Tether CEO fires back at accusations about company solvency

Tether CEO Paolo Ardoino responded to Deutsche Bank analysts’ questions about the company’s solvency and the stability of its USDT stablecoin.

Ardoino cited the latest statement from Deutsche Bank analysts on his X account, saying the financial institution has no room to talk.

The Tether CEO noted Deutsche Bank’s history of fines and sanctions, raising doubts about its ability to criticize others in the industry. Ardoino recalled that the International Monetary Fund also named Deutsche Bank the riskiest bank in the world.

“Deutsche Bank’s history of fines and penalties raises doubts about its own standing to critique others in the industry.”

Paolo Ardoino, Tether CEO

In comments to the post, users noted that Deutsche Bank has paid more than $20 billion for 99 violations since 2000. Therefore, the bank should not criticize other companies for risks, product structuring, or regulation.

Earlier, the Deutsche Bank expert group published the results of a study of the stablecoin market. Analysts named the asset class’s weaknesses and noted Tether‘s lack of transparency as the issuer of the USDT stablecoin.

Deutsch Bank analysts also added that given Tether’s monopoly in the stablecoin market, if USDT collapses, its consequences will be more serious.

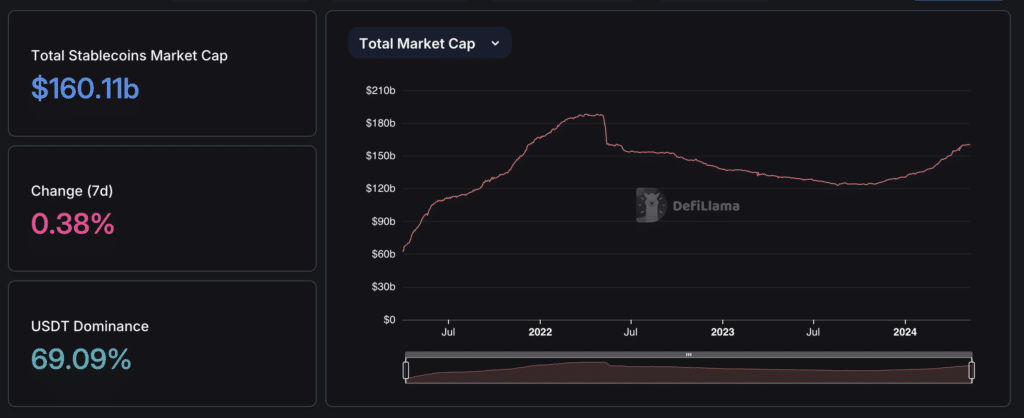

According to DefiLlama, the total capitalization of stablecoins currently exceeds $160 billion. USDT is the unquestioned leader in this market, with over 69% market dominance.

However, experts warn that Tether’s dominance could weaken due to new regulations being proposed in the United States.