Solana SHORT traders face $143 million losses if this happens

Solana (SOL) price has failed to break above the $200 level this week despite brimming capital inflows from the meme coin rave, can the recent spikes in DeFi activity intensify the bullish momentum?

Intense profit-taking among Solana traders has left SOL price nestled below the $200 territory in the past week. But with rising DeFi volumes, speculative traders are now piling on bullish bets in anticipation of another major breakout.

Solana DeFi TVL nears $5 billion first time since February 2022

Solana is trading at $190 at the time of writing on March 28, on course to end the month with gains in excess of 60%. Much of the Solana March rally has been attributed to the parabolic surge in interest surrounding native memes like Dogwifhat (WIF) and BONK and newly-launched SLERF and Book of Meme (BOME).

However, in the past week, the Solana boon has spread towards the defi sector. After flipping Ethereum (ETH) in terms of Dex trading volumes, Solana is now jet set on leapfrogging BNB chain on the global Total Value Locked (TVL) rankings.

DeFillama chart below provides real-time TVL data on the total assets deposited on a blockchain network.

As seen above, despite the recent price pull back, Solana defi TVL continues to rise. While SOL price action has been subdued with the $180 – $190 range since March 23, SOL defi ecoystem has received over 600 million worth of capital inflows during that period.

At the time of writing, the SOL TVL has now reached the $4.6 billion mark for the first time since February 2022.

When the TVL in decentralized finance protocols increases during a price consolidation phase, it may indicate several bullish underlying dynamics.

Firstly, it reflects growing confidence in the stability and reliability of Solana’s DeFi protocols. More importantly, it shows that investors are turning to defi platforms to earn yield or interest on their holdings during the ongoing price consolidation phase, rather than exit or book early profits.

This reduction is selling pressure puts SOL in prime position for an accelerated price breakout during the next surge in market demand.

Speculative traders betting big on next Solana price breakout

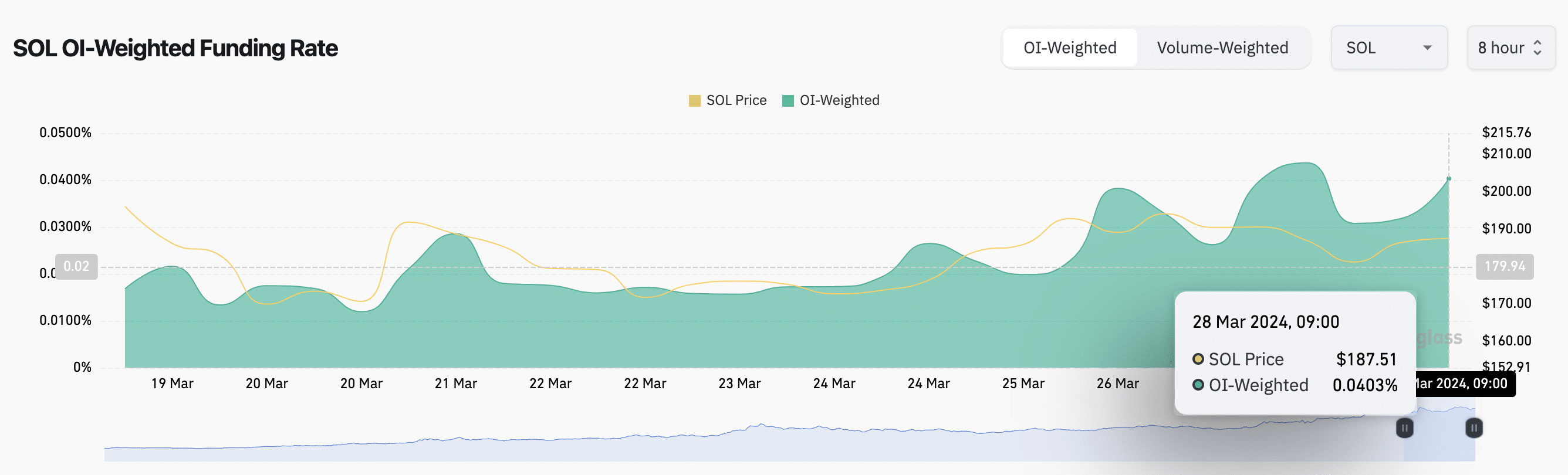

Speculative traders have started making strategic moves to front run the next Solana price rally. According to recent data trends observed in the derivatives markets SOL bulls are paying increased fees to keep their long positions open.

Coinglass’ funding rate metric tracks the aggregate fees paid by long traders to shorts, or vice versa, in perpetual futures markets. This metric serves as a real-time indicator of the dominant market sentiment.

Between March 20 and March 28, SOL’s aggregate funding rate has surged from 0.01% to $0.04%, based on the most recent data sourced from Coinglass.

This uptick in positive values of the funding rate indicates that not only are long contracts outnumbering short contracts, but leveraged long position holders are also increasingly willing to pay higher fees in anticipation of continued bullish momentum in the SOL spot price market.

SOL Price Forecast: Bears to book $140M losses if $209 resistance caves

Drawing insights from the $600 million growing in defi tvl and 400% jump in funding rate over the past week, Solana price looks set for a breakout towards $210 in the weeks ahead.

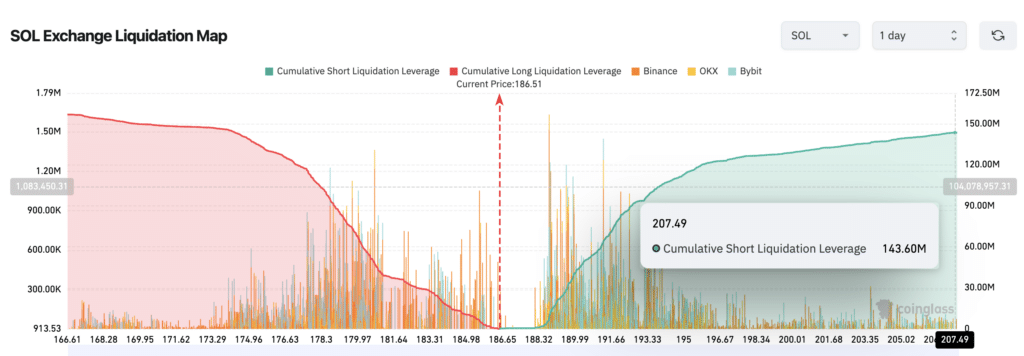

However, another vital derivatives market data shows that the bears have mount a major resistance to prevent prices surging to new 2024 peaks above $209.

Based on the active leverage positions data outlined above, SOL short traders face a potential liquidation losses of over $143 million if prices cross the $207.5 mark. To mitigate such large losses, the short traders could trigger early stop-loss orders to liquidate some of their positions as prices approach that $207 range.

Considering the high volume positions listed around at that range, the large scale sell-offs could put significant downward pressure on SOL price action in the near-term.

But if the growing defi traction persists, the bulls could garners sufficient momentum to scale that sell-wall and drive prices to new yearly peaks above $210.

On the flip side however, if the sell-offs trigger an outsized downward market reaction, SOL price stands the risk of tumbling toward the $165 area.