Synthetix halts SNX token inflation, pivots to buyback and burn strategy

Members of the Synthetix derivatives protocol community have given the green light to a governance proposal, SIP-2043, which seeks to halt the inflation of the SNX token.

The latest change paves the way for new strategies, including token buybacks and burns, scheduled for the upcoming Andromeda software release.

With the end of inflation, stakers on Synthetix will no longer need to claim their weekly inflationary token rewards.

The protocol’s future direction involves utilizing trading fees to facilitate token buybacks and burns. This strategy aims to decrease the token supply by using fees generated within the protocol to purchase and subsequently burn SNX tokens.

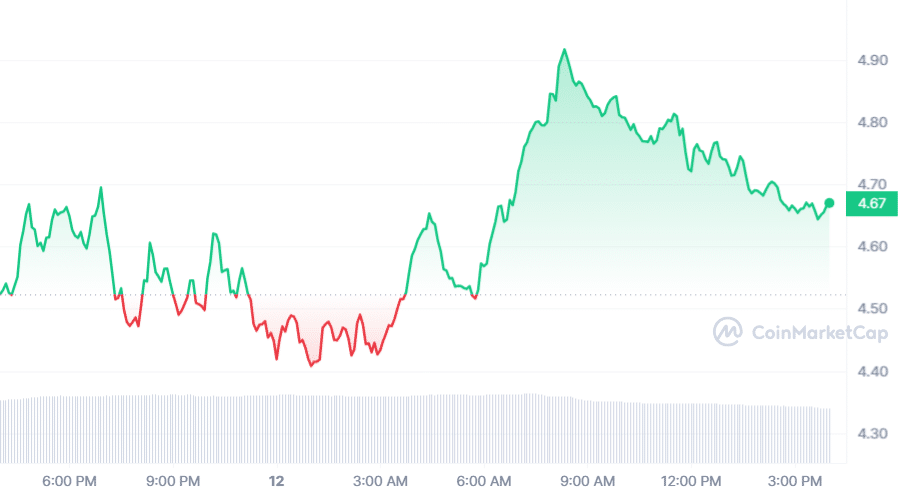

The Synthetix token has responded positively to this development, reaching a yearly peak with its price climbing to $4.91, as per data by CoinMarketCap.

The token has also experienced a 65% surge over the past month and an impressive 150% increase over a year. Despite these gains, the token’s value remains 82% lower than its all-time high in February 2021.

Currently, the Synthetix token has a circulating supply of around 300 million, leading to a fully diluted market capitalization of $1.53 billion.

The platform enables decentralized derivatives trading, with its liquidity pools holding over $890 million in total value, spanning the Ethereum and Optimism Layer 2 networks.