Tether buys another $735M in BTC in Q1, bringing total holdings to $8.2B

Tether, the issuer behind the USDT stablecoin, has continued its Bitcoin investment strategy, purchasing an additional 8,888 BTC on the last day of Q1 2025.

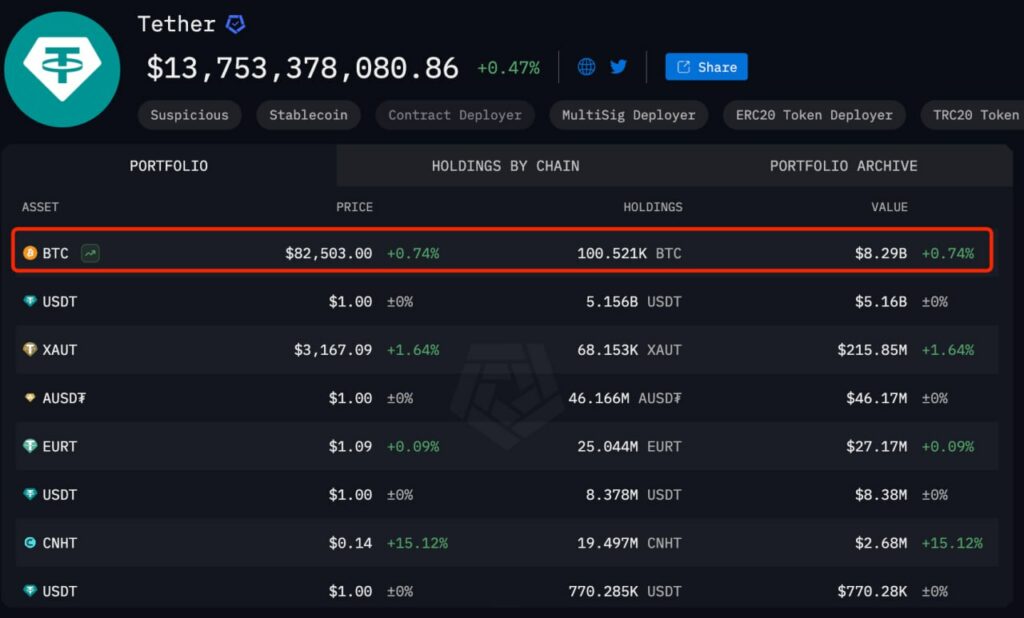

The latest acquisition, which cost $735 million, expands Tether’s (USDT) total Bitcoin (BTC) holdings to 100,521 BTC, or roughly $8.29 billion, according to data from Arkham Intelligence.

The acquisition is part of Tether’s ongoing strategy to bolster its reserves by allocating 15% of its profits to Bitcoin purchases, a commitment the company made in May 2023.

Among the company’s other on-chain assets are $5.16 billion in USDT, $215.85 million in XAUT, and $46.17 million in AUSDF.

Tether’s expansion extends beyond cryptocurrencies. On Mar. 27, the company increased its stake in Adecoagro, a Latin American agricultural firm, to 70%. This is in line with Tether’s policy of supporting companies that promote economic freedom, especially in emerging markets.

To further expand its investments across a variety of industries, Tether plans to purchase a 30% stake in the Italian media company Be Water.

The company reported a record profit of $13.7 billion last year, according to its Q4 2024 report. It established itself as the biggest stablecoin issuer by issuing USDT totaling $45 billion. With a market valuation of $144 billion, USDT now accounts for 61% of the total stablecoin market, far outpacing competitors such as USD Coin (USDC), which has a market cap of $60 billion.

To ensure that every USDT issued is completely backed, the company maintains $7 billion in excess stablecoin reserves. Tether also made big moves in traditional markets, becoming 2024’s seventh-largest buyer of U.S. Treasury securities with a $33.1 billion investment. This further diversifies Tether’s assets and puts its holdings ahead of nations like Canada, Mexico, and Germany.