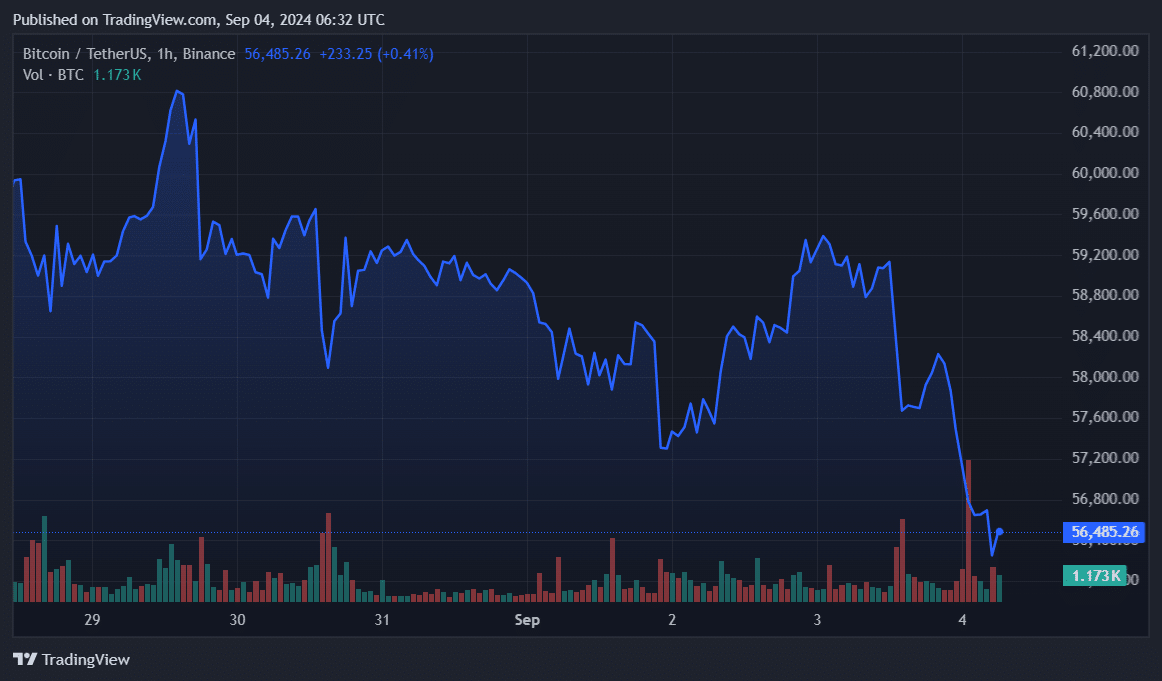

Spot BTC ETF outflows touch 4-month highs, price falls below $57k

Spot Bitcoin exchange-traded funds in the United States witnessed a four-month-high net outflow on Tuesday, Aug. 3.

According to data provided by Farside Investors, the U.S.-based spot Bitcoin (BTC) ETFs saw $287.8 million in net outflows yesterday, continuing their five-day downward momentum. This amount of outflows has not been seen since May 1.

Data shows that most of the outflows came from Fidelity’s FBTC and Grayscale’s GBTC funds, worth $162.3 million and $50.4 million, respectively.

Moreover, the ARK 21Shares ARKB and Bitwise’s BITB ETFs also recorded $33.6 million and $25 million in outflows, per Farside Investors. EZBC, HODL, BRRR and BTCO funds joined the bearish momentum with $8.4 million, $3.3 million, $2.5 million and $2.3 million in outflows, respectively.

The largest spot BTC fund with over $20.9 billion in total inflows, BlackRock’s iShares Bitcoin Trust ETF, remained neutral along with BTCW and Grayscale’s mini BTC fund.

Bitcoin dropped 4.6% in the past 24 hours and is trading at $56,330 at the time of writing. The leading cryptocurrency briefly touched a one-month low of $55,670 earlier today.

Spot Ethereum (ETH) ETFs also remained bearish with a net outflow of $47.4 million on Aug. 3, according to Farside Investors. Grayscale’s ETHE saw $52.3 million in outflows while Fidelity’s FETH recorded $4.9 million in inflows.

The remaining spot ETH funds stayed neutral.

Ethereum’s price also declined by 5.5% over the past day and is changing hands at $2,370 at the time of writing.