Crypto hedge funds soar: Brevan Howard and Galaxy Digital ride Bitcoin to stellar returns

The cryptocurrency market surge has delivered exceptional returns for hedge fund giants Brevan Howard and Galaxy Digital.

The duo has risen as standout performers following Bitcoin’s rise to $108,000.

According to data from Hedge Fund Research, cryptocurrency-focused hedge funds achieved gains of 46% in November, pushing their year-to-date returns to 76%. This performance outpaces the broader hedge fund industry, which recorded a more modest 10% gain in the first 11 months of 2024.

Hedge funds capitalize on market momentum

Brevan Howard Asset Management, with CEO Aron Landy at the helm, manages $35 billion in assets. The fund has seen its main cryptocurrency fund surge 33% in November alone. This contributed to a 51% gain for the first 11 months of 2024.

Under billionaire Mike Novogratz’s leadership, Galaxy Digital has posted even more impressive results. Its hedge fund strategy has delivered a 43% return in November and a 90% gain in 2024.

The New York-based firm has successfully expanded its assets under management to $4.8 billion. This was partly through strategic acquisitions of assets from distressed crypto companies.

The recent rally gained additional momentum following Donald Trump’s U.S. presidential election victory. Investors view this as a potential catalyst for more crypto-friendly regulatory policies.

Trump’s appointment of venture capitalist David Sacks as cryptocurrency czar and the anticipated replacement of SEC Chair Gary Gensler with cryptocurrency advocate Paul Atkins has further helped market confidence.

Still, it was under Gensler that the crypto sector received a major boost in January 2024 when the SEC approved 11 exchange-traded Bitcoin (BTC) funds. This move opened new channels for institutional and retail investment. However, the market experienced a slight pullback this week following the Federal Reserve’s announcement of lower-than-expected rate cuts for the coming year.

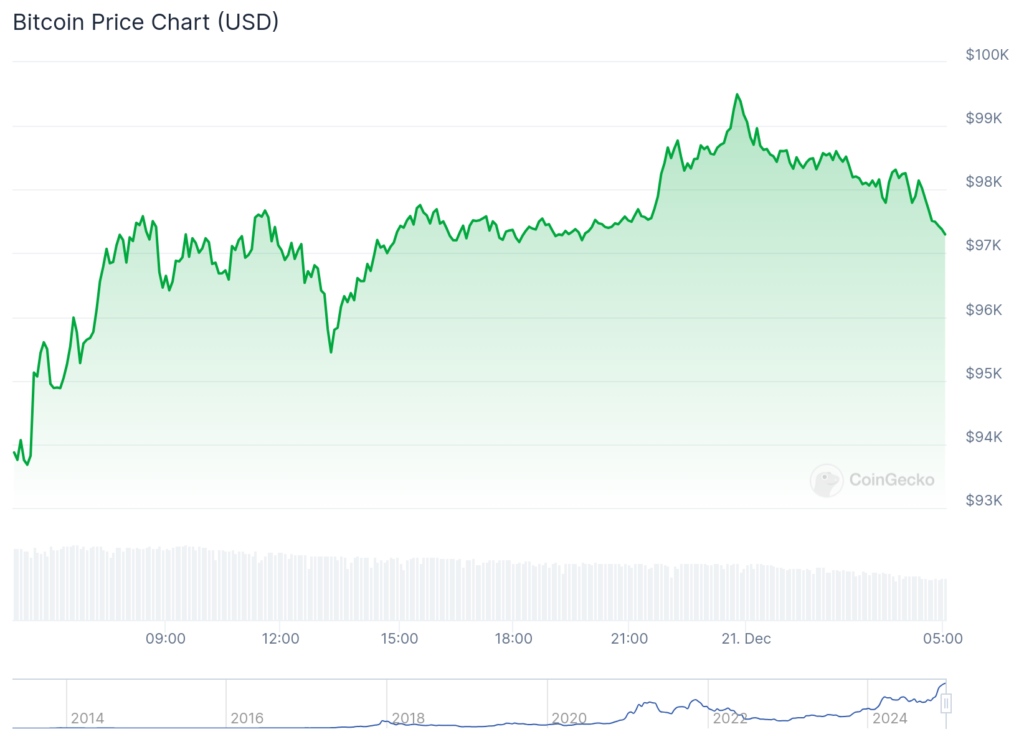

Bitcoin’s price has surged 130% year-to-date, reaching approximately $108,000. However, the recent pullback saw BTC going as low as $92,175. At last check on Saturday, Bitcoin was trading at $97,232.