Solana price flips key resistance as futures open interest nears ATH

Solana price made a strong bullish breakout on Monday as investors embraced a risk-on sentiment ahead of the Fed decision and key earnings.

The price of Solana (SOL) rose to a high of $193, its highest point since April 1st. External data shows that the crypto fear and greed index rose to the greed zone of 63, meaning that investors have embraced a risk-on sentiment.

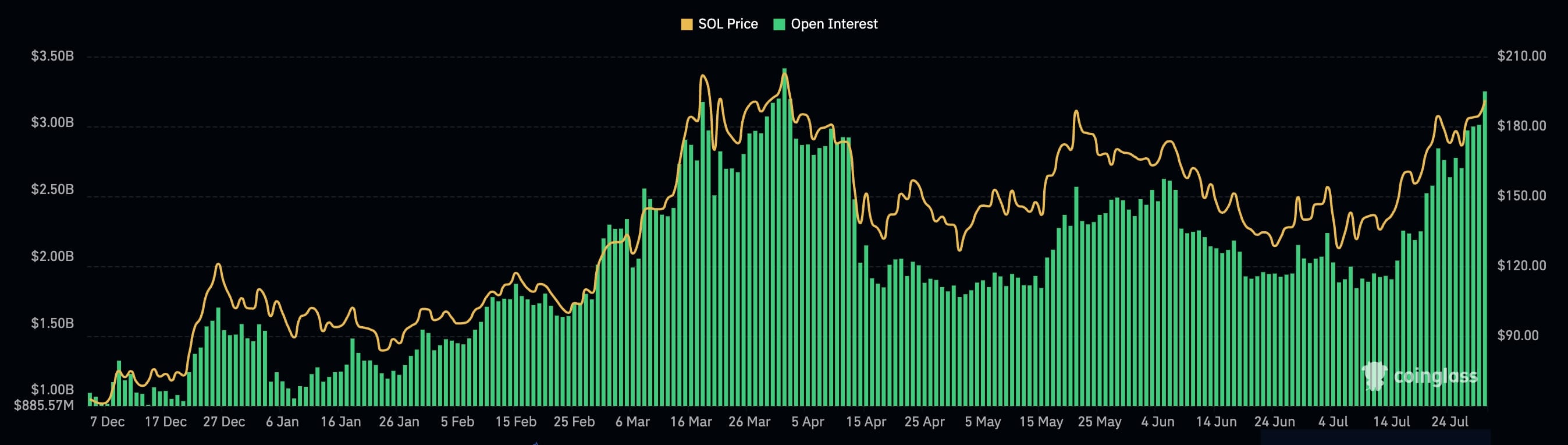

It also rallied as the futures open interest continued its recovery process. According to CoinGlass, the interest rose to a high of $3.25 billion on Monday, its highest level since April 1st when it reached its all-time high.

The open interest has been robust after bottoming at $1.77 billion earlier this month as cryptocurrency prices dived. A higher interest is usually a good sign that there is robust demand of an asset, meaning that it may continue rising.

Notably, Solana is not the only cryptocurrency seeing elevated open interest in the futures market. Bitcoin (BTC), the biggest coin in the industry, had a record open interest on Monday after Donald Trump and Robert Kennedy made the case for Bitcoin.

Solana has exciting fundamentals behind it. Data shows that its ecosystem fees have jumped to $2.13 million in the last 24 hours. Participants in Polymarket believe that the blockchain will make higher fees than Ethereum, at least in a single day, this month.

The number of active addresses in the ecosystem has risen to over 1.22 million while key networks like Jito, Marinade, and Kamino have seen strong demand.

