Sui forms a rare bullish pattern as open interest hits all-time high

Sui, the popular Solana-killer, continued rising on Sunday, Sep. 15 as sentiment in the crypto industry improved.

Sui (SUI) jumped to an intraday high of $1.10, its highest level since Aug. 12, and 137% above its lowest point last month. This recovery makes it one of the best-performing top 100 cryptocurrencies.

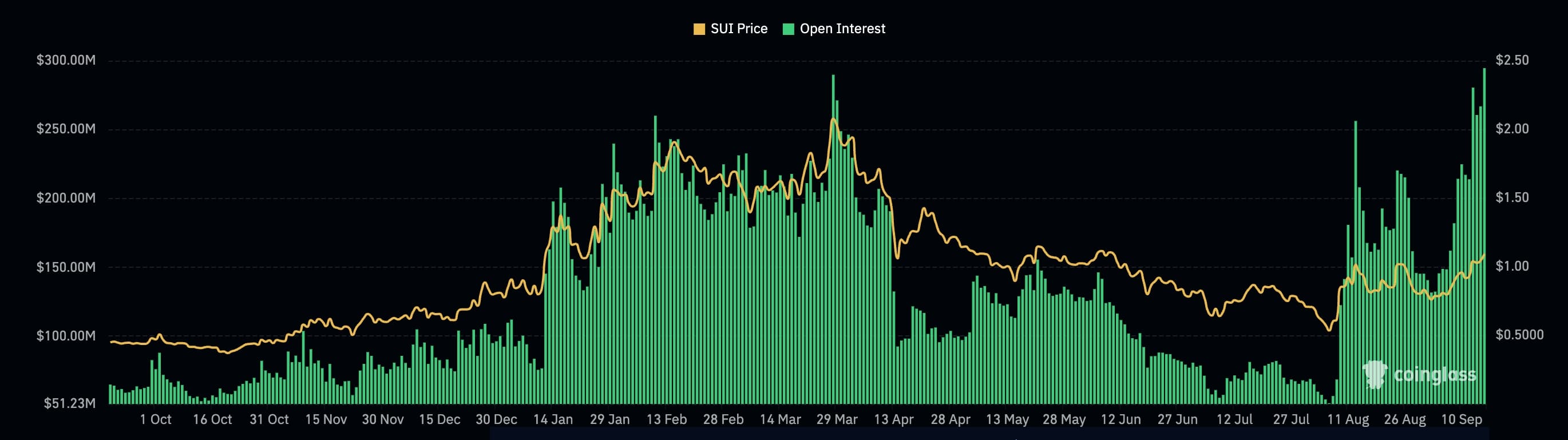

Futures open interest jump

The coins recovery has coincided with strong demand in the futures market, where open interest has jumped to a record high. According to CoinGlass, the interest rose to $295 million, crossing the previous record high of $289 million. It is a significant increase from August’s low of less than $60 million.

Futures open interest is an important number that looks at the volume of unfilled put and call orders. A higher figure is a sign that an asset is seeing substantial demand among futures traders. Most of this interest is among Bybit traders followed by Binance, and Bitget.

Additional data shows that Sui’s network is gaining traction among developers and users. The total value locked in its decentralized finance industry has risen by over 16% in the last 30 days to over $703 million. Most of these assets are in NAVI Protocol, Scallop Lend, Suilend, and Aftermath Finance.

Sui’s stablecoin volume has jumped to over $364 million while the volume of its decentralized exchange platforms has jumped by over 32% in the last seven days to almost $300 million. The most notable DEX platforms in its applications are Cetus, Kriya, and DeepBook.

Sui has also found use cases outside the crypto industry. In a statement last week, the network said that it was being used by 3DOS, a manufacturer of 3D printing devices. The company selected Sui because of its quick throughput and lower transaction costs.

