These countries have Bitcoin worth billions… and are selling up

The U.S. has a long history of selling Bitcoin — with incredibly bad timing. It might have ended up losing out on billions of dollars as a result.

It’s weird to think that — until very recently anyway — the U.S. government owned more Bitcoin than MicroStrategy.

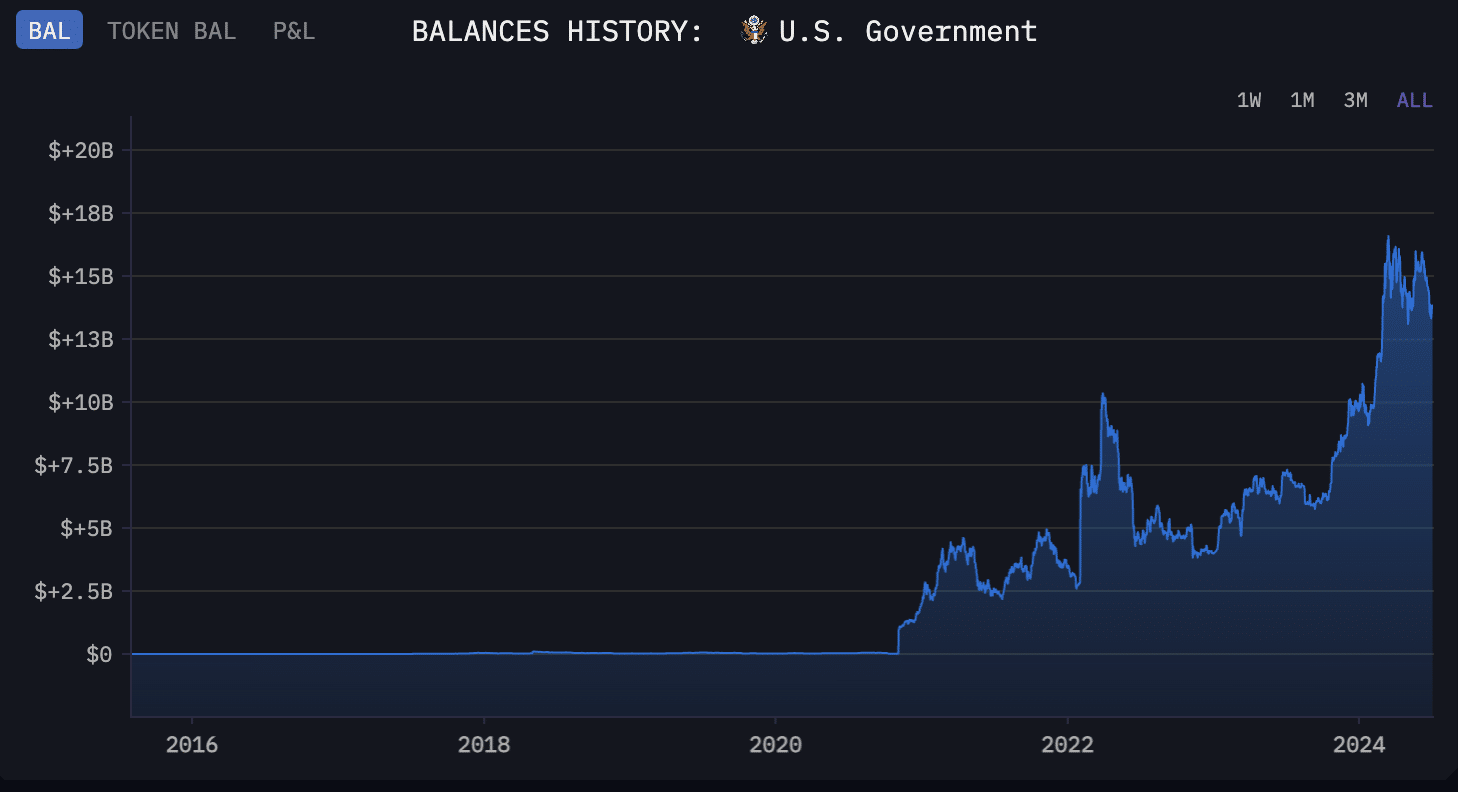

According to Arkham Intelligence, a slew of confiscations after criminal crackdowns means Uncle Sam is now sitting on an impressive stockpile of 213,543 BTC… that’s more than 1% of the total supply.

