K33 Research: Over 900 institutions invested $11b in spot Bitcoin ETFs

As of March 31, 937 institutions had invested over $11 billion in U.S. spot Bitcoin ETFs.

Senior Analyst at K33 Research Vetle Lunde says that $11.05 billion equals 18.7% of the total funds managed by BTC-based products. For comparison, only 95 firms invested in gold ETFs over the same period.

Morgan Stanley is among the 937 firms, investing $269.9 million in GBTC and becoming the second largest holder of an ETF from Grayscale after Susquehanna International Group (~$1 billion).

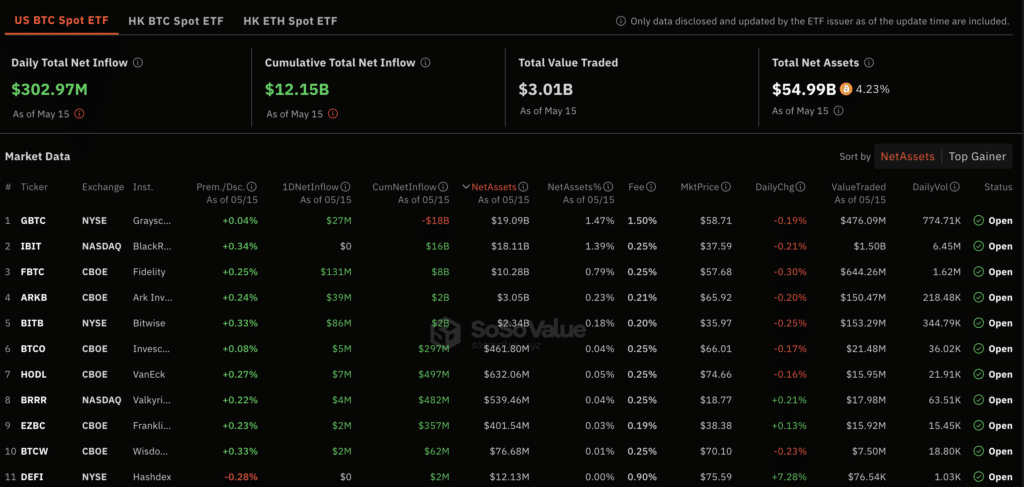

Institutions invested the most actively in GBTC, with a total of $4.38 billion. Following the Grayscale fund is IBIT from BlackRock, which has seen $3.23 billion in investments. FBTC from Fidelity closes the top three with investments of $2.1 billion.

On May 15, the net inflow into spot Bitcoin ETFs increased to $303 million, including $131 million in FBTC and $86.3 million in BITB. Since approval, inflows into spot Bitcoin ETFs have exceeded $12 billion, with the positive trend continuing for the third day in a row, according to SoSoValue.

On May 13, Bitwise Chief Investment Officer Matt Hougan emphasized that investing in Bitcoin ETFs is a new trend among institutions. According to him, about 563 investment companies have reportedly collectively invested about $3.5 billion in ETFs.

Hougan compares interest in spot Bitcoin ETFs to the surge in demand for gold-focused exchange-traded funds launched in 2004. Gold ETF funds were highly successful, raising over $1 billion in the first five trading days.