Shiba Inu price: can new addresses spark a recovery?

Shiba Inu price is holding firm above a critical daily support level, with on-chain data showing growth in new wallet addresses. The combination of strong structural support and steady network expansion suggests the asset may be entering an accumulation phase before a potential reversal toward higher resistance.

- Support Holding: Price remains steady above the value area low, confirming strong demand.

- Bullish Structure: Higher lows intact, signaling sustained upward momentum.

- On-Chain Strength: New wallet growth indicates rising investor confidence and reduced selling pressure.

After months of consolidation, Shiba Inu’s (SHIB) price action has stabilized around the value area low of its current trading range. The level has been tested multiple times and continues to hold, signaling that buyers remain active in defending this key zone.

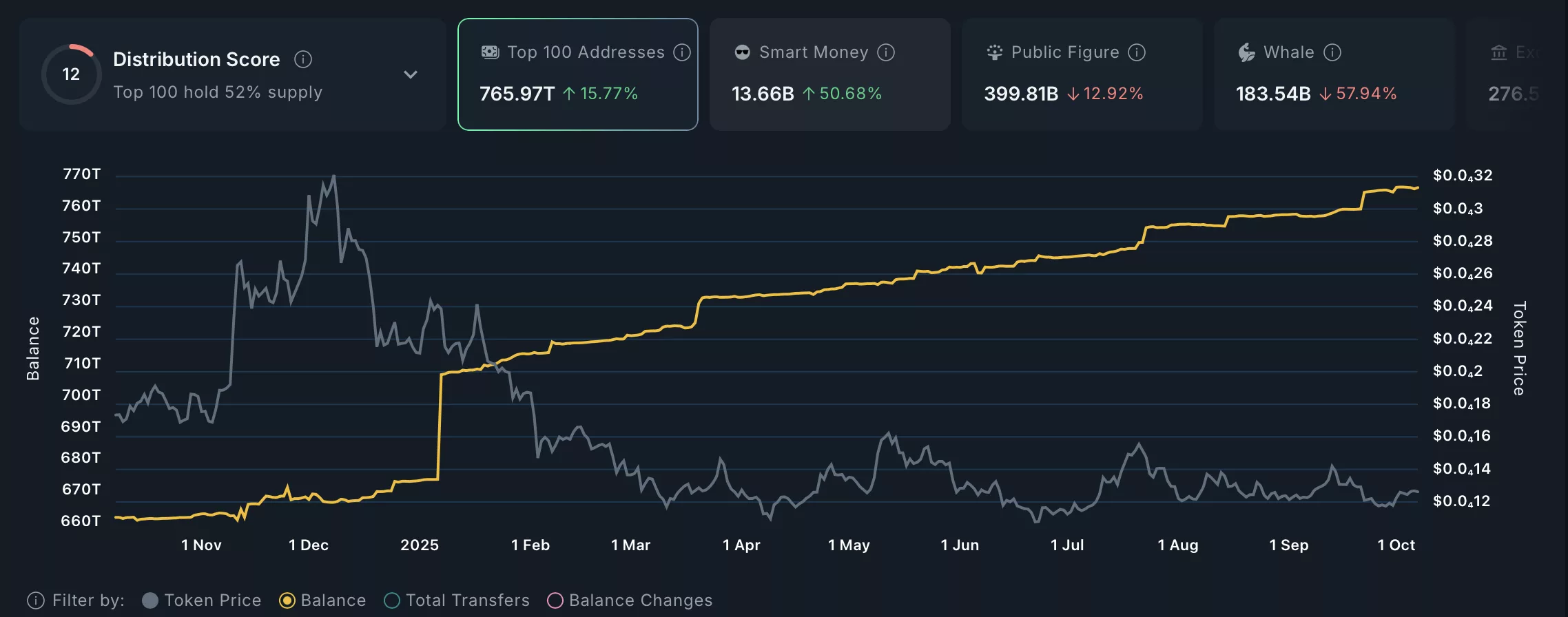

At the same time, an uptick in new wallet addresses and overall holder activity suggests that retail and mid-term investors are gradually accumulating positions in anticipation of a bullish recovery. Supporting this outlook, Shiba Inu is eyeing a potential rebound as its token burn rate surges more than 7,000%, reducing circulating supply and reinforcing bullish sentiment.

Shiba Ina price key technical points

- Strong Daily Support: The value area low has held across several retests, forming a base for potential reversal.

- Bullish Market Structure: Higher lows remain intact, maintaining an upward projection.

- Growing On-Chain Demand: Rising total and new wallet addresses support long-term bullish sentiment.

From a technical standpoint, SHIB’s current position near the daily support zone highlights an area of significant demand. The value area low, which represents the lower boundary of the current trading range, has acted as a reliable floor through multiple attempts by sellers to drive price lower. Each retest has been met with buying pressure, confirming that the market continues to value SHIB within this accumulation range.

The market structure remains bullish as price action continues to respect higher lows and defend prior swing levels. This indicates that sellers have failed to gain control, and as long as price remains above the daily support zone (approximate value area low), a recovery toward the daily resistance zone remains probable. A breakout above the value area high would likely trigger a move toward the previous swing high, reaffirming bullish momentum.

On-chain data further supports this technical picture. The number of wallet addresses interacting with Shiba Inu continues to increase steadily, alongside growth in the total number of holders. This pattern reflects healthy network activity and ongoing interest from investors, which typically precedes stronger market participation during recovery phases.

More importantly, it implies that mid-term investors are holding through volatility, waiting for higher returns rather than exiting prematurely, a behavior consistent with bullish accumulation.

This reduction in short-term selling pressure allows for price stabilization, giving SHIB room to form a sustainable foundation for future rallies. The current consolidation, supported by both technical and on-chain confluence, resembles prior accumulation periods that preceded significant upward expansions in the past.

What to expect in the coming price action

As long as Shiba Inu maintains support above its value area low, the probability of upside continuation remains high. A decisive reclaim of the value area high could ignite a new bullish phase toward the higher resistance.

Conversely, failure to hold above support could extend the consolidation phase before the next breakout attempt.