Is Ethereum’s rally driving Solana’s price to $150?

On Feb. 20, Solana TVL surpassed $2 billion for the first time in 2 years, and funds flowing in from Ethereum through the Wormhole bridge suggest more SOL price gains ahead.

SOL‘s price has lost steam after soaring to a new 2024 peak of $118.40 on Feb. 15. However, an on-chain data trail of funds inflows trickling down to Solana from the Ethereum (ETH) network this week could spark a SOL price rebound toward $150.

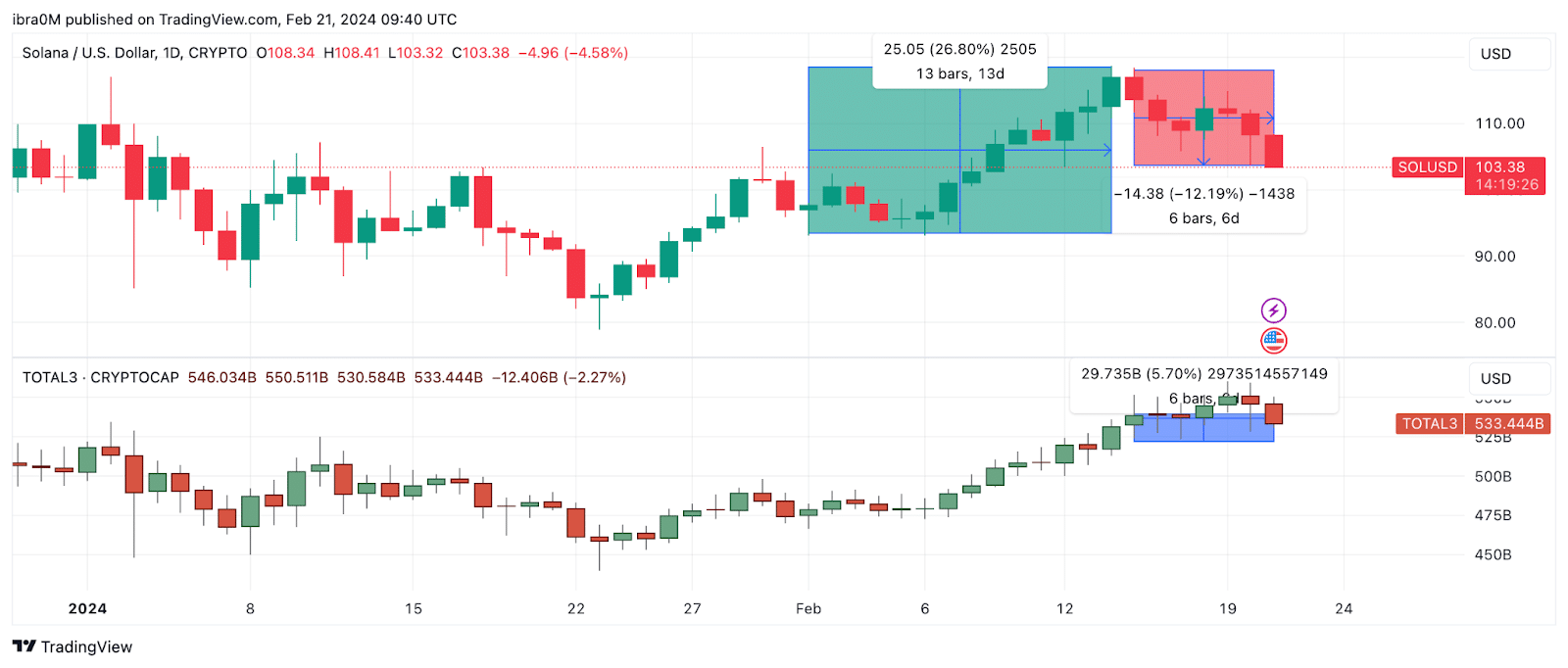

Solana price dips 12%, falling below market average

In the first half of February 2024, Solana was at the forefront of the crypto market rally, with SOL price soaring 26.8% and adding nearly $11 billion to its market capitalization. But that market trend flipped on Feb. 15 as investors began to take profits once the SOL price reached the 2024 peak of $118.