MicroStrategy, which began aggressively adding the world’s biggest cryptocurrency to its balance sheet all the way back in August 2020, only surpassed this milestone in March.

When you take these figures in isolation, it would be easy to assume that America’s vast BTC holdings are exceedingly bullish — a vote of confidence in the crypto sector.

But make no mistake, the U.S. is no El Salvador.

American politicians, regulators, and law enforcement agencies have repeatedly expressed fears that Bitcoin has the potential to undermine the U.S. dollar — with some warning this cryptocurrency can be used for money laundering and criminal activity.

This worldview is no doubt informed by the fact that this huge stash primarily came from two major seizures. Late 2022 saw the Justice Department seize 50,676 BTC that was hidden in the home of a man who unlawfully stole it from the Silk Road darknet marketplace.

In a particularly surreal development, some of the coins forfeited by James Zhong were “on a single-board computer that was submerged under blankets in a popcorn tin stored in a bathroom closet.”

OK… that’s quite an unusual hiding place.

Another record-breaking haul came a little earlier that year, when 94,000 BTC that was stolen from Bitfinex was seized by a husband-and-wife duo later charged with money laundering.

All of this opens the door to another question: what should the U.S. do with all this crypto?

HODL or auction?

There have been some American politicians who have vocally argued that the government should hold on to this crypto for as long as possible so it can appreciate in value.

