Tether’s USDT surpasses $100b mark, sets new stablecoin record

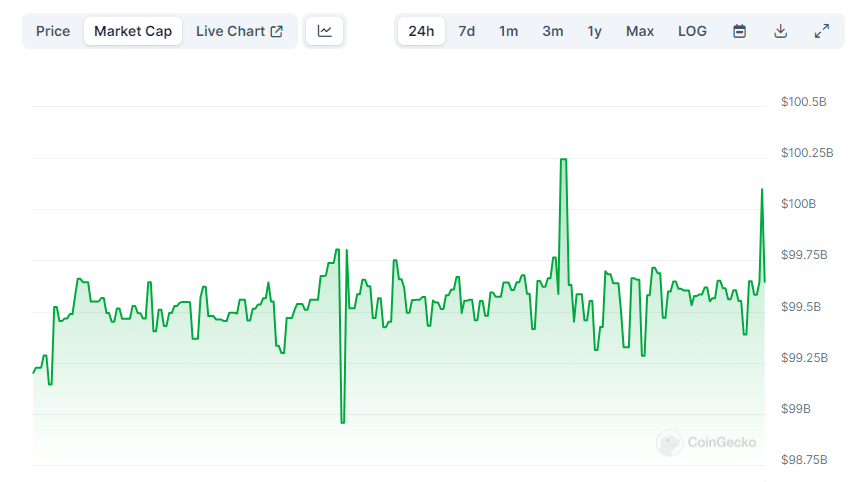

Tether’s USDT stablecoin market cap exceeded the $100 billion mark today, setting a significant benchmark.

As the first stablecoin to achieve this scale, USDT’s distribution has increased by over 9% from the beginning of the year, driven by a surge in demand for Bitcoin, which reached $66,000 today for the first time since November 2021. Tether’s position as the most frequently traded cryptocurrency worldwide has been cemented as part of the milestone.

The peak in circulation reached $100.2 billion around 8:10 a.m. GMT on Monday, as per CoinGecko, though it later adjusted to approximately $99.6 billion. Additionally, there was a moment when the token’s value exceeded $1. Attempts to obtain comments from Tether representatives were not immediately answered.

According to a January attestation, Tether’s declared reserves for its USDT stablecoin climbed to $97 billion in December, with more than 76% held in short-term U.S. Treasury bills. The increased yields on securities have significantly enhanced Tether’s financial gains over the last year.

In December, the company revealed an excess capital of $2.85 billion allocated to investments in sectors like industry research and Bitcoin mining. With plans to further invest in these areas in 2024, Tether CEO Paolo Ardoino announced in November the intention to dedicate approximately $500 million to Bitcoin mining projects alone.

Tether currently dominates 70% of the stablecoin market, with its nearest competitor, Circle’s USDC, only accounting for 19%. Circle’s Policy and Regulation Chief scrutinized Tether recently at a House Financial Services Committee session, asking Congress to take more strict actions against the leading stablecoin provider.