Semler Scientific unveils strategy for Bitcoin Treasury

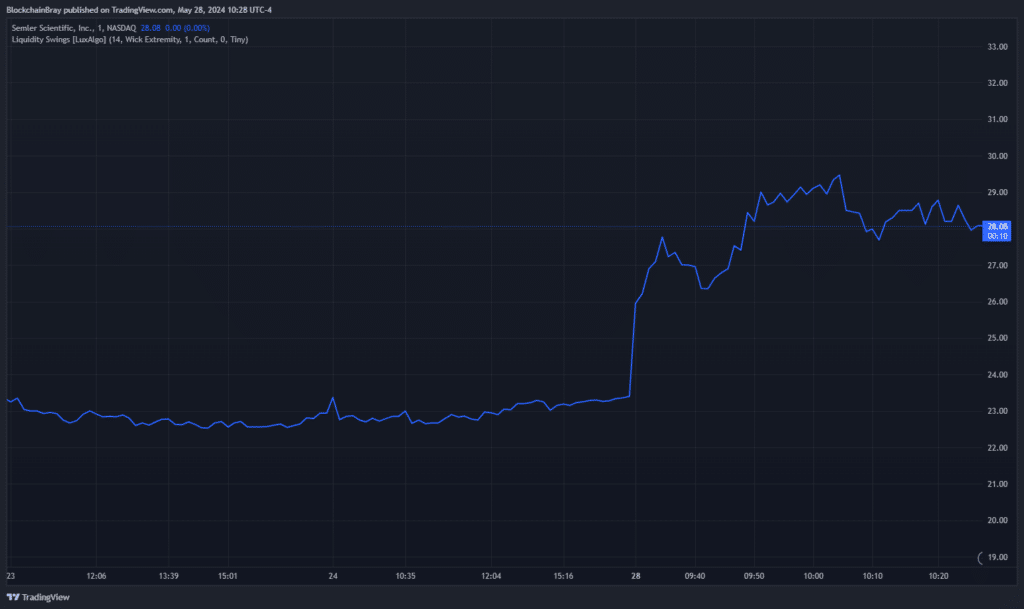

Semler Scientific ($SMLR) disclosed the purchase of 581 bitcoins for its treasury, sending its stock price higher by 25% in early U.S. trading hours Tuesday.

According to its most recent earnings statement, the company, which had a market cap of less than $200 million before this morning’s price rise, had cash and cash equivalents of $62.9 million as of the end of the first quarter. It had first-quarter revenue of $15.9 million and operating cash flow of $6.1 million.

According to this morning’s press release, Semler purchased 581 bitcoins (BTC) for $40 million, suggesting an average price of about $68,850 per token.

“Bitcoin is now a major asset class with more than $1 trillion of market value,” said company Chairman Eric Semler. “We believe it has unique characteristics as a scarce and finite asset that can serve as a reasonable inflation hedge and safe haven amid global instability. We also believe its digital, architectural resilience makes it preferable to gold, which has a market value of approximately 10 times that of bitcoin.”

Today’s 25% gain has brought the stock to just a 2% decline year-over-year.