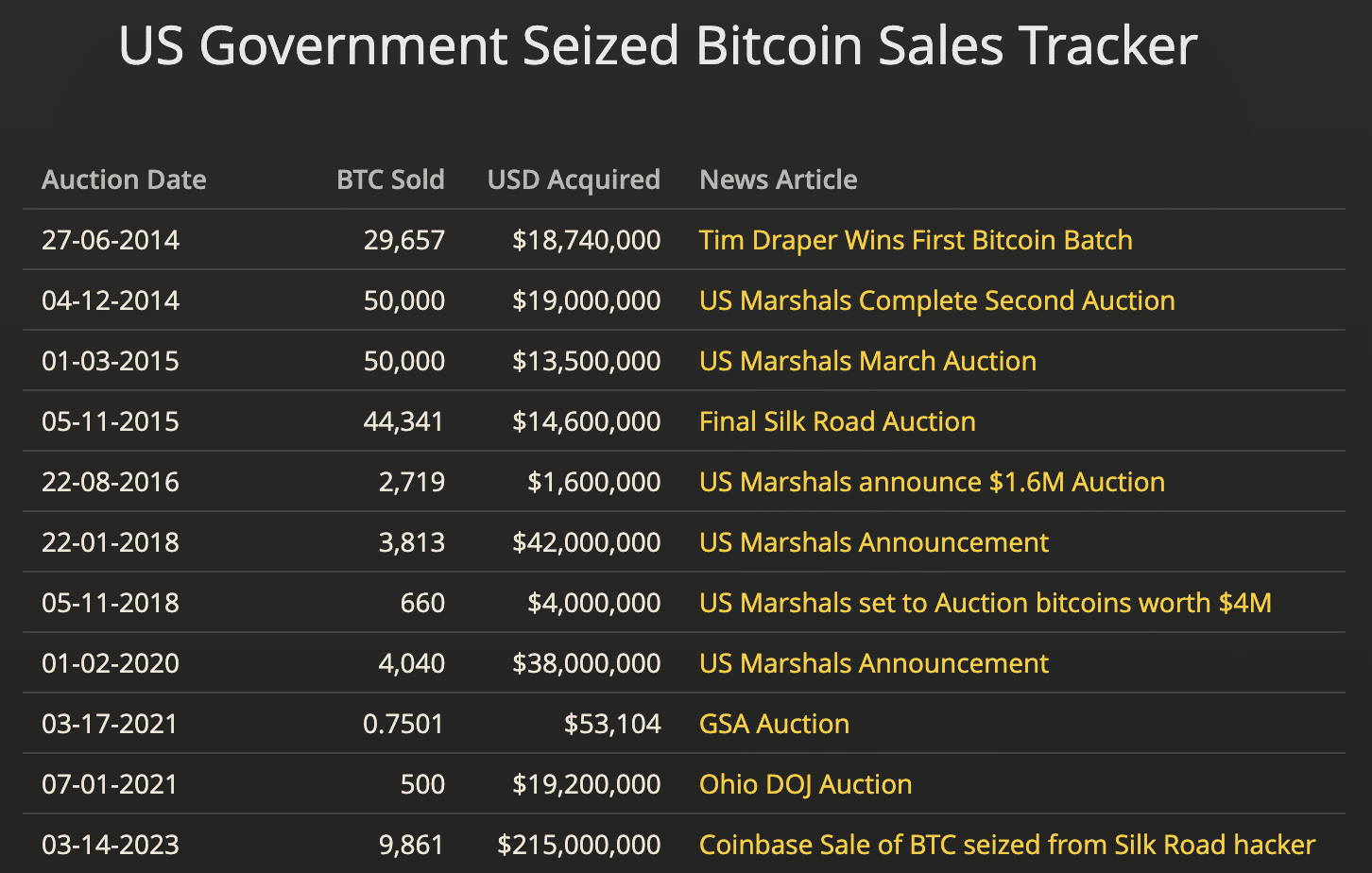

But the U.S. actually started selling off BTC all the way back in 2014 — and data shows that, well, it isn’t very good at it. Just look at this research of past liquidations from Jameson Lopp:

By his estimates, the government has gained $366 million from sales so far — but dramatic price rises over recent years means it could have missed out on $11.7 BILLION.

Back in 2014, a chunk of 50,000 BTC that belonged to Ross Ulbricht was sold off for $19 million. At the time of writing, this self-same crypto would be valued at more than $3.1 billion. Ouch.

Typically, transactions orchestrated by the U.S. Marshals Service sees proceeds split in multiple directions — between federal agencies, police forces that help bring perpetrators to justice, and those who were victims of the crime. Anything left over goes back to the Treasury.

While American officials couldn’t have had a crystal ball back then, it’s painfully clear now that victims could have ended up being better served if liquidations took place a few years down the track.

Undeterred, the government sold off another 9,861 BTC related to Silk Road back in March 2023 for $215.5 million after fees — an average price of about $21,853 per coin. It was planning to sell off roughly 40,000 BTC in four further batches in the year that followed. But while large amounts of Bitcoin have been on the move, it doesn’t seem those transactions have been finalized. As GlobalData Thematic Intelligence recently noted:

“If Bitcoin were to continue to perform as it has done in the past, by 2030 the U.S. stash of 210,000 BTC would start to rival their central bank’s holdings of gold, currently worth over $600 billion.”

