Shiba Inu burn rate grows as a rare risky pattern forms

Shiba Inu is stuck in a deep bear market after falling by over 71% from its highest level this year, making it one of the top laggards in the crypto industry.

Shiba Inu (SHIB) was trading at $0.000013 on Tuesday, Sept. 17, as third-party data showed its demand was waning.

According to CoinGecko, SHIB’s 24-hour volume was just $177 million, significantly lower than Pepe’s (PEPE) $747 million and Dogwifhat’s (WIF) $290 million. SHIB has also been outpaced by smaller tokens like Baby Doge Coin and Neiro, which had $205 million and $364 million in volume, respectively.

Additional data reveals that Shiba Inu’s open interest in the futures market has dried up. It stood at $24 million, where it has remained for the past few months, down from the year-to-date high of $137 million.

Shiba Inu’s price action is likely influenced by significant changes in the meme coin industry over the past 12 months. The biggest shift has been the launch of Pump.fun and SunPump, which have simplified the process for developers to launch their own meme coins.

Pump.fun meme coins have accumulated a market cap of over $500 million, while SunPump tokens have reached a valuation of over $514 million. Some of the most popular meme coins among traders are Sundog, Tron Bull, Dogwifhat, Bonk, and Brett.

Shiba Inu’s price has also lagged despite the network’s continued token burns. According to Shibburn, the burn rate in the last 24 hours jumped by 440% to over 28.2 million coins. As a result, the total number of burned coins has reached over 410 trillion.

In theory, token burns are seen as positive catalysts for a cryptocurrency, as they reduce the number of coins in circulation.

Meanwhile, Shiba Inu’s underperformance is likely due to the weak growth of its ecosystem. Data compiled by DeFi Llama shows that Shibarium, its Layer 2 network, has attracted just $1.17 million in assets while ShibaSwap has $15.64 million.

Shiba Inu forms risky pattern

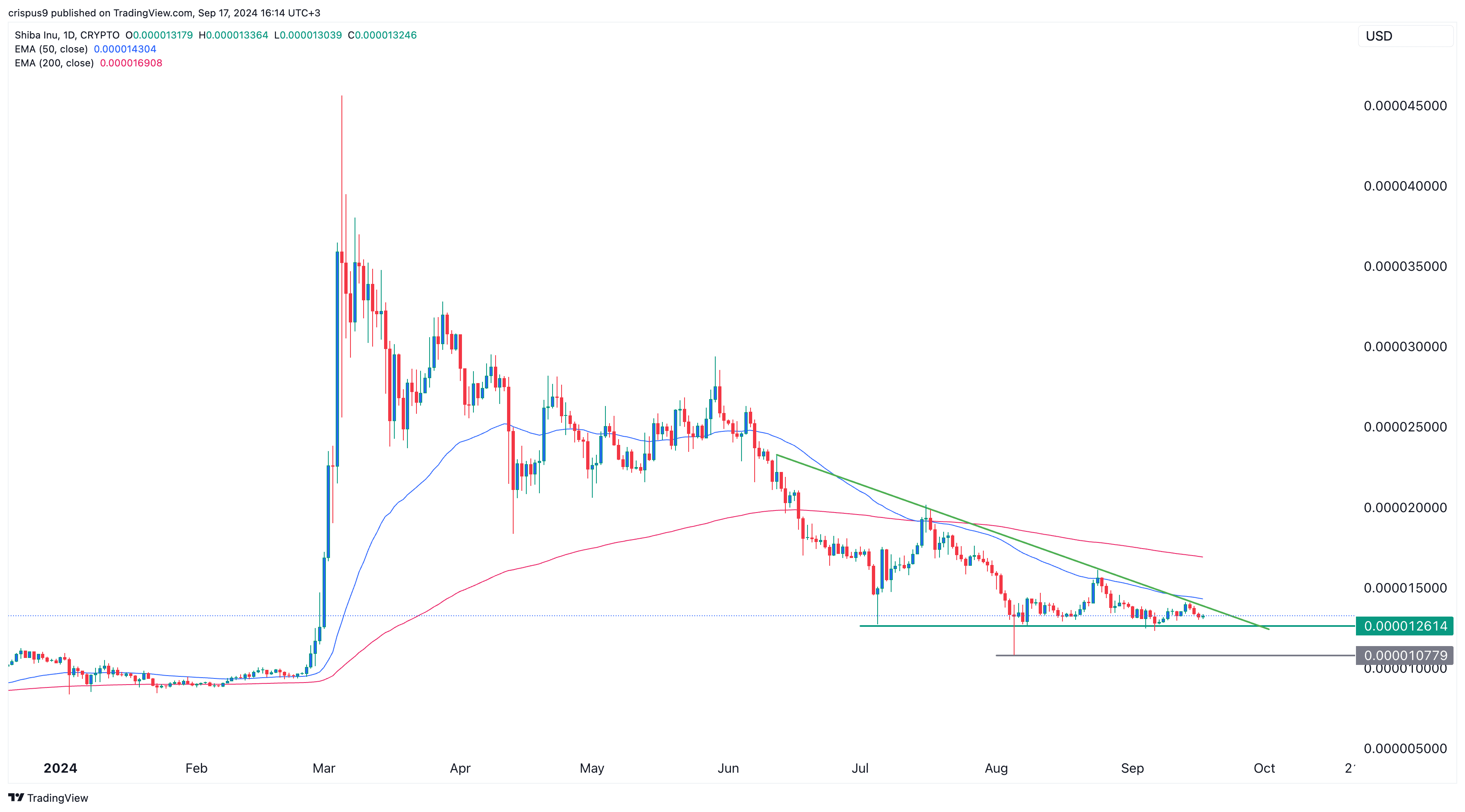

SHIB formed a death cross in July as the 200-day and 50-day moving averages made a bearish crossover, with the price dropping by over 30% since then.

Shiba Inu has also formed a descending triangle pattern, with the lower side at $0.0000126. In technical analysis, a descending triangle is considered a highly bearish chart pattern.

Therefore, there is a risk that the token will experience a bearish breakout as the triangle nears its confluence. If this happens, it could drop to the next key support level at $0.000010, its lowest swing on Aug. 5, which is 20% below the current level.