These three cryptos could breakout with Ethereum price rally

Ethereum bull Arthur Hayes, founder of BitMEX and a long-term crypto proponent, repurchased $10.5 million worth of Ethereum above $4,100 just days after taking profit on $8.3 million in Ether holdings. On-chain intelligence trackers are monitoring large-volume ETH transfers from whales and institutions, likely for profit-taking or initiating new positions as ETH hovered around $4,500 on Tuesday.

- Ethereum rallied closer to its $4,500 target on Tuesday, as Bitcoin and other top cryptos gain.

- Chainlink, Polkadot and Pump.fun are the top three cryptos most likely to extend gains alongside the largest altcoin.

- Thomas Lee, popular as Tom Lee, founder and head of research at Fundstrat Global Advisors set a $16,000 target for Ethereum.

- Whales are purchasing ETH after taking profits on their holdings, following in the footsteps of Arthur Hayes.

- Ethereum ETFs net record $1 billion inflows on Monday, beating Bitcoin and other altcoins.

Table of Contents

Ethereum price analysis

Ethereum (ETH) has been in an upward trend since August 3. The token is currently trading near its $4,500 target, less than 10% away from its previous all-time high of $4,878. The rally appears to be driven by increased demand from institutional investors and higher inflows to ETFs and Ethereum-based investment products.

Despite profit-taking from large wallet holders, Ethereum is holding steady above the psychologically important $4,000 support level.

Two key technical indicators, the RSI and MACD, support the ongoing rally. The MACD is showing green histogram bars above the neutral line, indicating positive underlying momentum. The RSI is at 76 and trending higher.

Traders need to watch RSI carefully, a drop under 70 could generate a sell signal for traders and likely result in a correction. ETH could then sweep liquidity at the $4,000 support before another leg up.

Chainlink, Polkadot and Pump.fun

Chainlink (LINK), Polkadot (DOT) and Pump.fun (PUMP) posted gains of between 6% and 9% in the past 24 hours. All three have rallied in double digits over the last week. Compared to other altcoins, these tokens appear well-positioned to climb higher alongside Ethereum this week.

LINK is 15% away from its 2025 peak of $27.21, with a target of $30.94, the December 2024 high. If a correction occurs, LINK could find liquidity at $20, a key psychological support level.

Both RSI and MACD readings support a bullish outlook for Chainlink, suggesting further upside potential this week.

For Polkadot, key resistance levels on the DOT/USDT daily chart are $5.362 (May 2025 high), $8.044 (January 2025 high), and $11.640 (December 2024 high).

DOT’s momentum indicators on the daily timeframe are bullish, with the immediate target at $5.362. At the time of writing, DOT trades at $4.167.

The 4-hour price chart for Pump.fun shows that there is a likelihood of a rally to R1, R2 and the target for the token at $0.004137, $0.004500 and $0.0050 respectively. The native token of the launchpad could find support at the $0.003200, a key level.

PUMP is currently hovering close to $0.0040, at the time of writing, on Tuesday.

Whales are bullish on Ethereum

Fundstrat’s Tom Lee’s Bitmine Immersion has announced plans to purchase additional Ethereum through a $20 billion capital raise. The firm filed with federal regulators on Tuesday and is positioning itself in the race to become the world’s largest Ethereum treasury.

Bitmine Immersion aims to raise $24.5 billion through common stock issuance, with shares priced at $0.0001. The company already holds $2 billion worth of Ether at press time.

Another whale, Arthur Hayes, recently repurchased $10.5 million in Ether above $4,150 after taking profits on $8.3 million in holdings.

Large wallet investors are simultaneously taking profits and adding to their ETH positions, reinforcing demand for the altcoin.

Hayes told his followers on X that he “would never take profit again,” reinforcing a bullish narrative for Ethereum. With sentiment improving, ETH is advancing toward the $5,000 target, trading above $4,500 at the time of writing on Tuesday.

Institutions fuel demand for Ethereum this week

Ethereum ETF data shows a record $1 billion in inflows on Monday. The altcoin outpaced Bitcoin, drawing significant institutional capital. Data from Farside Investors shows five consecutive business days of inflows into U.S.-based spot Ethereum ETFs.

Total ETH ETF flows now stand at $10.85 billion, a major milestone for the second-largest cryptocurrency.

Bitmine’s announcement and Ethereum treasury strategy firms are catalyzing demand for the altcoin in the ongoing cycle. This could act as a catalyst in H2 2025, supporting ETH price rally to Tom Lee’s $16,000 target.

Long Ethereum is everyone’s new favorite position

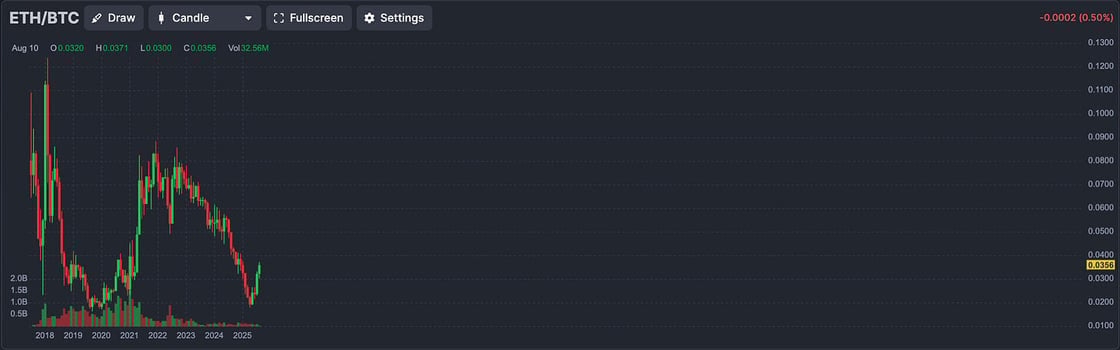

Derivatives market data shows Ethereum has become a leading Web3 risk-on trade for investors. The ETH/BTC ratio is signaling the shift.

Rising futures open interest supports the bullish thesis, with current levels exceeding those of December 2024. This suggests ETH’s uptrend could continue, with derivatives traders betting on further gains.

Over $105 million in Ethereum short positions were liquidated in the past 24 hours, according to Coinglass, showing that bearish bets are being punished and funding long positions across derivatives exchanges.

The long/short ratio exceeds one, meaning more traders are bullish on Ethereum and are positioning for further price increases. As such, Ethereum could revisit its $4,800 all-time high if the bullish sentiment prevails and the altcoin’s upward trend is sustained this week.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.