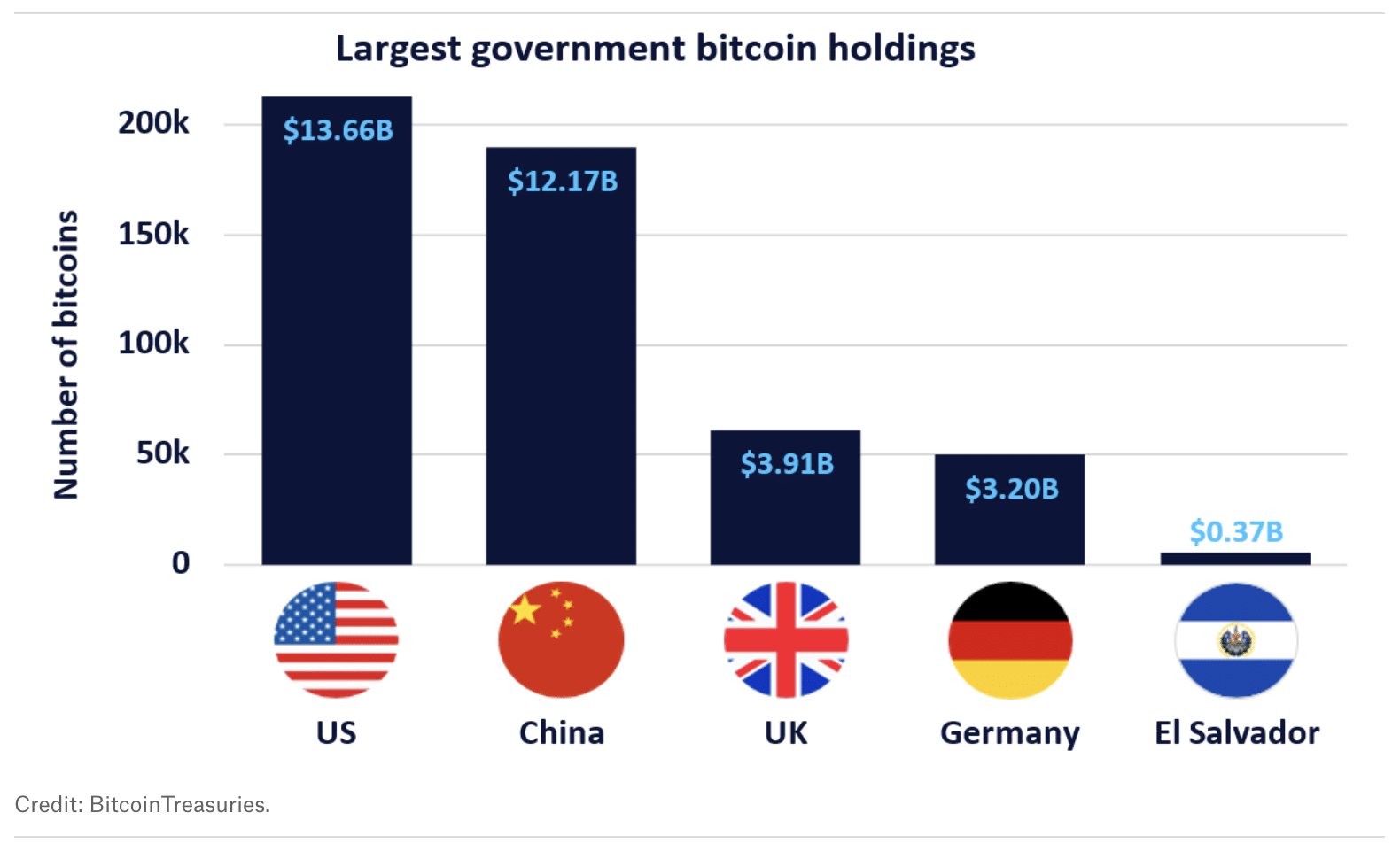

What about other countries?

China, the U.K. and Germany also own close to $20 billion in BTC between them — and in recent days, there’s been growing nervousness that Berlin might be close to staging some liquidations.

That’s because a large tranche of Bitcoin that was seized by the European powerhouse has been shifted over to centralized exchanges.

At times, this has weighed heavily on BTC’s spot price amid fears it would exacerbate selling pressure — and coincide with the imminent release of Mt. Gox payouts to creditors.

In an unusual turn of events, Bitcoin’s short-term price performance could be plunged into peril by the self-same governments it was meant to challenge.