sUSD struggles to regain $1 peg as Synthetix deploys recovery measures post SIP-420

Synthetix’s algorithmic stablecoin sUSD is continuing to drift from its $1 peg, currently trading at $0.90.

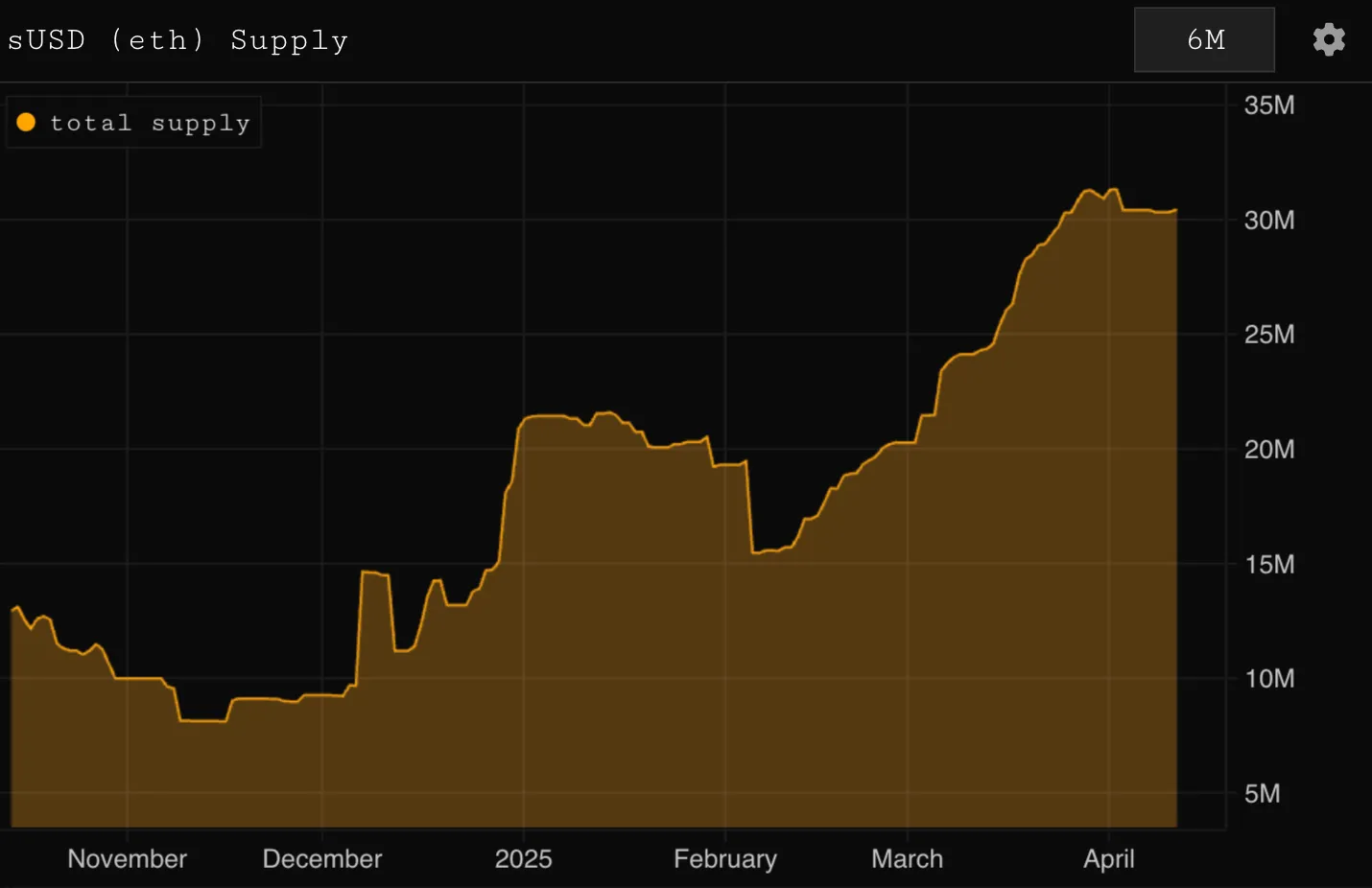

The depeging began in March, with sUSD briefly slipping below $1, but the situation worsened after the implementation of SIP-420—a governance proposal aimed at improving capital efficiency and simplifying the user experience within the Synthetix (SNX) ecosystem. According to Parsec research, the implementation of SIP-420 has inadvertently caused a large increase in the supply of sUSD, which triggered the current depeg.

Specifically, SIP-420 introduced a protocol-owned staking pool, allowing SNX holders to delegate their staking to a shared pool rather than managing their own debt and minting sUSD. The new setup lowered the collateralization ratio from 500% to 200%, making it easier to mint more sUSD — roughly 2.5x, according to Parsec. This has removed the stablecoin’s stabilizing mechanism—the incentive for individual stakers to purchase sUSD at a discount to pay off their debt when the price falls below peg.

Now, with the debt pooled, stakers essentially have no skin in the game to restore the peg. Combined with the fact that the 420 Pool now holds over $80 million in SNX, sUSD’s supply has expanded significantly, with some Curve liquidity pools containing over 90% sUSD. With no immediate demand to balance this increased supply, the price of sUSD is continues to fall.

To make matters worse, Infinex began incentivizing the holding of sUSD in the Infinex wallet just before the depegging had started. However, these incentives have led to more liquidity in the system without corresponding demand. As one user on Infinex’s Discord channel wrote, “You guys promote sUSD through campaigns, you take responsibility.”

The Synthetix team has reassured users that this is a “transition period.” They’re working to create new demand sinks, such as Aave (AAVE) and Ethena (ENA) integrations, to counterbalance the excess supply of sUSD. Additionally, they have promised to bolster incentives for liquidity pools, particularly on Curve, to restore stability.

To summarize, the SIP-420 upgrade has brought capital efficiency and a simpler UX to Synthetix, but it has removed the organic reflexive peg stabilizer, resulting in the sUSD depeg as a side effect. By moving to a protocol-owned staking pool and lowering the collateralization ratio, SIP-420 has led to an increase in the supply of sUSD without sufficient demand to counterbalance it. This has caused the stablecoin to depeg, with the price currently hovering around $0.90. This means sUSD holders are left with a choice: exit now or hold and wait for full recovery.