At press time on Feb. 21, Solana is trading at $103, down 12% from its Feb. 15 peaks.

Meanwhile, in contrast, the total altcoin market has grown by 5% during that period. Solana’s negative price performance seems driven by insiders and existing holders’ booking profits rather than macro factors.

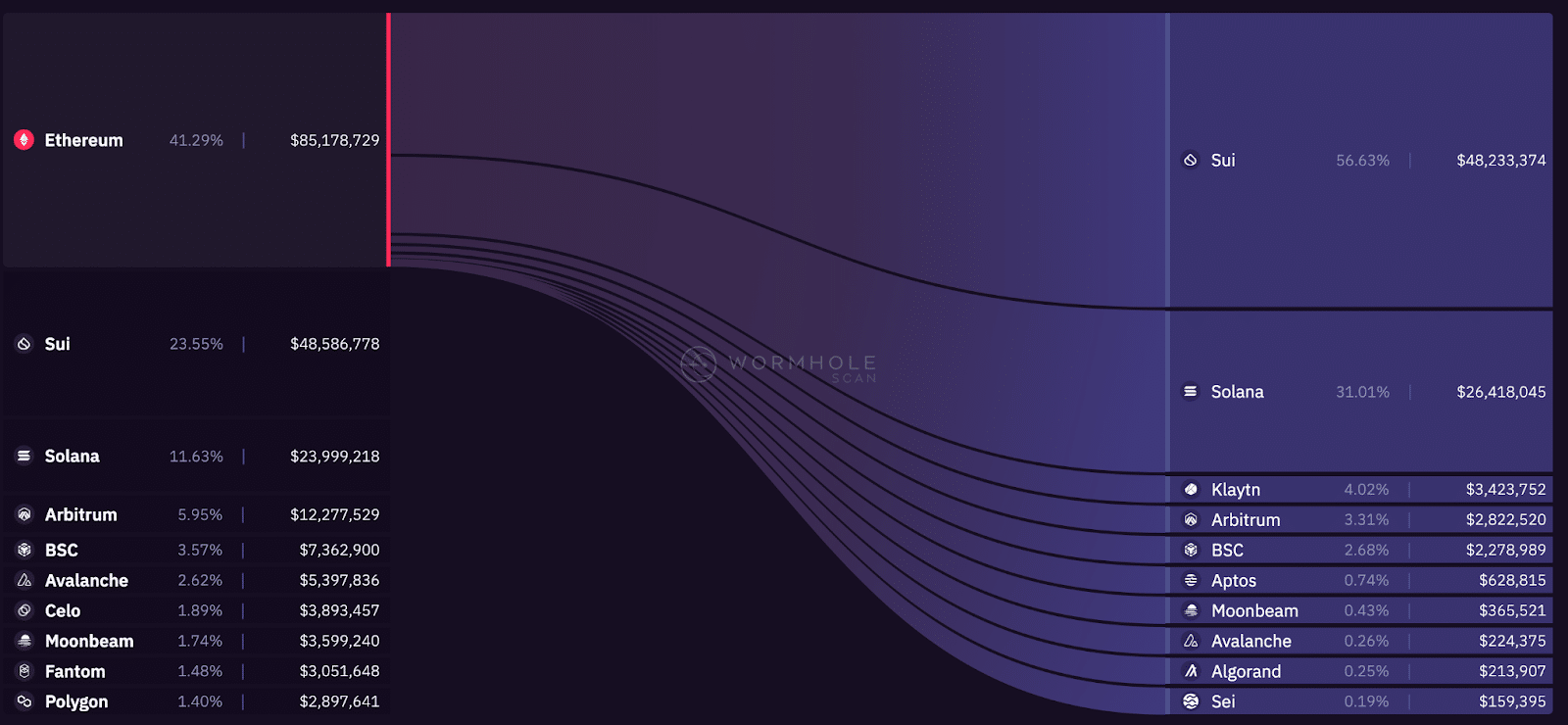

Solana receives $25 million in inflows from Ethereum

However, while some SOL traders are taking chips off the table, the Solana network has continued to make some giant strides this week, which could trigger an early price rebound.

