The bullish case for crypto? Polymarket forecasts and Sahm Rule

It was a sea of red in the crypto market on Monday as the fear and greed index moved to the fear zone of 35, with most tokens falling by over 20%.

Bitcoin (BTC) plunged by 17% in the past 24 hours while other notable coins like Pepe (PEPE), Ethereum (ETH), Solana (SOL), and Notcoin (NOT) performed even worse. Altogether, the market cap of all cryptocurrencies has dropped from almost $3 trillion in March to $1.8 trillion.

Crypto outlook seems bearish

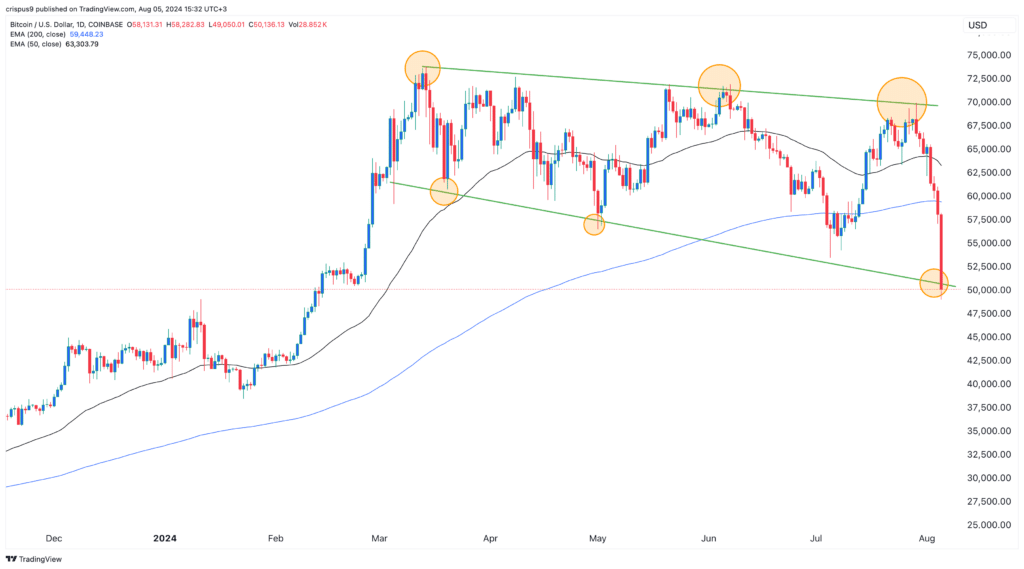

The outlook for Bitcoin and other coins seems highly bearish, with Bitcoin forming a series of lower lows and lower highs. It has even moved below the lower side of the falling broadening wedge pattern.

Technically, Bitcoin has moved below the 50-day and 200-day moving averages, meaning that bears are in complete control.

Further, crypto investors have turned fearful, with the fear and greed index dropping to the fear zone of 35. In most cases, cryptocurrencies drop when there is a sense of fear in the market.

Additionally, crypto liquidations have soared, crossing over $1 billion on Monday. Bearish volume has also risen across the biggest crypto exchanges.

This trend is happening for several reasons. The biggest one is that the Bank of Japan is moving in the opposite direction from other central banks like the Bank of England and the European Central Bank.

Further, the US presidential election is much tighter than before, and there are rising odds that Trump will not win the election. Trump is seen favorably among crypto investors.

The bull case for Bitcoin and altcoins

Still, a bull case can be made in the crypto market. Goldman Sachs has raised its recession odds while the Sahm Rule index has risen to 0.53. The Sahm Rule looks at the average unemployment rate in the US over 12 months.

Odds of a recession rise when the Sahm Rule moves above 0.50%. Recent data shows that it has risen to 0.53%, meaning that a recession could happen.

Ironically, stocks and cryptocurrencies do well during a recession because of the Federal Reserve. If a recession happens, the Fed will likely cut interest rates at a quicker rate than expected. Polymarket traders anticipate a jumbo rate cut of 0.50% in September while ING analysts see four cuts this year.

Such cuts would have an enormous impact on the market since investors have allocated $6.1 billion in money market funds, where they are earning about 5%. When rates start falling, these investors will likely move funds to riskier assets like stocks and crypto.

We saw this happen during the COVID-19 pandemic when stocks jumped after the Fed slashed interest rates to zero.