StakeStone x Native: Introducing the redefined era of liquidity

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

StakeStone and Native join forces to launch STONE, a truly liquid and yield-bearing ETH, revolutionizing liquidity management across multiple chains.

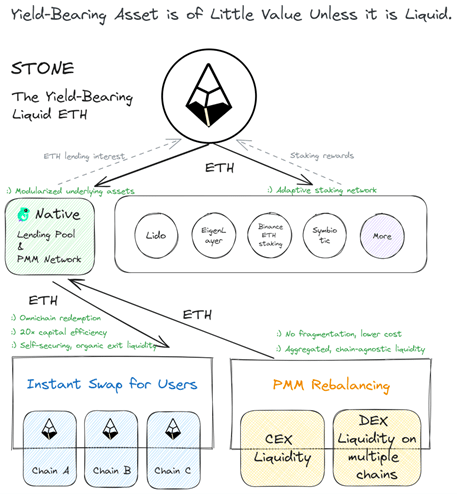

StakeStone, in partnership with Native, the intent-based liquidity infrastructure, is building STONE as the genuinely liquid, yield-bearing ETH. As a liquid asset, it can be effortlessly acquired or exited at any time, across multiple chains. Liquidity fosters trust in an asset and enables a wide range of use cases and a yield-bearing ETH is of little value unless it is liquid.

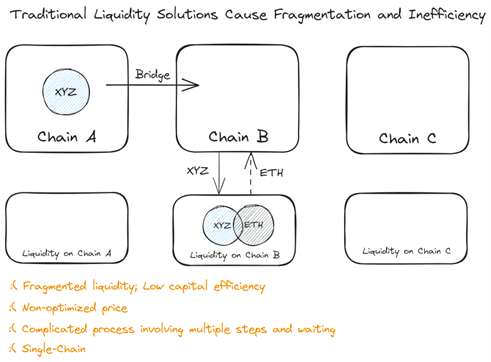

Challenges for building a yield-bearing liquid asset

However, building a liquid ETH faces many challenges today. Firstly, for users holding liquid ETH, how can they seamlessly swap liquid ETH (STONE) back to ETH on a chain outside the ETH mainnet with a one-click process that minimizes price impact, risk, and maximizes speed? Asset liquidity is often fragmented across multiple chains, DEXs, and pools, leading to lower capital efficiency, dispersed volume, higher liquidity costs, worse prices, and more operational steps.

How StakeStone and Native start the new era of building liquidity

STONE’s architecture was specifically designed to create an omnichain liquid ETH from the outset. This unique design allows STONE to be compatible with various underlying assets, or in other words, STONE’s underlying consists of multiple modules. Each module can cater to diverse requirements for building liquid ETH, going beyond passive yield generation.

By supporting Native as one of STONE’s underlying assets, a fraction of STONE’s ETH will be deposited in Native’s on-chain lending pool. Pioneered by Native’s Credit Margin Engine (CME), this kickstarts a flywheel of liquidity benefitting STONE users with instant, seamless bridging and minimal slippage. This ETH portion will be leveraged by Native to facilitate users’ seamless conversion of STONE back to ETH across different chains with a single click.

Enabled by Native’s liquidity infrastructure, users can enjoy optimized speed and pricing, eliminating the complexities and risks associated with bridging, DEX pool discovery, or finding the best routing options.

The Native lending pool on ETH can also serve as an organic lending & leveraging module for STONE. Regardless of STONE’s scale, a portion of ETH will always remain in the money market. Users with advanced needs can use STONE as collateral to borrow this ETH, enhancing capital efficiency, or engage in a STONE-ETH-STONE loop.

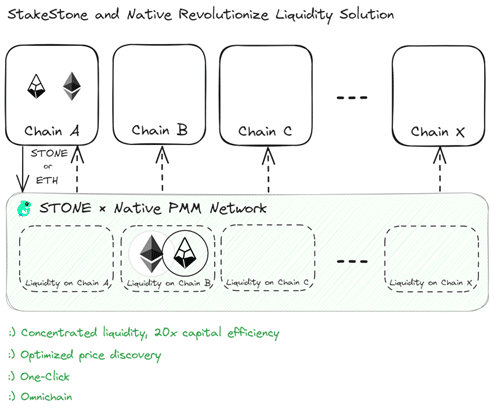

The combination of StakeStone and Native addresses the issue of liquidity fragmentation across multiple chains and DEXs.

Native’s shared pool of liquidity maximizes the efficiency of asset liquidity. Because liquidity aggregation sourced through Native is chain-agnostic, this offers the best price discovery to users on each chain.

In this setup, a few highly liquid DEX pools can meet STONE’s liquidity needs across multiple chains. This concentration of liquidity allows STONE to operate more efficiently with reduced fragmentation. Compared to the costly practice of establishing multiple DEX pools, STONE’s price discovery process will be more effective when supported by Native.

Market Makers can find the best prices for end users across all chains, assess risks, compete with each other, and deliver a superior service experience to users. Users can swiftly acquire assets at optimal prices, bypassing the hassles typically associated with such processes.

Looking ahead

StakeStone has established itself as a prominent player in the staking industry, boasting a market cap of $615 million and providing secure and efficient staking services. STONE aims to introduce a long-term, adaptive asset to the crypto industry and wider audiences: a yield-bearing liquid ETH. Liquid assets help users offset opportunity costs, provide easy access and exit across multiple chains, and can be utilized in various scenarios.

We believe liquidity is crucial for this vision. Strong liquidity allows STONE users to enjoy greater flexibility and a better experience, fostering trust. In our view, when building liquid ETH, Total Value Trusted is more important than Total Value Locked.

The organic integration of STONE and Native has the potential to kickstart a liquidity flywheel. The ETH liquidity from StakeStone’s underlying assets will enhance STONE’s omnichain price discovery, leading to increased trading activity and attracting more liquidity. This positive cycle will strengthen STONE’s liquidity and accessibility, laying a solid foundation for additional use cases and mass adoption.

About StakeStone

StakeStone is an omnichain liquidity asset protocol building an adaptive staking network for liquid ETH / BTC. Through its yield-bearing asset, STONE/STONEBTC, it allows for asset staking beyond the traditional consensus layer. It is fully decentralized, has multi-underlying asset compatibility, automatic yield optimization, and maximizes capital efficiency for the crypto space. StakeStone is dedicated to establishing new standards for liquid assets and enhancing liquidity distribution to earn widespread user trust and adoption. For more information, visit our website at stakestone.io or follow us on Twitter @Stake_Stone.

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.