish trend is gaining strength.

Given the current trend, traders should keep an eye on the $0.50 mark, which could serve as the next psychological resistance. A successful breach of this level, combined with strong volume, might push the price toward $0.55 or higher.

However, the overbought Relative Strength Index at 74 signals the possibility of a near-term correction or consolidation. In case of a reversal, the middle Bollinger Band around $0.3224 may serve as a key support level.

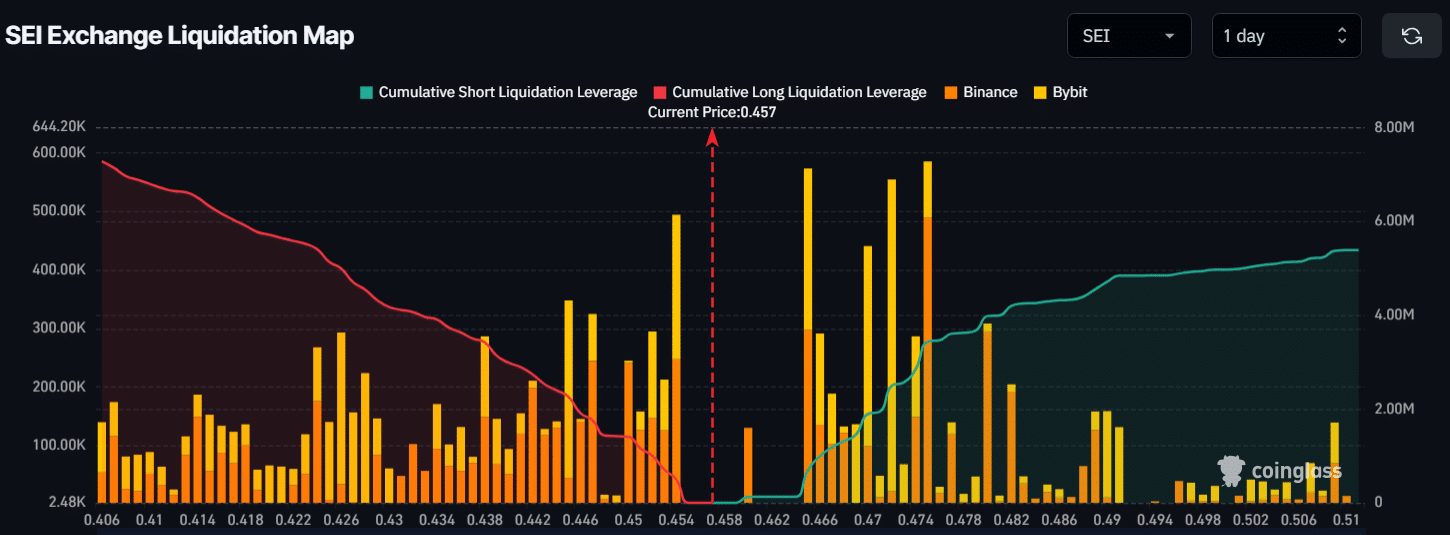

Major liquidation levels

Currently, the key liquidation thresholds for SEI are around $0.454 on the downside and $0.475 on the upside, with significant leverage among intraday traders at these levels, according to Coinglass.

If SEI drops to $0.454, nearly $494.47K in long positions could be liquidated. Conversely, a rise to $0.475 could lead to the liquidation of approximately $3.44 million in short positions.

At press time, bulls seemed to be in control, with the potential to trigger liquidations of short positions at higher levels.