Spot Bitcoin ETFs net $88m in inflows, spot Ether ETFs outflows see slowdown

Spot Bitcoin ETFs have seen their second consecutive inflow day this week, while spot Ether ETFs logged a drop in outflows in its 4-day negative flow streak.

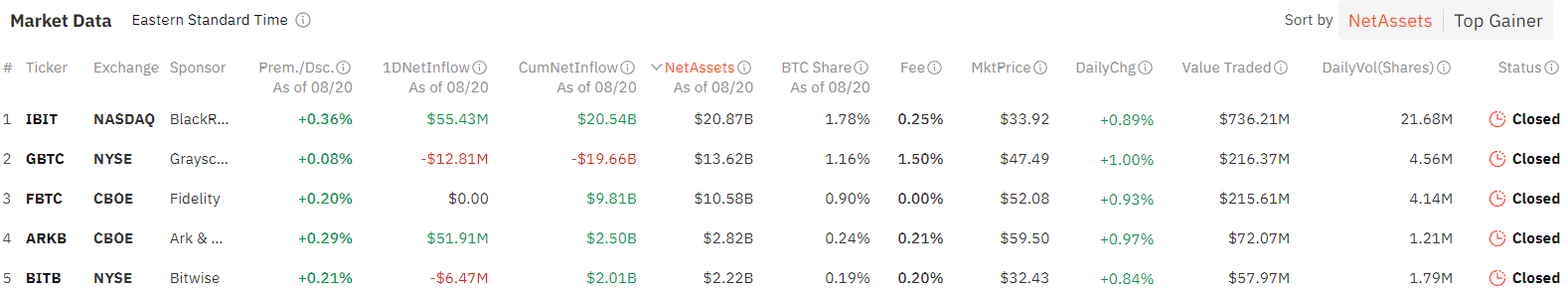

According to data from SoSoValue, the 12 spot Bitcoin exchange-traded funds recorded $88.06 million in inflows on Aug. 21, representing a 42% increase compared to the net inflows seen on Aug. 20.

BlackRock’s IBIT recorded the highest inflows with $55.4 million, bringing its total inflow since launch to $20.53 billion. It was the only fund to record a second consecutive day of inflows. ARK 21Shares’s ARKB followed with inflows of $51.9 million following a day of no activity.

These inflows were offset by Grayscale’s GBTC and Biwise’s BITB, which logged outflows of $12.8 million and $6.5 million, respectively. Interestingly, the previous day was marked as the first day when GBTC saw no flows. The remaining eight BTC ETFs remained neutral.

Trading volume for BTC ETFs jumped to $1.35 billion on Aug. 21, 73% higher than the $779 million seen the previous day. These funds have recorded a cumulative net inflow of $17.52 billion since inception. At the time of writing, Bitcoin (BTC) was down 1.7%, trading at $59,842, per data from crypto.news.

Institutional ownership of U.S. spot Bitcoin ETFs rose to 24% by the end of Q2 2024, despite a challenging market and declining Bitcoin prices. Big investors like Goldman Sachs and Morgan Stanley are holding $412 million and $188 million respectively in ETF shares, though some of these assets are likely held on behalf of clients.

Ongoing outflows persist in Ether ETFs

In contrast, the nine-spot Ethereum ETFs collectively saw outflows of $6.49 million on Aug. 21, marking the fourth consecutive day of outflows.

Grayscale’s ETHE led the outflows once again, with $37 million leaving the fund, bringing its total outflows to $1.47 billion since its launch on July 23. Meanwhile, BlackRock’s ETHA and Biwise’s ETHW were the only offerings to record inflows of $26.8 million and $3.7 million. The remaining six ETH ETFs saw no flows on the day.

These investment vehicles have seen their daily trading volume rise to $194.6 million, a significant jump over the previous day. The spot Ether ETFs have experienced a cumulative net outflow of $440.11 million to date. At the time of publication, Ethereum (ETH) was also down by 2.6%, trading at $2,600.