Sui price nears key resistance

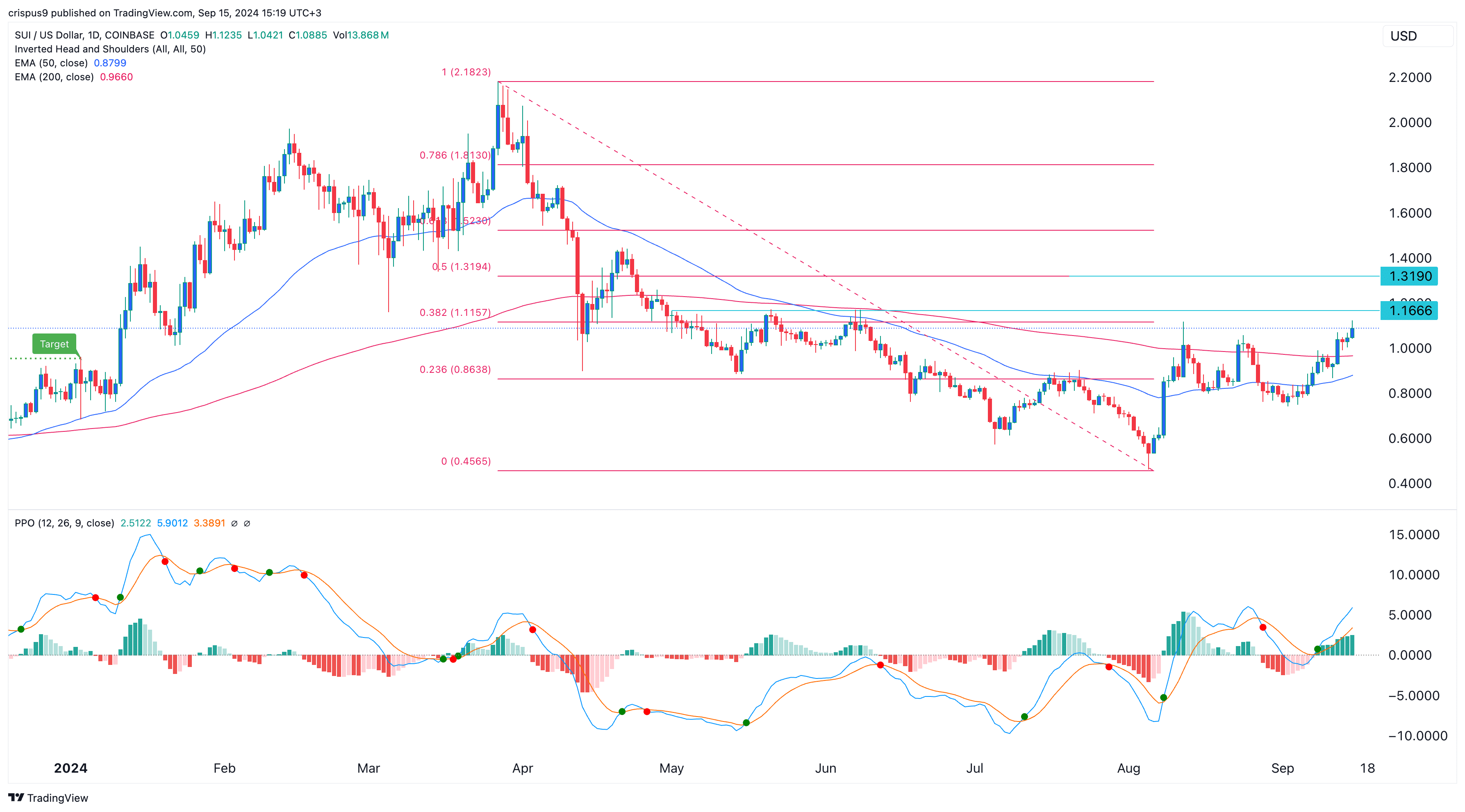

On the daily chart, Sui has formed an encouraging and rare inverse head and shoulders pattern, which is often a bullish sign. It is now nearing its neckline at $1.165, its highest point in May and June and the 38.2% Fibonacci Retracement point.

Sui has also jumped above the 50-day and 200-day Exponential Moving Averages while the Percentage Price Oscillator has remained above the neutral point.

Therefore, a break above the H&S neckline at $1.66 will likely lead to more upside as traders target the 50% retracement point at $1.3190.