The WazirX hack is wreaking havoc on crypto — here’s how

Bitcoin’s trading pairs with the Indian rupee have fallen off a cliff. A whopping $100 million worth of SHIB was stolen from WazirX too, with the memecoin tanking in value.

Let’s be honest: hacks are a pretty routine occurrence in the world of crypto. Cybercriminals find security vulnerabilities with alarming regularity — stealing millions of dollars in the process.

That being said, audacious exploits involving centralized exchanges have become a little less common in recent years, especially those to the tune of hundreds of millions of dollars. And that’s what makes the recent events at WazirX so concerning.

This is India’s biggest crypto platform — and on its website, it wastes little time in declaring it’s “trusted” by more than 15 million people. But now, it’s out of pocket to the tune of $235 million. If alarm bells weren’t ringing already, that’s about half of the funds this exchange had in custody.

In a worrying development that spooked customers, WazirX confirmed what happened on X:

But this is an attack that’s already had multiple knock-on effects, some of them pretty unexpected.

For one, it seems that a substantial chunk of the crypto that was stolen was denominated in two coins: Shiba Inu and Ether.

Estimates suggest about $100 million of SHIB was taken, which is now being aggressively offloaded on the decentralized exchange Uniswap. A further $52 million of ETH is also missing — but given this is the world’s second-largest cryptocurrency, with plenty of liquidity and a lot of buzz surrounding the approval of ETFs in the U.S., it’s in a much better position to absorb the selling pressure.

Figures from CoinMarketCap suggest SHIB is far and away the worst performer on a 24-hour timeframe — hemorrhaging 8.35% of its value at the time of writing. By contrast, ETH’s down a mere 0.38%.

Blockchain analytics firm Arkham Intelligence later confirmed that all of this SHIB had now been offloaded, posting on X:

At the time of writing, they continue to hold 43,800 ETH as well as just 52 cents of MATIC.

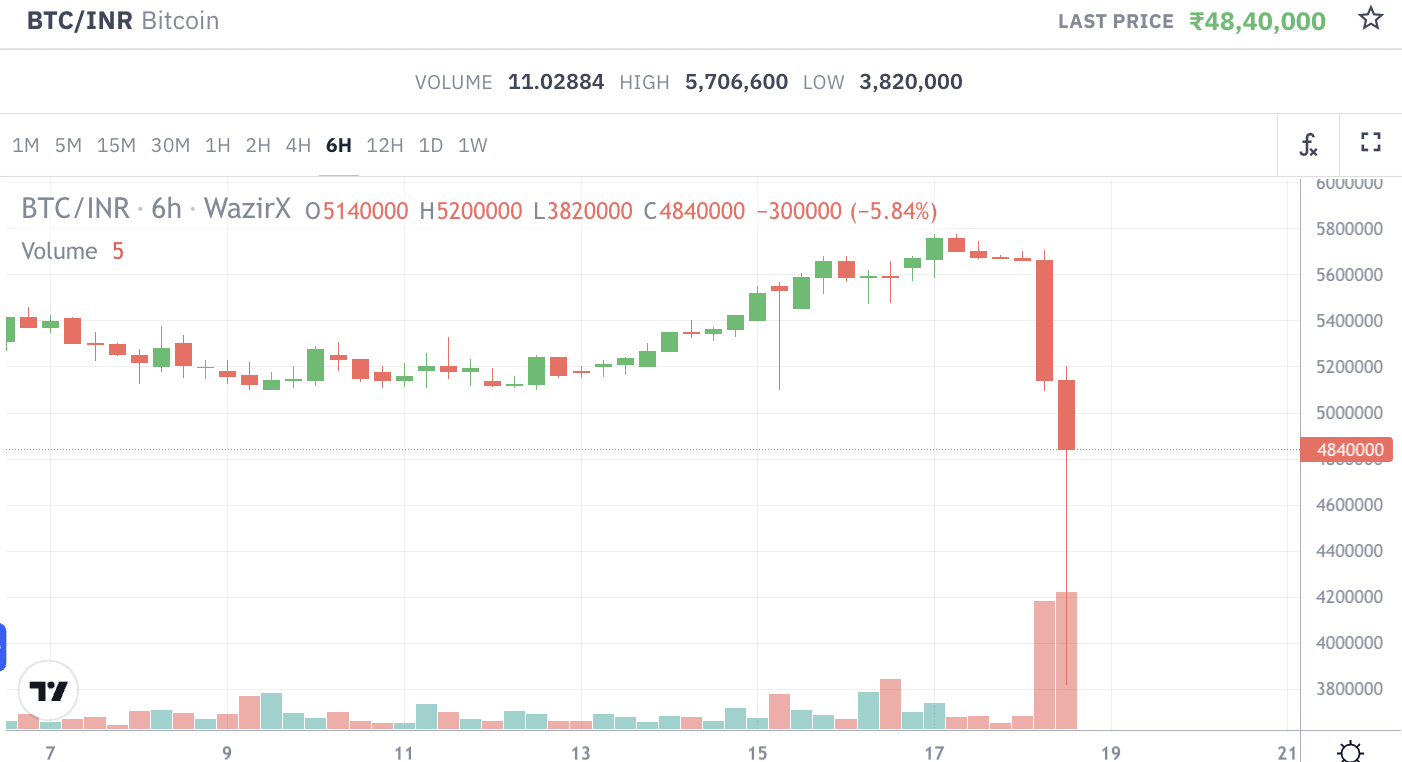

The exploit has also wreaked havoc on trading pairs connecting major cryptocurrencies with the rupee. In dollar terms, Bitcoin’s seen a pretty routine fall of 0.83% over the past 24 hours — but in India, the world’s biggest digital asset has literally fallen off a cliff:

At the time of writing, BTC was trading at roughly 4.84 million INR on this exchange — about $57,869. That’s a discount of about 9.2% compared with U.S. markets. The panic is real.

Investigators are now working to piece together what happened, with Mudit Gupta, the chief information security officer of Polygon Labs, suggesting this was a “methodical and organized attack” that was planned well in advance:

They went on to warn that there is a “high chance of partial recovery, low chance of complete recovery,” — indicating that WazirX customers may be left out of pocket as a result.

Meanwhile, the renowned on-chain sleuth ZachXBT has declared that this hack “has the potential markings of a Lazarus Group attack yet again” — with allegations repeatedly suggesting this hacking group is backed by the North Korean government and designed to sidestep economic sanctions.

ZachXBT has now received a substantial bounty from Arkham after submitting “definitive evidence of a KYC-linked deposit address used by the exploiter to receive funds from WazirX.”

What next?

Exchange hacks cause huge reputational damage — shaking the confidence of customers in the process.

But in India, the WazirX incident could lead to even more aggressive regulation from the Indian government, which wasn’t a fan of cryptocurrencies in the first place.

Even before this exploit, profits from crypto transactions resulted in a punishing 30% tax — putting it on the same level as gambling. This has primarily been driven by fears they could undermine “macroeconomic and financial stability” — with recently re-elected Prime Minister Narendra Modi even claiming that digital assets could “spoil our youth.”

It’s also fair to say that WazirX customers are pretty furious as they try to get answers from their support team.

In the meantime, rival crypto exchanges based in India are working overtime to stress that their customer funds are safe — undoubtedly a tactic to draw some customers away from WazirX.

The dust is yet to settle from this latest exploit, but the consequences will be severe.