The end of ETF euphoria: Will there be a recovery for Bitcoin?

Heading into the first half of 2024, crypto investors are wondering about the future of Bitcoin, which continues to lose value after hitting an all-time high in March.

Table of Contents

According to Bloomberg, Bitcoin (BTC) has lost about 13% in value since March, after sharp surges of 67% and 57% in previous quarters. Amid the decline in the price of the first cryptocurrency, questions have emerged about whether cracks in momentum trades such as Bitcoin indicate a stricter outlook for risk appetite as the prospect of higher interest rates for longer looms over financial markets.

Austin Reid, global head of revenue and business at FalconX, believes the crypto market is only temporarily uncertain. A slowdown in demand for spot Bitcoin ETFs could be one of the best measures to reduce interest.

Matthew O’Neill, co-director of research at Financial Technology Partners, believes the approval of spot Bitcoin ETFs in January sparked euphoria in the market, followed by a natural price correction after the rally.

The expert notes that ETFs attracted an outpouring of interest from professional investors who wanted exposure to Bitcoin but only wanted to buy the cryptocurrency through institutional means. O’Neill sees the current decline in BTC as an excellent time to buy before the subsequent increase in Bitcoin prices.

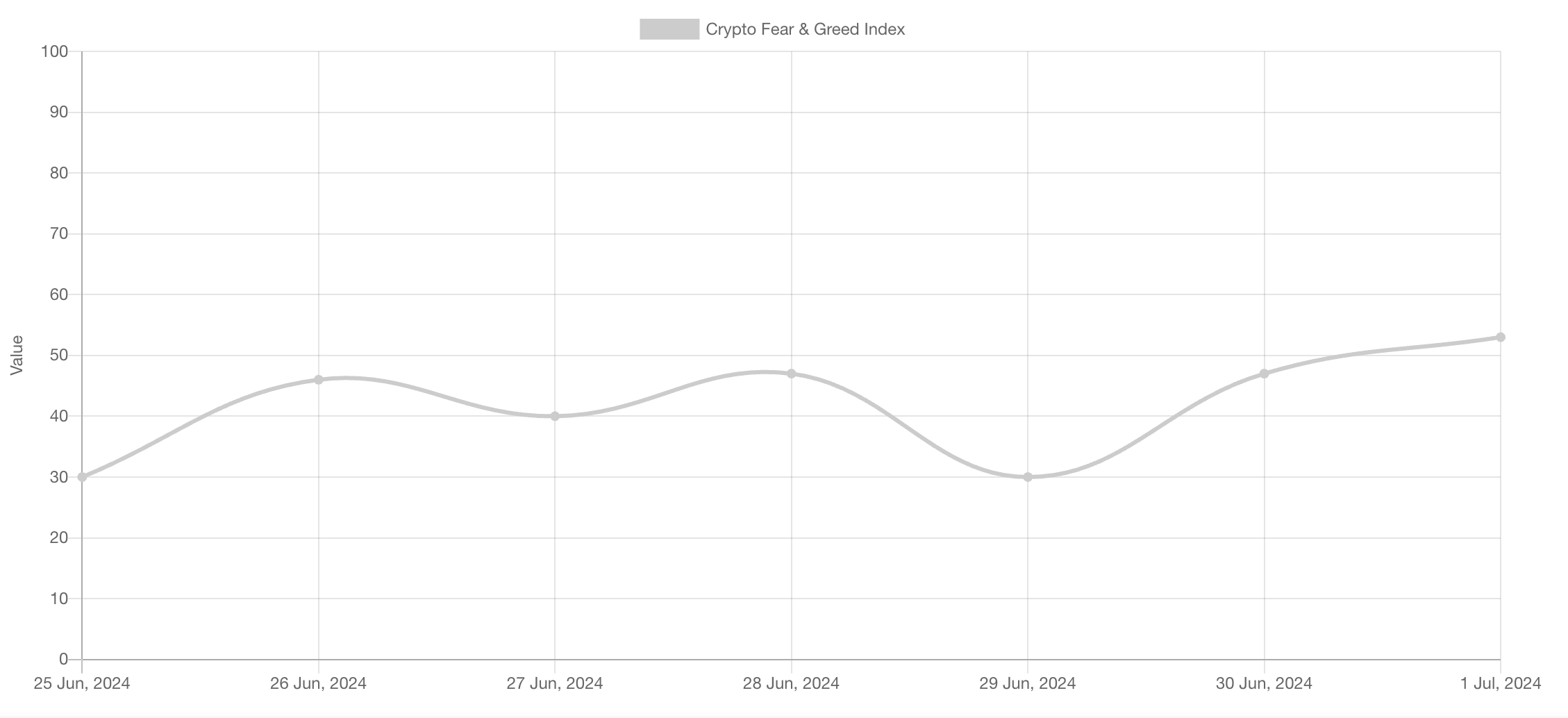

Fear and Greed Index records sharp decline

Last week, on June 25, the index of fear and greed in the crypto market fell to 30 points, the lowest figure since September 2023.

The index’s move towards fear occurred against a general decline in the crypto market when Bitcoin fell from $62,500 to $59,100, dragging other assets with it, after the news of the start of payments to Mt. Gox clients.

Blockchain analyst Willy Wu pointed out a “cascading long squeeze” in BTC. In his opinion, the asset’s fall to a 53-day low occurred against the backdrop of miners’ capitulation after the Bitcoin halving in April.

The expert believes miners began selling off BTC to upgrade equipment since old devices are no longer profitable. The analyst named $54,000 as the next significant level for BTC. The cryptocurrency market may enter a bearish phase if it falls below this level.

What will happen to the Bitcoin ETF?

According to CoinShares data, investors poured about $2.6 billion into Bitcoin ETFs in the second quarter, up from about $13 billion in the first three months of the year. After a steady outflow of funds, spot Bitcoin ETFs again showed positive dynamics at the end of June.

The trend reversal occurs against the backdrop of general instability in the market for cryptocurrency investment products. CoinShares said over $1 billion was withdrawn from the sector over the previous two weeks. Renewed inflows into spot Bitcoin ETFs could signal a return to investor interest in the asset class and the start of a new phase in cryptocurrency market dynamics.

However, most of the attention is now focused on the Ethereum ETF. According to a recent analysis from Citi, net inflows into Bitcoin ETFs exceeded $13 billion. These investments triggered a sharp rise in the price of BTC: according to the company, every $1 billion in inflows increased the value of Bitcoin by 6%.

The bank predicts that the launch of ETF trading on Ethereum will attract inflows of between $3.8 billion and $4.5 billion over the same period, potentially increasing the price of ETH by 23-28%. This means that ETH could rise to $4,417 by November this year.

Will the situation improve?

Experts from the analytical company CryptoQuant said they expect positive movements in the cryptocurrency market in the third quarter of 2024.

Analysts explained that the upward rally would continue again if miners completed the sale of BTC.

CryptoQuant also added that the crypto market has been falling recently because of the miners. After the halving, the profitability of their activities fell, and they were forced to sell off their assets.

Because of this, miners’ activity decreased, and they began to sell Bitcoin on over-the-counter markets to cover mining costs.

Former Goldman Sachs CEO Raoul Pal also predicted significant cryptocurrency growth in the fourth quarter of 2024. The investor noted that risky assets like BTC usually rally against the backdrop of the U.S. presidential election.

Thus, experts maintain a bullish forecast for Bitcoin’s medium-term trend. However, growth slowed down as part of a local downward correction.