Stader crypto price is nearing $1; how high can SD go?

Stader crypto price has staged a strong comeback, reaching its highest level since May 9, making it one of the best-performing altcoins this week.

Stader (SD), a prominent player in the liquid staking industry, surged to $0.95, marking a 213% increase from its lowest level this month. This rise has pushed its market cap to $37.90 million, with a fully diluted valuation of $111.7 million.

Stader is a top player in the liquid staking industry. Most of its assets, about $426 million of them, are in Ethereum (ETH), while the remaining ones are in Hedera, Polygon, and Binance Smart Chain. According to its website, Stader has over 100,000 users from around the world.

Liquid staking allows users to swap staked coins for liquid tokens that represent the staked assets. These liquid tokens can then be traded, utilized in decentralized finance protocols, and redeemed for the original staked assets.

The SD token’s recent rally corresponds with the stabilization of assets in its ecosystem. Data from DeFi Llama indicates that the total value locked in Stader’s ecosystem had been declining after peaking at $778 million on March 14, bottoming at $381 million in September before rebounding to $463 million.

This recovery suggests potential further growth as cryptocurrencies continue to regain momentum. For example, Randy, an analyst with over 318,000 followers on X, predicted that Ethereum could climb to $5,000 in the upcoming months.

A notable risk for the Stader price is its maximum supply of 120 million tokens, with a current circulating supply of 40.76 million. The platform releases 1.38 million SD tokens monthly, which could lead to further dilution.

How high can Stader price jump?

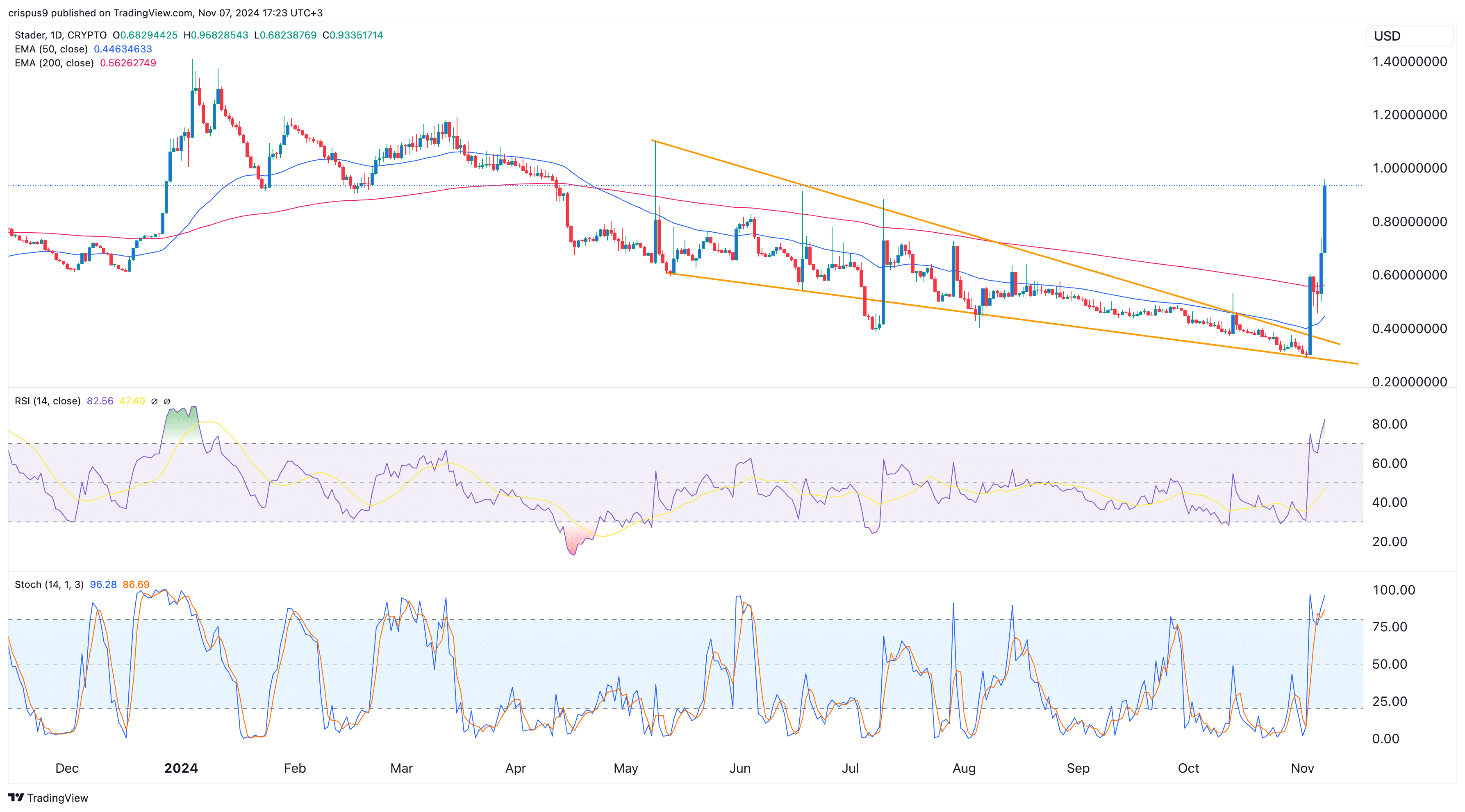

The Stader token also experienced a technical breakout. As shown in the chart, SD surged after forming a falling wedge pattern, a common bullish indicator. Typically, a breakout occurs as the pattern nears its confluence point.

Stader has moved above the 50-day and 200-day moving averages and is approaching the psychological $1 mark. Additionally, the Relative Strength Index and Stochastic Oscillator have signaled upward movement, reaching overbought levels.

Given these technicals, the Stader crypto price may likely pull back and retest the lower side of the wedge pattern at $0.40, about 60% below its current level.