Will this $42b signal send Solana’s price to $150?

Solana (SOL) price peaked at $115 during the daily timeframe on Feb. 13, but spikes observed in SOL staking deposits could trigger more bullish action.

Solana network has attracted investor attention recently, propelling SOL price to a 30-day peak at $115 on Feb. 13.

Solana staking deposits cross $42 billion

Solana price gains for February 2024 have hit 20% at the time of writing on Feb. 13. Recent market reports suggest the rising volumes of defi activity on the Solana network have been pivotal to the ongoing SOL price rally.

In further affirmation of this stance, the observed staking deposit trends suggest most of the current Solana network validators are positioned for more bullish action.

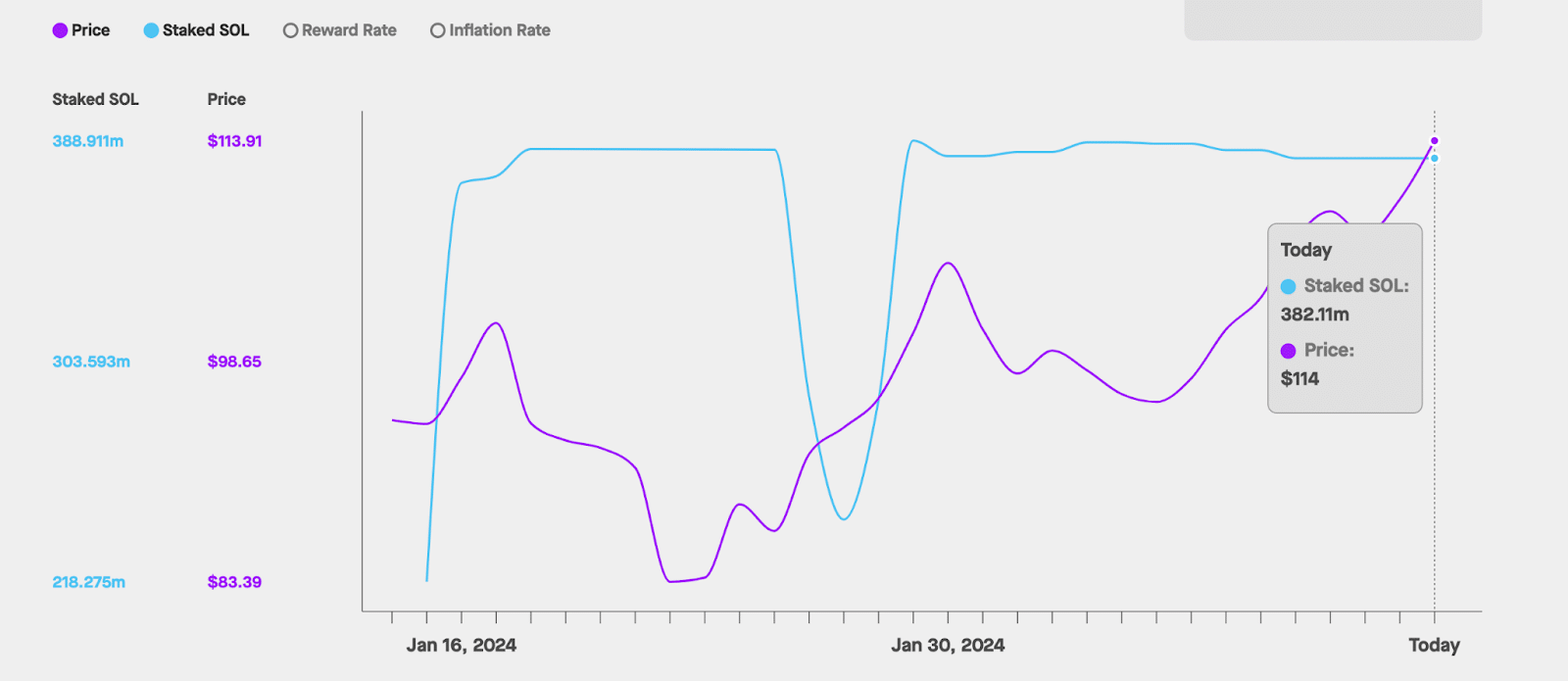

The StakingRewards chart shows that investors deposited an additional 140 million SOL into smart contracts between Jan. 27 and Feb. 13. Currently, 382.1 million SOL are locked up, bringing the total value of staked coins to $42 billion.

Valued at the current price of around $110 per coin, investors staked $15.4 billion worth of SOL as the rally broke out over the last three weeks.

With a staking ratio of 67%, most Solana holders appear to be holding out for more gains rather than selling at current prices.

In addition, increased staking on PoS networks like Solana enhances the security and efficiency of the ecosystem.

The rising defi volumes appear to have created a bullish cycle where more users Stake SOL as they look to participate in on-chain activities. These factors could combine to drive the ongoing SOL price rally into second gear.

Solana price forecast: Breaking above $125?

The staking trends observed during the ongoing rally suggest an overwhelming expectation of further price gains. A bullish pattern shown by the Parabolic Stop and Reverse (SAR) technical indicator further emphasizes this stance.

The SOL price trades at $110 at press time, while the Parabolic SAR dots point toward the $98.8 mark. Parabolic SAR is typically considered bullish when its dots are positioned below the price bars, indicating an upward trend.

However, in the short term, SOL faces major resistance at the recent local high of $126 recorded in December 2023.

If the bulls capitalize on the positive market sentiment, SOL prices could break towards $150, as predicted.

Conversely, the bears could negate this positive prediction if the SOL price dips below $90. But in this scenario, the Parabolic SAR dots show that the bulls can mount a daunting support buy-wall at the $99 area.