In the past week, Solana has received significant inflows from Ethereum as investors increasingly look to leverage Solana’s more efficient and cost-effective defi services.

Between Feb. 14 and Feb. 21, investors transferred funds worth over $24.6 million from Ethereum to Solana, per on-chain data from Wormhole bridge Explorer.

This indicates that Solana continues gaining traction among developers and defi users due to its high throughput and low transaction costs. Hence, this rising flow of funds bridged into Solana-hosted decentralized applications (dApps) is a bullish indicator of its growing adoption and utility.

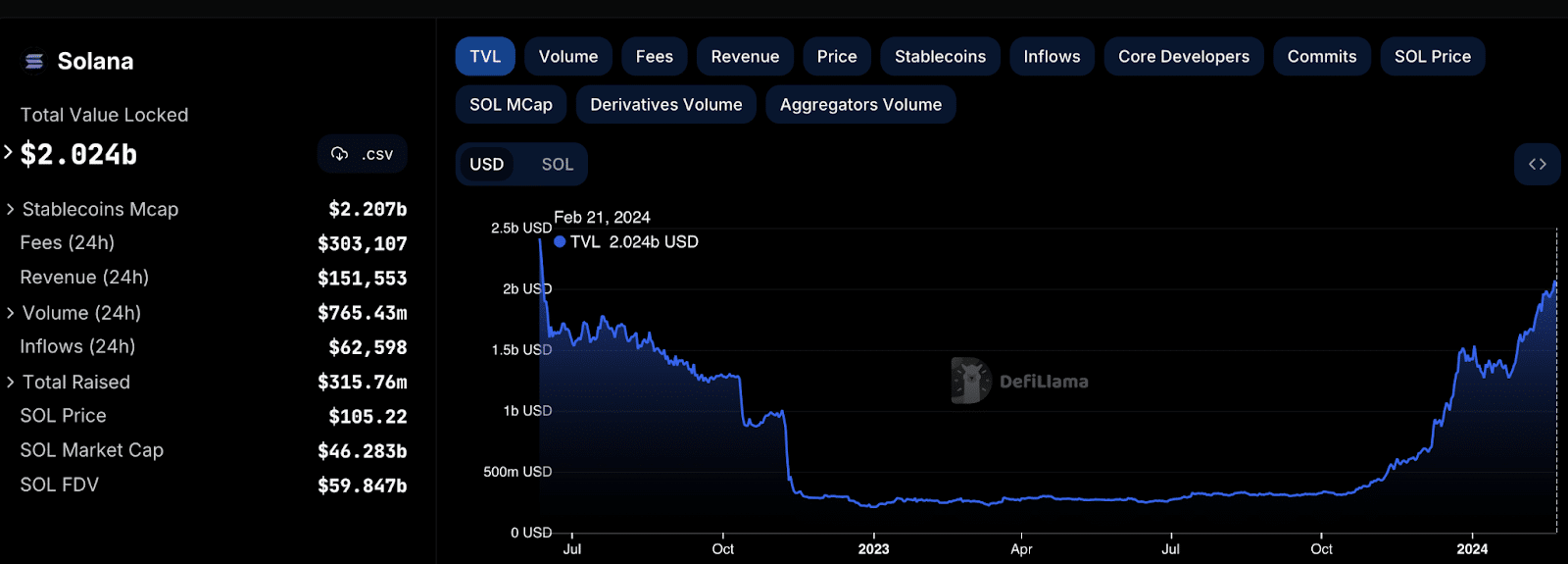

Solana defi TVL hits $2 billion milestone

Investors transferring funds worth over $24.6 million from Ethereum into the Solana ecosystem, despite the 12% decline in Solana’s price over the last seven days, shows an evident divergence between short-term price movements and long-term investor sentiment.

The latest wave of fund inflows has now propelled Total Value Locked (TVL) on the Solana network above the $2 billion milestone for the first time since June 2022.

This further underlines that the ongoing SOL price pullback is not driven by any discernible deterioration of Solana’s fundamental network growth metrics.

If the trends persist, the rising demand for Solana defi service could eventually evolve into market demand for native SOL tokens and ultimately trigger a bullish price reversal towards the $150 territory in the coming weeks.