Solana price prediction: Can SOL trade higher on ETF optimism?

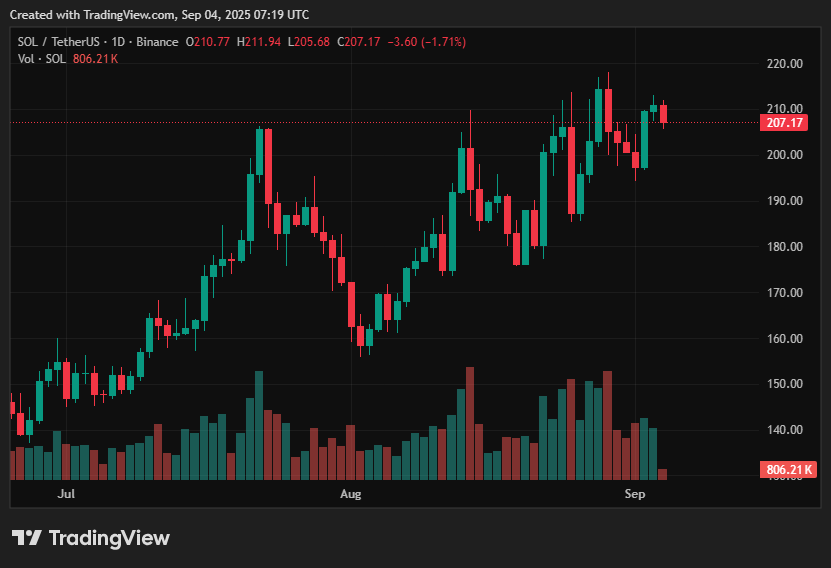

- With a daily volume of almost $6 billion, SOL is trading at about $206.8, keeping above the important $200 level.

- The 98% approved Alpenglow upgrade promises scalability and finality improvements of about 150 ms, adding positive sentiment to the current Solana price prediction.

- The resistance level is between $215 and $220; a breakout might aim for $236 to $252 or even $260.

- Despite the SEC’s delay, ETF euphoria persists; downside risk is still about $190 to $180.

With a daily trading volume of nearly $6.0 billion, Solana is currently trading at approximately $206.8, indicating a modest decline of around 0.85% over the past day.

The much-awaited Alpenglow upgrade and the continued confidence surrounding ETFs are the two main narratives impacting the current Solana price prediction.

With the help of technologies like Rotor and Votor, the upgrade, which was just approved by a large majority of validators, promises to increase consensus efficiency and reduce finality times to about 150 milliseconds.

With traders keeping a careful eye on whether the $206–$215 area may serve as a foundation for additional upward momentum, these developments have fueled hopes of a big performance rise. Even though the SEC just postponed its decision on Solana (SOL) ETF submissions until mid-October 2025, ETF debates are still ongoing.

Table of Contents

Solana price prediction market info

Solana’s current price is $206.8, and its intraday trading ranges from $206.2 to $212.4. An ascending pattern of higher lows supports the price structure’s continued bullishness, and the $197–$200 range has emerged as a crucial support zone. On the upside, traders are being cautious because $215–$220 is still a tough resistance level.

The market’s mood is a mix of anticipation for ETF developments and euphoria about the Alpenglow upgrade. The ETF decision delay highlights the ongoing uncertainty in regulatory clearance processes, despite the upgrade potentially resulting in significant network efficiency. This sets the stage for a cautiously positive Solana outlook as investors weigh near-term risks against long-term benefits.

Factors that could boost Solana price

Momentum could swiftly push Solana above $236–$252 if it breaks convincingly above the $215–$220 resistance zone. If heavy volume supports the advance, some estimates even go as high as $260. A large portion of this optimistic argument depends on Alpenglow’s successful deployment, which should provide near-instant block finality and enhanced scalability, two features that are essential for user acceptance and ecosystem expansion.

Another possible cause is the resurgence of interest in ETF products in spite of the regulatory hold-ups. When taken as a whole, these factors support a cautiously bullish Solana price prediction, with the expectation that positive upgrade results could drive stronger adoption across liquidity pools.

Downside Risks to Solana price

However, if support in the $206–$200 range is not maintained, Solana may be vulnerable to a regression toward $190–$186, with further weakness perhaps reaching the $180 level indicated by recent analysis. One major danger is that expectations could become negative and bullish sentiment could wane if the Alpenglow upgrade fails to live up to expectations.

Furthermore, any decline in risk appetite or tightening liquidity circumstances could deplete Solana’s momentum because the larger cryptocurrency market is still susceptible to macroeconomic changes. In particular, low trading volume may make rallies unsustainable, making recent gains susceptible to a reversal.

Solana Price Prediction Based on Current Levels

In conclusion, as of September 4, 2025, Solana is trading in the $200–$215 consolidation area. Under strong bullish conditions, a confirmed breakout over $215–$220 would target the $236–$252 zone, with a potential revisit to $250–$260. On the other hand, if sellers regain control, price action may retreat around $190–$186 and possibly as low as $180 if there is a collapse below $200.

Overall, the SOL price forecast is cautiously optimistic, with upside potential hinging on the successful implementation of the Alpenglow upgrade and growing institutional interest through ETF discussions. The short-term SOL price prognosis is mostly dependent on how well the Alpenglow upgrade performs as promised and how the story around ETF approvals develops. With short-term direction dependent on these crucial upgrade signals and regulatory developments, traders can anticipate ongoing volatility.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.