Stock market crash weighs on crypto with continuing sell-offs and slowed stable coin inflows

Crypto market is bleeding because of a wider selloff in tech stocks, fueled by concerns about potential trade wars and a possible economic downturn in the US.

On Monday, Bitcoin (BTC) price fell by 4% to $80,000 while Ethereum (ETH) price fell by as much as 6% to $1,756, a level not seen since Oct. 2023, though both assets have since recovered some of these losses. At press time, BTC is back at $81,600, while ETH climbed to $1920, though both are down by 1% and 8% from yesterday, respectively.

The declines in crypto prices were triggered by a broader selloff of technology stocks in the US. The Nasdaq 100 Index, which is heavily weighted towards technology companies, had its worst day yesterday since Oct. 2022, dropping by 3.8%. Economic experts are increasing their predictions of a potential economic downturn in the U.S. Donald Trump did warn of a potential “disturbance” from trade wars with Canada, Mexico, and China.

“Now that the industry has its strategic Bitcoin reserve executive order, crypto has one fewer positive forward catalyst to price in, and we’re left at the mercy of macro risk appetites,”

FalconX Global Co-Head of Markets Joshua Lim said.

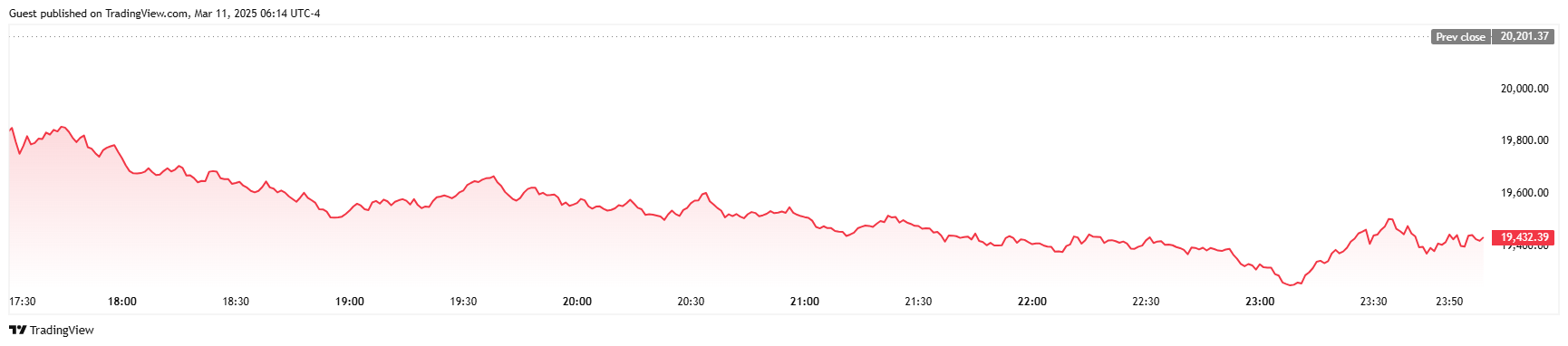

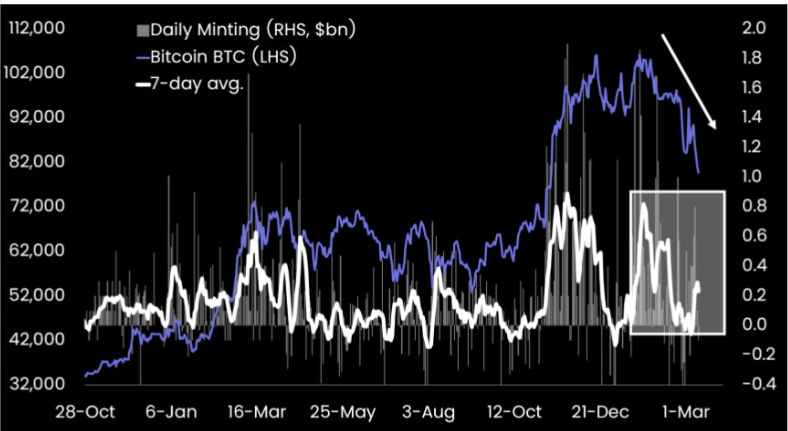

The blow to crypto as a result of stock market crash is also evident in the slowing of stablecoin inflows. According to the chart Matrixport shared on X today, stablecoin inflows have dropped by more than 50%, correlating with Bitcoin’s price decline from its peak. In December 2024, stablecoin minting peaked near $1.8 billion. By March 2025, it fluctuated between $0.4–0.8 billion, a decline of more than 50% from the peak.

Stablecoins are often used for market entry/exit and provide stability, so a decline in their minting directly impacts liquidity. This suggests less demand for crypto, further pushing the market into consolidation. Matrixport analysts attribute the slowing of stablecoin minting to two main factors. Either the stablecoin issuers have accumulated enough in reserves. Or, there’s simply not enough demand from the market. Regardless of the cause, the crypto market needs a significant injection of new capital to lift up prices.