The United States is focused on tokenized certificates of deposit | Opinion

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

A recent study by Atmos positioned the United States as a worldwide frontrunner among nations for digital asset support and integration. The nation’s commitment to blockchain technology sets a precedent for tokenization/digital payment integration of the global financial sector with a progressive regulatory approach, according to a study by BoxBet.

Indeed, many large US banks such as J.P. Morgan, Citibank and other large banks such as UBS, Société Générale, the Swiss Banking Association, Banque de France, UK Regulated Liability Network, HSBC, Standard Chartered, Barclays, Lloyds, DZ Bank, Deutsche Bank, Commerzbank, Unicredit, SBI Holdings, Hitachi, SHIZUOKA BANK, TIS, NSD, Fujitsu, KDDI, MUFG Bank, Higo Bank, Kagoshima Bank, GMO Financial Holdings have launched digital asset services departments fueling the tokenization trend of the financial sector.

Adopting new digital technologies enables financial institutions to considerably reduce operating costs, enhance transparency, and offer innovative services. Vivek Raman, CEO of Etherealize, states:

“Tokenized deposits will be the largest unlock for liquidity movement within banks. While stablecoins were the first instance of mass product-market fit for the blockchain ecosystem, stablecoins are not capital efficient. Tokenizing deposits (which could be IOUs or earn interest) allows for more capital-efficient movement. We are already seeing that with SAB 121 being repealed, the desire for banks to hold tokenized assets is increasing. We think the default choice—the safest, most secure blockchain ecosystem to hold tokenized assets—is within the Ethereum economy.”

What are tokenized deposits?

Tokenized deposits are a token representation of the traditional commercial deposits that have been converted into digital tokens on a blockchain network, where each token is backed by a retail or institutional deposit. It involves the conversion of traditional financial assets such as a certificate of deposit, or a savings account into a digital token that offers investors potential benefits like faster 24/7 round the clock transactions with smart contracts used to automate interest rates, increased liquidity, fractional ownership, transparency—eliminating any possibility of fraud or manipulation.

Instead of holding physical cash or keeping money in a bank account, investors can hold digital tokens representing their certificate of deposit or savings account amount on a secure and decentralized ledger by empowering them to participate in the digital asset ecosystem, ultimately leading to cost savings.

For example, a tokenized certificate of deposit is a digital representation of a traditional CD, which is a fixed-term cash investment with a guaranteed interest rate of return, adapted into a token that the investor can freely trade on various digital asset exchanges or platforms similar to other digital assets that are regulated under the same framework as traditional bank deposits, focusing on ensuring the underlying bank’s stability and compliance with existing regulations. This gives investors more flexibility and liquidity than a certificate of deposit, which often has an early redemption penalty.

Universal Digital Payments Network’s tokenized deposit platform

Last year, after running over a dozen proofs of concept, or PoC, with multiple global banks, technology companies, and intergovernmental organizations, UDPN launched two digital asset management systems for commercial use, designed to reshape the landscape of digital payments and assets in the financial sector:

- Tokenized deposit/stablecoin management system: Designed for both commercial banks and regulated stablecoin issuers, it streamlines the entire lifecycle of tokenized deposits and stablecoin services—from issuance to operation, including advanced interoperability features.

- Digital asset tokenization system: Provides a robust platform for financial institutions, such as banks and investment firms, to tokenize real-world assets and manage them within a regulated environment.

Operating a digital asset system involves complex lifecycle management. These new digital asset systems—tokenized deposit/stablecoin management system and digital asset tokenization system—easily integrate into core banking systems and can be installed in a bank or a stablecoin operator’s on-premises or cloud environment to ensure compliance and security in a regulated environment.

UDPN’s solutions efficiently link to legacy systems via APIs, ensuring seamless interoperability with traditional banking infrastructures and other digital asset systems within regulated frameworks, granting institutions full data sovereignty and the flexibility to choose their underlying infrastructure and deploy digital assets and tokens on any public or private blockchain. Both solutions allow the optional ability to interoperate with other regulated digital currency systems through UDPN’s infrastructure. This feature promotes seamless collaboration and integration within the digital asset ecosystem. As regulatory scrutiny intensifies around stablecoins and digital assets globally, UDPN’s platforms offer a robust and compliant framework tailored for operation within regulated financial environments.

