Strategy stock plummets 50% from November peak, but Saylor keeps betting big on BTC

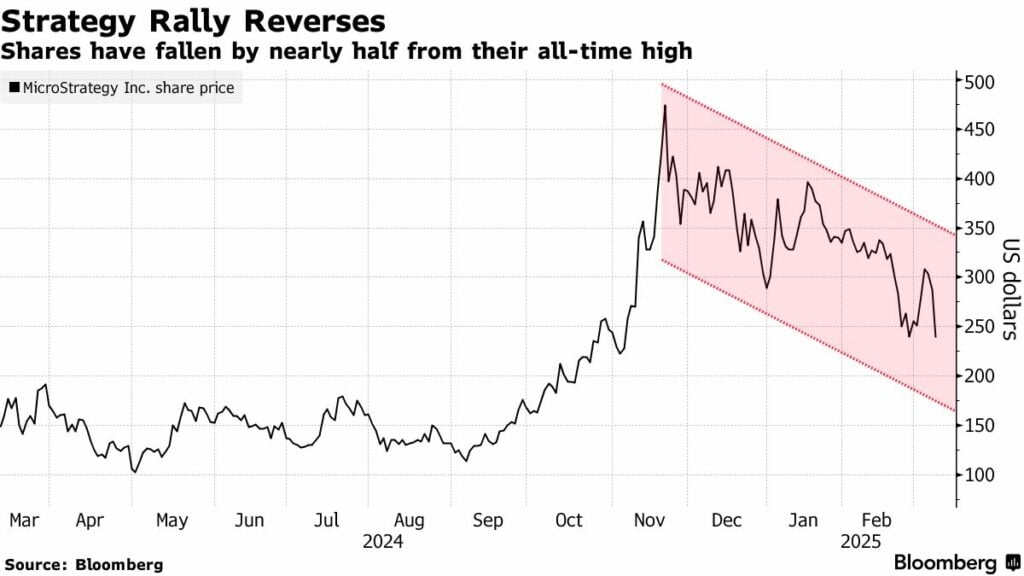

Strategy’s stock is down almost 50% from its Nov. peak, but the company continues its aggressive Bitcoin accumulation strategy amid the current crypto bloodbath.

Strategy stock plunged 17% yesterday, closing at $239.27. This marks an almost 50% shave-off its value since its peak of $473.83 in Nov. 2024. According to Bloomberg, Strategy’s stock surged even faster than Bitcoin, driven by optimism that Trump would create a strategic Bitcoin reserve. However, as Bitcoin (BTC) has surrendered most of its recent gains, Strategy’s stock has tumbled at an even steeper rate.

Investor sentiment turned particularly sour when Trump’s executive order made it clear that the reserve would consist of existing government-held Bitcoin (acquired from seizure of BTC in criminal cases), and that no additional purchases beyond budget-neutral strategies will be made.

Both Bitcoin and Strategy faced further pressure on Monday due to a broader shift away from risk assets amid the macroeconomic uncertainty, mainly due to Trump’s trade war with Canada, Mexico, and China. Bitcoin dropped 4%, trading around $80,000.

Despite the falling stock and Bitcoin struggling to hold key support, Strategy recently announced that it wants to raise $2.1 billion by selling its Class A strike preferred stock and use this money to buy more Bitcoin. This is part of a larger plan (“21/21 roadmap”) led by their executive chairman, Michael Saylor, to raise a total of $42 billion and invest it in Bitcoin. Moreover, Strategy remains ahead of its Bitcoin purchases, recently snapping 20,356 BTC for nearly $2 billion at an average price of $97,514, when its stock was already in freefall.

With the latest addition, Strategy’s Bitcoin stash is now 499,096 BTC, purchased with around $33.1 billion to buy it, averaging $66,357 per Bitcoin, and funded this primarily through equity sales. Its total holdings are now worth around $40 billion representing approximately 21% unrealized gain at the current BTC price of $80,381.

Even though some are skeptical of Saylor’s BTC buys in the current climate, analysts generally have a positive outlook on Strategy’s future. Specifically, all eleven financial analysts surveyed by Bloomberg recommend that investors buy Strategy’s stock, predicting that the stock price will surpass the $540 peak it reached last year.