Solana price zoomed past key resistance

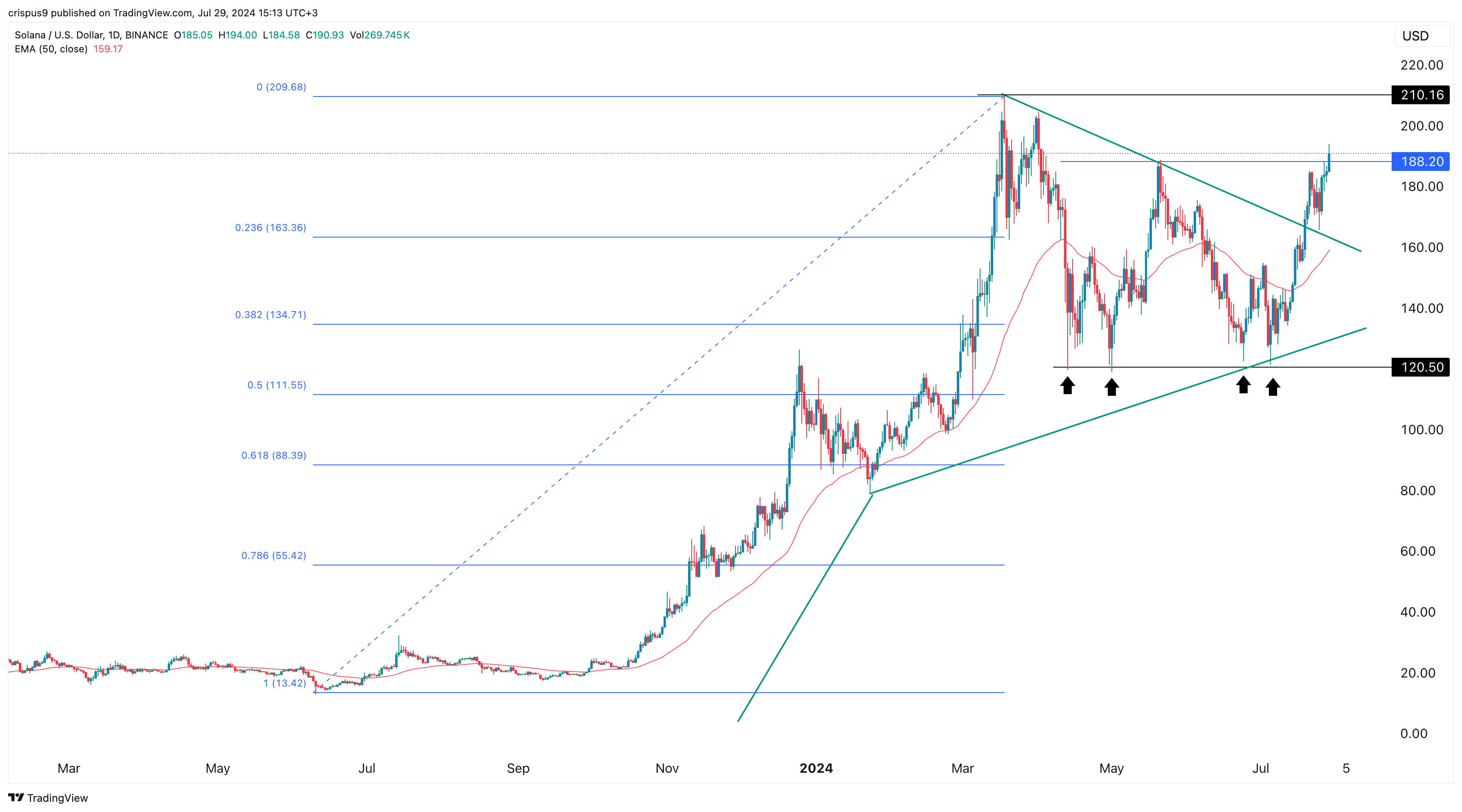

Technically, there are signs that this breakout could be real. On the daily chart, the token found a strong bottom at $120.50, where it failed to drop below four times since April.

It has also moved above the upper side of the symmetrical triangle pattern. In a recent article, we noted that this triangle was a sign of a bullish pennant chart pattern, a popular continuation sign.

Solana also jumped above the crucial resistance point at $188.20, its highest point in May this year. Therefore, the token may continue rising as buyers target the year-to-date high of $210.15.

Looking ahead, this week will have several macro factors that could impact its prices. Some companies like Franklin Templeton and Blackrock could submit their Solana ETF documents to the Securities and Exchange Commission.

The Federal Reserve is expected to signal that it will start cutting interest rates in its September meeting on Wednesday. Such a move will be positive for risk assets like Solana and Cardano (ADA).

Meanwhile, the biggest companies in the US like Amazon, Microsoft, Meta Platforms, and AMD will publish their financial results. Last week, the mixed earnings by companies like Tesla and Alphabet led to a big drop in US equities and some cryptocurrencies.