Sen. Warren advises 75bps Fed cut on recession fears

Despite rhetoric about a strong U.S. economy, three Democratic Senators urged the Federal Reserve to implement an aggressive monetary policy shift.

Crypto-skeptic U.S. Senator Elizabeth Warren of Massachusetts called on the Federal Reserve and its chair, Jerome Powell, to slash interest rates by 75 basis points to curtail recession risks. Warren’s letter, co-signed by fellow Senators Sheldon Whitehouse and John Hickenlooper, warned of potential economic declines that smaller funding cuts may usher in.

If the Fed is too cautious in cutting rates, it would needlessly risk our economy heading towards a recession. A number of economists have warned of this risk since July… The Committee must consider implementing rate cuts more aggressively upfront to mitigate potential risks to the labor market.

Sen. Elizabeth Warren to Fed on rate cuts

The document, dated Sept. 16, was issued less than 48 hours before the next Federal Open Market Committee meeting on Wednesday, Sept. 18.

Markets expect Fed chair Jerome Powell to announce a dovish pivot at the FOMC meeting, but the exact rate cut preferred by the central bank was unclear at press time.

What are the odds?

The CME FedWatch tool showed a 61% probability of a 50 bps cut and a 39% probability of a 25 basis-point reduction. Last week, the same tool gave a 14% likelihood of a 50 bps interest rate slash.

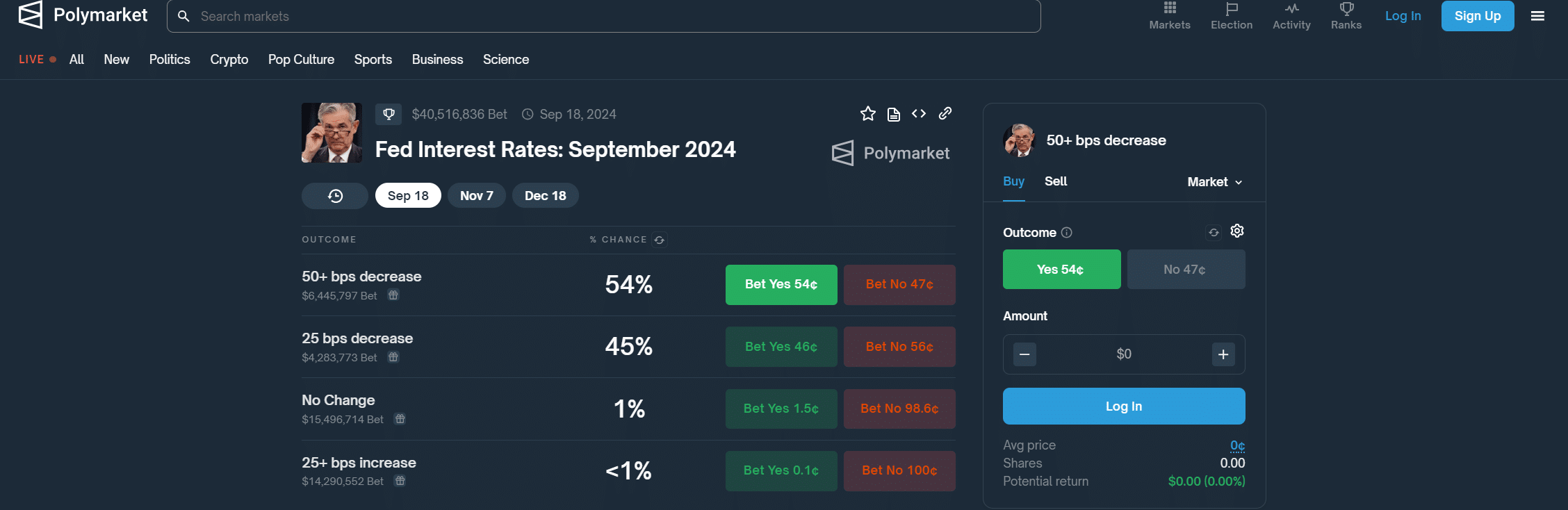

The 50 bps option also held sway on crypto prediction venues. Polymarket data noted odds of 53% for a 50 basis points announcement, followed by 45% for 25 bps. Previously, users predicted a 78% chance of a 25 bps pivot. Bettors had wagered over $40.5 million via the Polygon-based platform on this month’s FOMC decision.

Fed cut impact on crypto market

If the Fed matched expectations and announced a fund rate cut, experts believe liquidity would flow into risk assets like cryptocurrencies. Market participants still debated how an aggressive or modest pivot might indicate the Fed’s outlook, with the former suggesting recession concerns and the latter pointing to a firmer grip on inflation.

Horizen Labs CEO and co-founder, Rob Viglione, told crypto.news that a Fed rate cut seemed likely to propel a bullish Q4 for digital assets like Bitcoin (BTC), and Ethereum (ETH). The fourth quarter has historically recorded higher crypto prices than in mid-late Q3.

In the short term, we could see a price surge, especially in Ethereum and Bitcoin, though it may also bring heightened market volatility. Over the long run, a prolonged low-rate environment could encourage greater innovation and investment in blockchain technology and crypto-related startups.

Rob Viglione, Horizen Labs CEO and co-founder