Sui token forms a bullish pattern, nears a pivotal price

Sui, the so-called ‘Solana killer,’ has done well in the past few weeks, making it one of the best-performing tokens in the industry.

The native currency of the Sui (SUI) Network ecosystem has risen in the past four consecutive days. It was trading at $0.9820, its highest swing since Aug. 27, and jumped by over 100% from its lowest point in August.

Bitcoin (BTC) is up by 10% in the same period.

Sui’s recovery has happened in a high-volume environment. Data by CoinGecko shows that the coin’s volume in the spot market has been in a slow increase. The volume jumped to over $413 million on Saturday, Sept. 8, its highest level since Aug. 24.

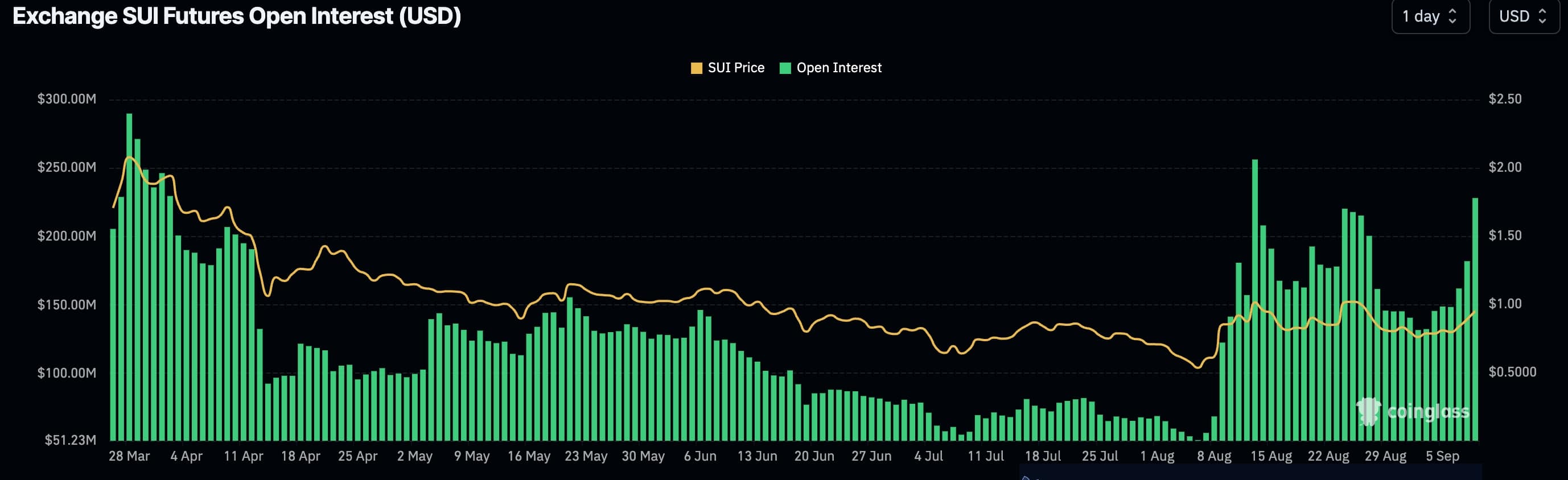

Additionally, as shown below, Sui’s open interest in the futures market has risen in the last six consecutive days, and is hovering at its highest point since Aug. 13.

It stood at over $228 million, higher than last month’s low of $130 million.

Sui has also had some other positive fundamentals. Its weekly DEX volume stood at over $222 million, making it the tenth-biggest chain for DEX platforms. Its most active DEX platforms were Cetus, DeepBook, Turbos, and Kriya. Its monthly volume rose for three straight months, reaching $1.35 billion in August.

Meanwhile, a lot has been going behind the scenes. For example, SuiPlay, the first Web3-native handheld gaming device, will launch in the first half of next year. The device has opened for pre-orders with a price tag of $599.

There’s also Mysticeti, an upgrade that has led to faster settlements as it continues building a case on why it is a better blockchain than Solana.

