SpaceX moves $268M in BTC to two new addresses

On-chain monitoring revealed that SpaceX recently transferred $286 million worth of Bitcoin to two unmarked addresses after three months of no on-chain activity.

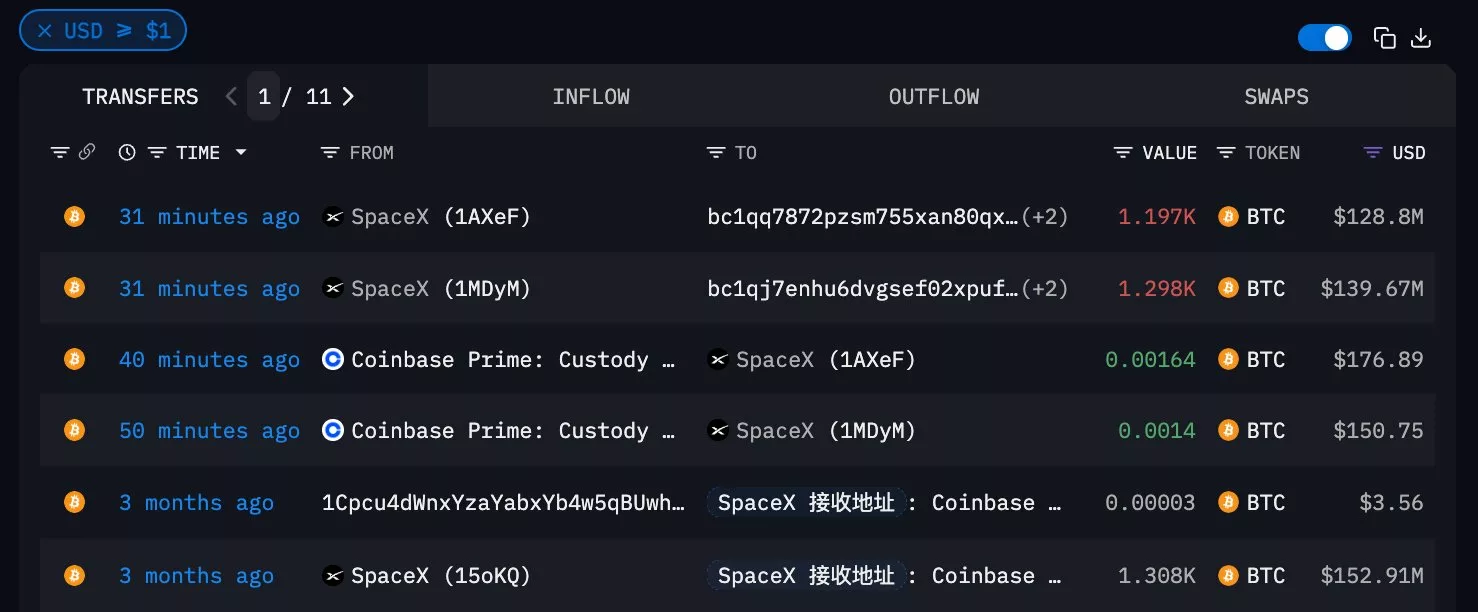

- SpaceX transferred 2,395 BTC, worth about $268 million, to two new wallets after three months of inactivity.

- The transfers come as Bitcoin’s price falls below $110,000, prompting market watchers to monitor SpaceX’s activity closely for signs of a potential sell-off despite traders viewing the move as standard housekeeping.

After three months of inactivity, a wallet owned by Elon Musk’s space exploration company has recently transferred a total of 2,395 BTC to two on-chain addresses. Currently, both addresses are only holding BTC, with no indication that the holdings have been sold or moved to other wallets.

Based on current market prices, the company’s Bitcoin (BTC) transfer is currently valued at around $268 million. One address beginning with bc1qq78 received around 1,187 BTC, which is valued at $128.35 million. At press time, the address only holds Bitcoin and no other assets.

Meanwhile, the second address, beginning with bc1qj7e, received a Bitcoin transfer of about 1,208 BTC. Its holdings are currently valued at $130.4 million, with no other assets held aside from the recent SpaceX transfer.

On-chain analyst Ai Yi, who highlighted the two transfers based on information from Arkham Intelligence, surmised in a post that the move could just be a routine wallet reorganization, considering the firm had to pay a transfer fee to Coinbase Prime just minutes before the transactions were made. It is widely known that SpaceX’s holdings are currently custodied with Coinbase Prime.

Therefore, the two unmarked wallets could possibly belong to SpaceX as well, even though they are currently unmarked by Arkham Intelligence.

The last time Musk’s company moved its crypto assets was back in July 2025. At the time, the wallet moved 1,308 BTC after three years of being dormant. The transfer was valued at $152 million based on market prices back then. However, the receiving address at the time was recognized as a Coinbase Prime Custody wallet.

After today’s transfers, SpaceX’s wallet currently holds a total of 5,790 BTC, which is equal to $626.7 million based on current market prices. Its holdings have gone down 2.98% in the past 24 hours, following Bitcoin’s drop below $110,000.

According to data from Bitcoin Treasuries, SpaceX’s BTC holdings amounted to 8,285 BTC before the transfers were made. This means that the firm’s holdings were valued at $895.38 million.

Having held Bitcoin in its portfolio since 2021, the company’s BTC trove of 5,790 BTC is still relatively larger compared to companies like KindlyMD, Semler Scientific, and GameStop Corp. Though it is still trailing far behind Galaxy Digital, Trump Media & Technology Group, Riot Platforms, and Musk’s other company, Tesla.

What could SpaceX’s BTC moves mean for the market?

The last time SpaceX’s wallet moved Bitcoin was in July 2025. At the time, the move sparked concerns among traders who feared the company might be offloading its holdings and could very well trigger widespread selling pressure.

However, much like the discourse surrounding today’s transfer, some traders have downplayed the risks. Many of them stated that the move could just be the firm shifting its holdings to a fresh wallet, an act deemed as simply “routine housekeeping.” Therefore, it should not be cause for alarm.

This time, the decision to move a large chunk of its funds to two new wallets coincides with a major drop in Bitcoin’s value. On Oct. 21, Bitcoin dropped 2.76% from a high of $111,555 to just around $107,000. The largest cryptocurrency by market cap is currently trading at around $107,875.

The asset has continued its downward trend, having declined by 3.76% in the past week following a series of crypto market crashes. Market traders may be watching SpaceX closely in case of a sell-off that could trigger similar moves across the market that would lead to more downward pressure on the price of Bitcoin.