Spot crypto ETFs fail to bridge gap as most advisors lack crypto buying capabilities: Bitwise

Access to crypto investments remains a challenge for advisors, with only 35% able to invest in client accounts despite the rise of spot Bitcoin and Ethereum ETFs in 2024.

Crypto’s mainstream appeal grows, but access limitations for advisors leave many clients investing outside the advisory relationship.

A new survey by Bitwise Asset Management and ETF data provider VettaFi reveals that most financial advisors still face challenges in accessing crypto for their clients. Only 35% of advisors said they could buy crypto in client accounts, highlighting a major barrier to broader adoption.

The survey, conducted from Nov. 14 to Dec. 20, 2024, included over 400 financial advisors. It showed that while crypto allocations have doubled to 22% year-over-year, access issues still persist. Meanwhile, 71% of advisors reported that “some” or “all” of their clients are investing in crypto independently, outside the advisory relationship.

Matt Hougan, CIO of Bitwise, pointed out that advisors are “awakening to crypto’s potential like never before, and they’re allocating like never before.”

“But perhaps most staggering is how much room we still have to run, with two-thirds of all financial advisors — who advise millions of Americans and manage trillions in assets — still unable to access crypto for clients.”

Matt Hougan

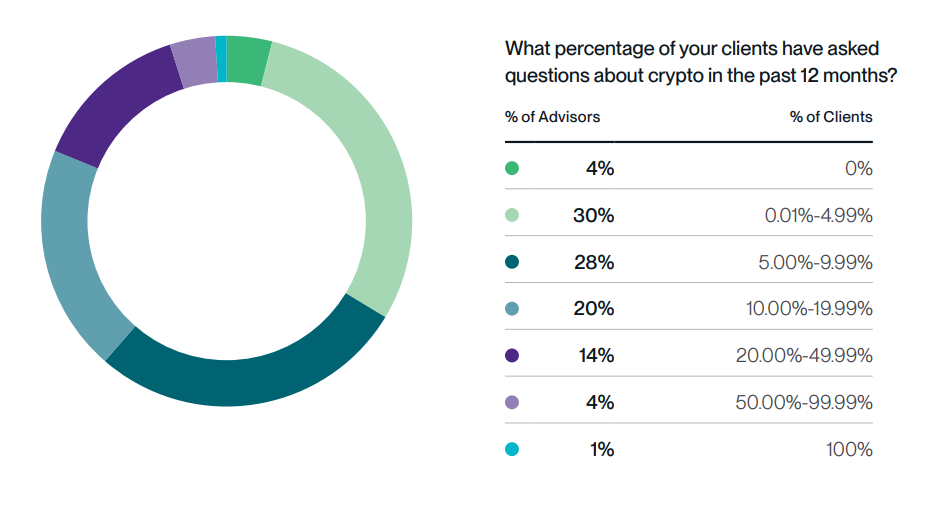

Although there are still some barriers, interest remains strong. Ninety-six percent of advisors received questions about crypto from clients in 2024, and 99% of advisors with existing crypto allocations plan to maintain or increase their exposure in 2025.

The findings also showed growing optimism among advisors. Nineteen percent of those who haven’t allocated to crypto yet said they are likely to add exposure in 2025, more than double last year’s figure, the report reads.