Solana price eyes bullish reversal as 21 EMA holds strong

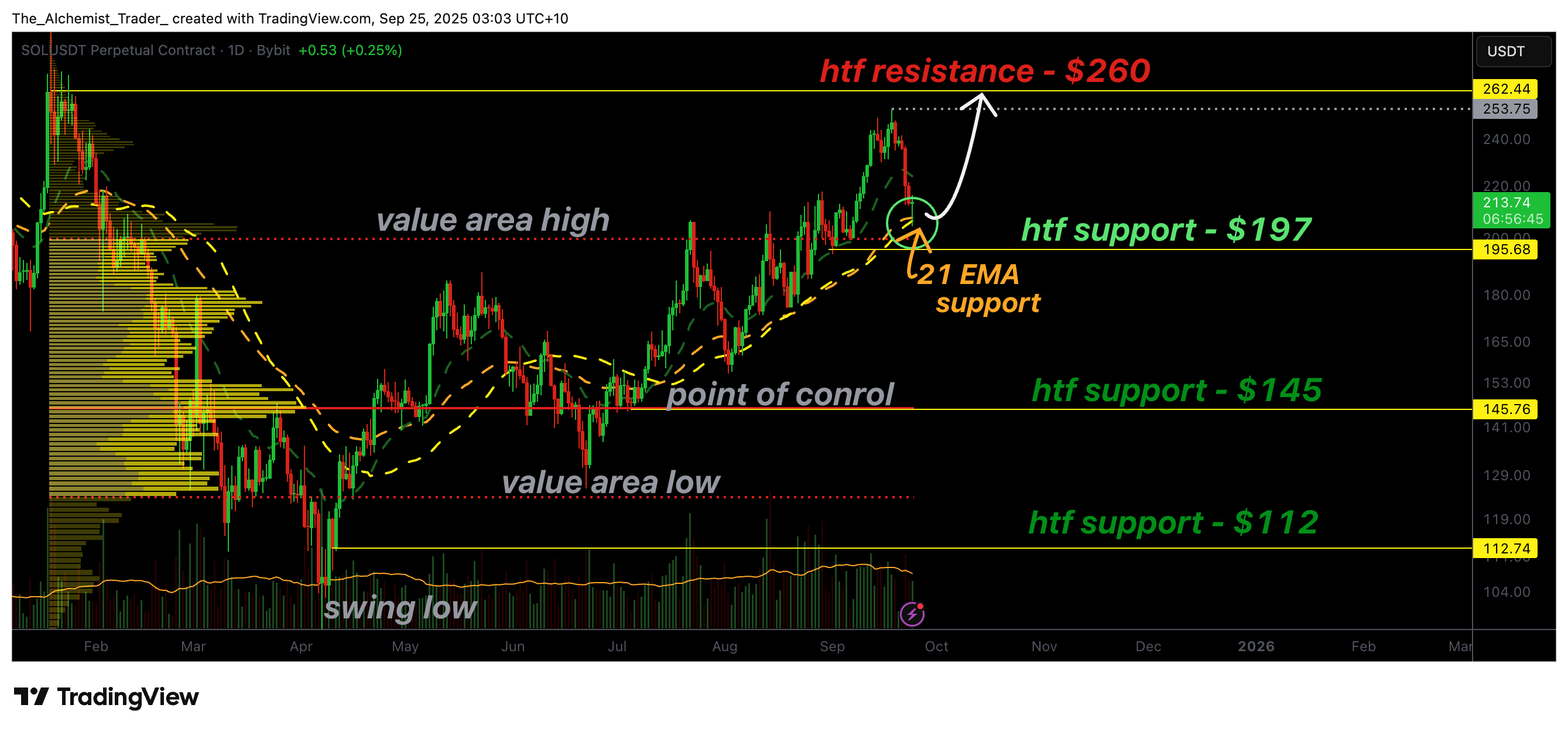

Solana price is holding a critical support zone where the 21 EMA, value area high, and high-volume levels converge. Price action suggests a potential bullish reversal if buying inflows sustain.

- Solana is holding $197 support in confluence with the value area high and 21 EMA.

- Bullish trend intact with higher highs and higher lows continuing.

- Next major resistance at $260, defining the upper range.

Solana (SOL) remains within a bullish market structure, consistently forming higher highs and higher lows. The reclaim of the value area low and point of control has reinforced the uptrend, with the 21 EMA acting as dynamic support. Currently, price has retraced into a high-timeframe support region that overlaps with the value area high, creating a strong technical confluence zone.

If buyers can defend this level, Solana could rotate back toward the upper boundary of its trading range.

On the fundamentals side, momentum is reinforced by Kazakhstan’s rollout of a Solana-based stablecoin in partnership with Mastercard and a major local bank.

Kazakhstan is rolling out a stablecoin supported by Solana, Mastercard, and a leading local bank, further strengthening the fundamental outlook.

Solana price key technical points

- 21 EMA Support: Price has respected this level throughout the uptrend.

- High Confluence Zone: Value area high overlaps with major support, strengthening reversal probability.

- Trading Range: $197–$260 defines the immediate high timeframe structure.

Solana’s technical picture remains constructive as long as the 21 EMA holds. This dynamic moving average has acted as a reliable support since the reclaim of the value area low and point of control, guiding the bullish structure of consecutive higher highs and higher lows.

Currently, Solana has retraced into a major support area around $197, which is also in confluence with the value area high. This overlap between structural support and high-volume nodes significantly strengthens the probability of a reversal. Such confluence levels often serve as springboards for renewed upside momentum, provided demand continues to flow into the market.

Volume analysis further supports the bullish case. Recent sessions have shown inflows into bullish nodes, suggesting that buyers are defending support zones. However, for a sustained reversal, this influx of demand must persist and translate into decisive bullish price action, such as engulfing candles on higher timeframes.

Looking ahead, the key upside target remains $260, the next high-timeframe resistance. Solana previously front-ran this level, indicating its importance as a supply zone. The current structure establishes a trading range between $197 and $260, with a bullish bias as long as EMA support continues to hold and momentum builds.

What to expect in the coming price action

If Solana sustains its defense of the $197 support zone and 21 EMA, a bullish rotation toward $260 resistance is likely. The overall bullish trend remains intact, with the potential for new highs if volume inflows strengthen further.