Tim Bailey, VP of Global Business and Operations, Red Date Technology, explained:

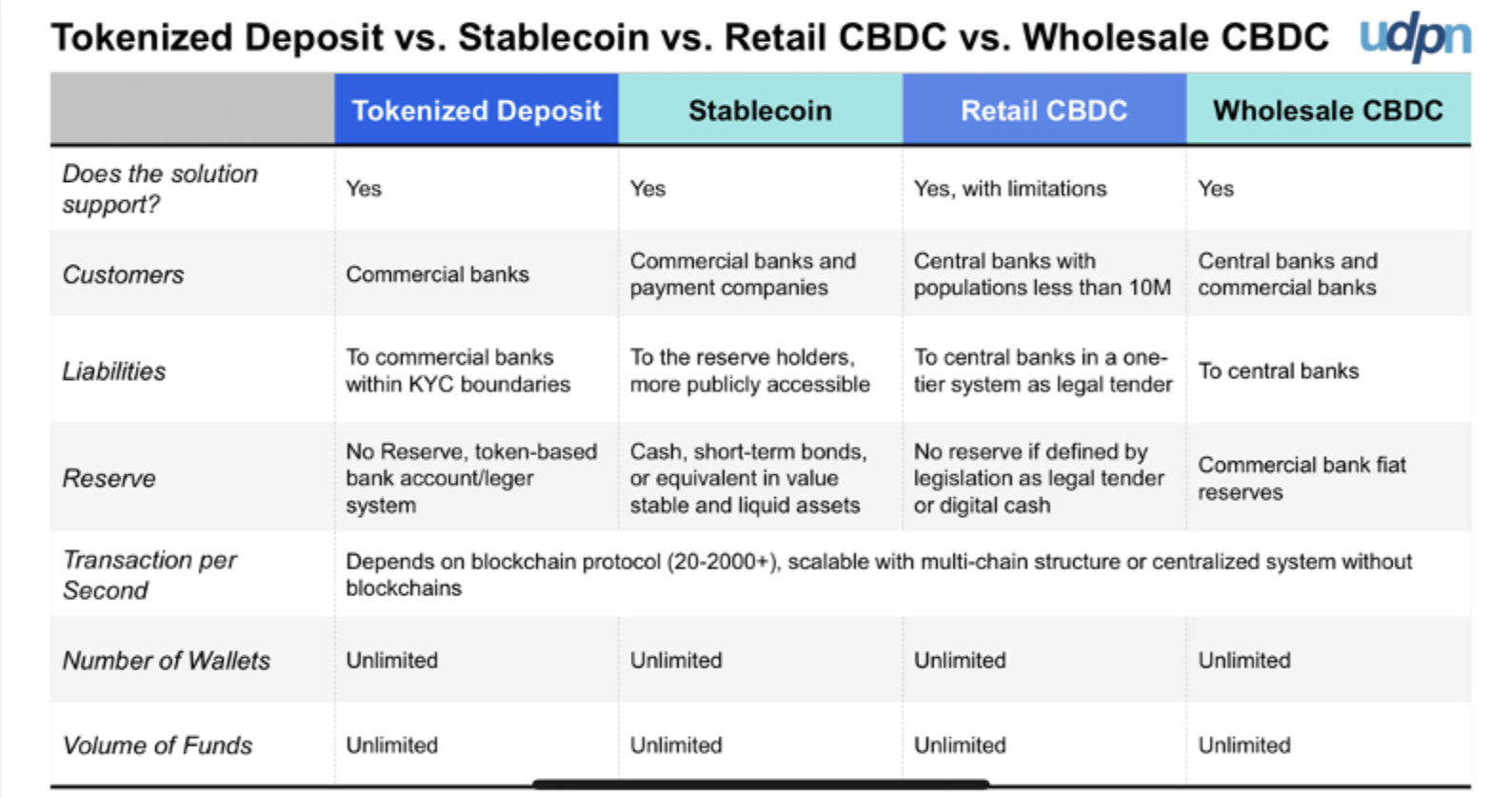

“Financial institutions and banks are embracing innovation to stay ahead by utilizing UDPN’s cutting-edge tokenized deposit/stablecoin management system and digital asset tokenization system to forge the future of tokenized banking. This chart [above] is a general comparison between different types of digital currencies, such as tokenized deposits vs. stablecoins vs. retail and wholesale CDCs, not necessarily the capabilities of UDNP’s tokenized deposit/stablecoin management system.”