Tokenized gold breaks $19B in volume, rivaling major gold ETFs

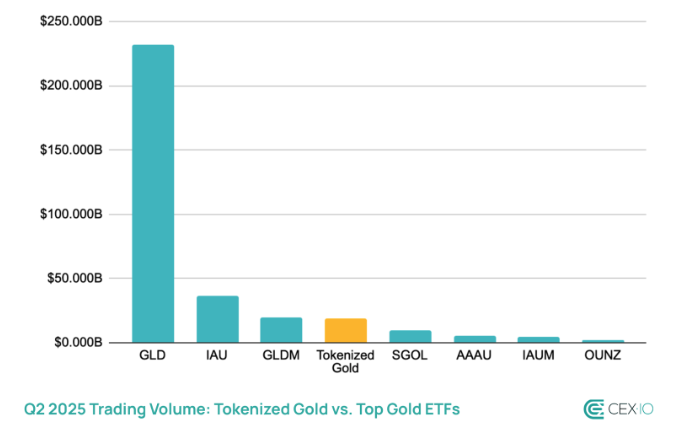

Tokenized gold trading volume has surpassed $19 billion so far this year, outpacing many popular gold ETFs.

Tokenized assets are gradually proving to be a viable alternative to traditional investment instruments. According to a July 8 report by CEX.io, tokenized gold is gaining traction compared to gold ETFs. The asset class has attracted $19 billion in trading volume this year, outpacing several widely held gold ETFs.

While tokenized gold still trails major ETFs like SPDR Gold Shares (GLD) and iShares Gold Trust (IAU), it has surpassed many smaller counterparts. The asset class now sees higher trading volume than SGOL, AAAU, IAUM, and OUNZ.

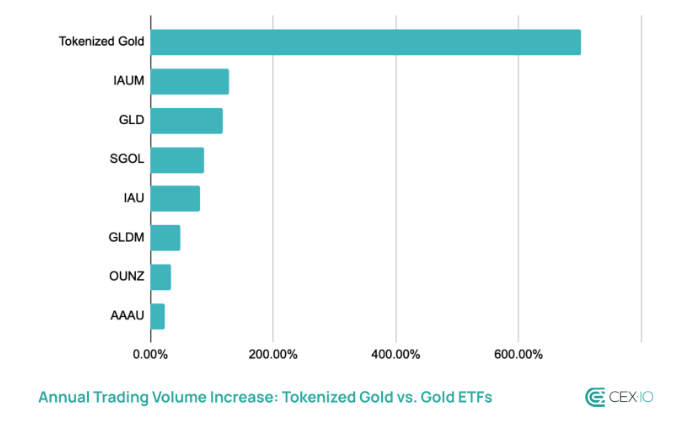

Moreover, the growth in tokenized gold trading volume has significantly outpaced all gold ETFs so far this year. In the second quarter of 2025, volume in the asset class rose from $2.4 billion to $19.2 billion—an eightfold increase.

This marks part of a broader trend, as tokenized gold has outperformed gold ETFs in trading volume growth for four consecutive quarters. According to CEX.io, this outperformance suggests that capital is shifting from gold ETFs to tokenized gold assets.

Retail investors fuel shift to tokenized gold

According to the CEX.io report, most of the new trading volume in tokenized gold is being driven by retail and crypto-native investors. Meanwhile, institutional investors continue to dominate traditional gold ETFs. Notably, the number of PAXG holders grew by 25%, while XAUT holders increased by 151%, highlighting a significant influx of new traders into the market.

Still, tokenized gold continues to trail ETFs in terms of market capitalization. For instance, GLD’s total market cap rose 36%, while tokenized gold’s grew just 29%. This indicates that tokenized gold is not yet widely perceived as a long-term store of value; rather, most traders still use it as a utility asset within the DeFi ecosystem.