Sui price nears a key level

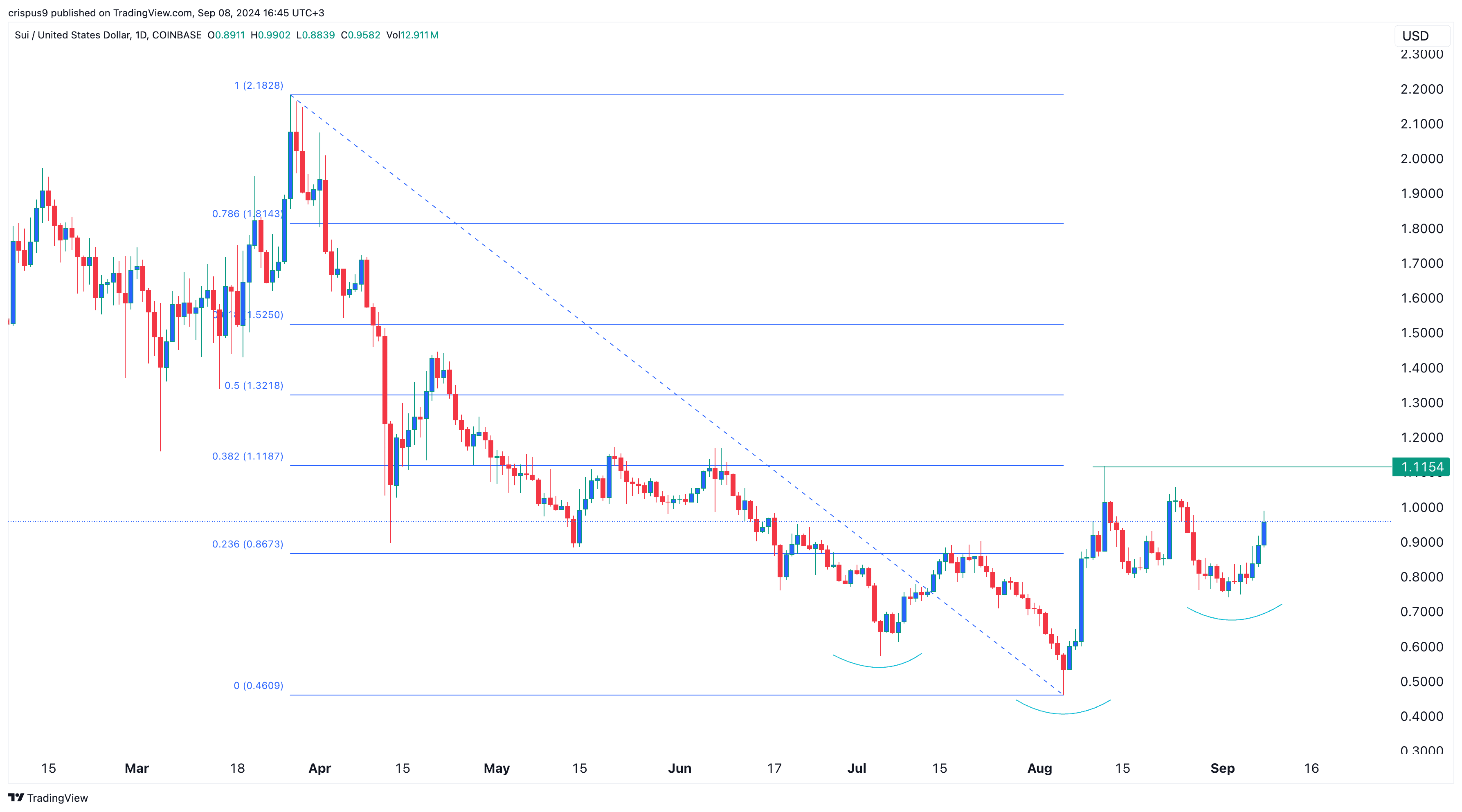

Technically, Sui is nearing the psychologically-important resistance point at $1. Additionally, it has formed an inverse head and shoulders chart pattern, which is a popular bullish reversal sign.

The coin has also crossed the 23.6% Fibonacci Retracement level, turning it into a support. It has also jumped above the 50-day moving average.

Expect Sui to continue rising, with the next point to watch being at $1.1154 — its highest swing on Aug. 12 — and the 38.2% retracement point.