TON secures top gainer spot with 7% jump, but market signals caution ahead

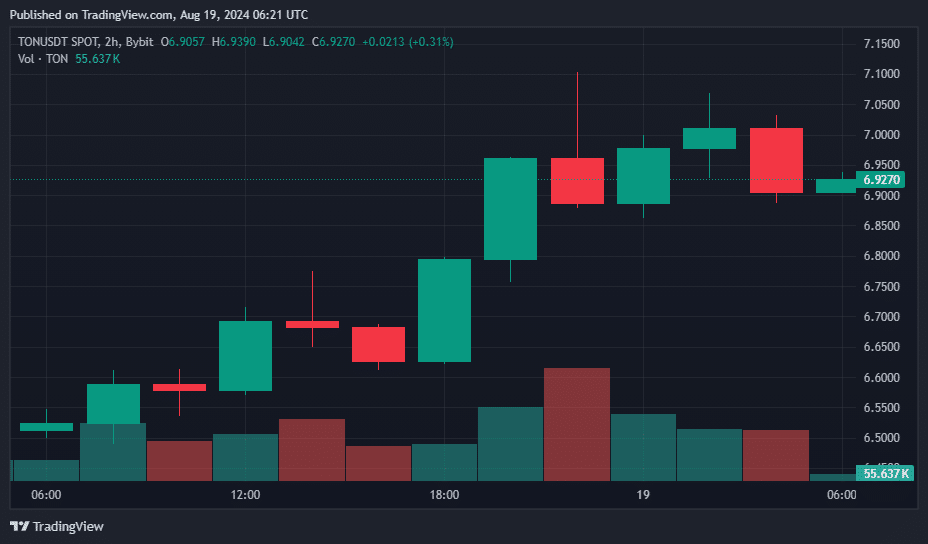

Toncoin’s price jumped by 7% on the morning of Aug. 19, making it the top performer in the crypto market.

At the time of writing, Toncoin (TON) was still up 6%, exchanging hands at $6.92 per price data from crypto.news. The crypto asset’s daily trading volume jumped by 143%, hovering around $568 million, while its market cap stood at $17.3 billion, ranking it 9th among the top largest cryptocurrencies.

Toncoin’s current price positions it above the middle Bollinger Band at $6.3421 and significantly higher than the lower band at $5.4265. This situates the coin in a relatively strong position within its recent trading range, although it still lingers below the upper Bollinger Band at $7.2578.

The positioning indicates a considerable recovery from lower levels, yet the coin remains shy of reaching an overbought zone, suggesting there may be additional room for upward movement before encountering significant resistance.

On the Directional Movement Index, the +DI line, which signifies the strength of upward price movements, TON stands at 24.8112, overtaking the -DI line at 18.8496, suggesting that recent price actions have been predominantly bullish. However, the average DI line at 24.7785 hints at a strong trend presence overall.

Typically, when the ADX value is above 25, it shows a trend’s strength, whether bullish or bearish. In this case, the elevated ADX alongside a dominant +DI over -DI reflects a robust bullish momentum, although this momentum should be carefully monitored for any shifts that might suggest increasing bearish pressures.

The current market dynamics for the coin show a clear bullish inclination with potential for further price increases, supported by a robust trend strength as indicated by the ADX and DI lines. However, vigilance is advisable as the proximity to the upper Bollinger Band could signal upcoming resistance or a potential shift in market sentiment.

Per data from CoinGlass, the total open interest in Toncoin increased by 14.7% over the past 24 hours, rising from $246.83 million to $283.03 million, showing increased trader interest in TON as the price rebounds.

Toncoin RSI suggests cautious outlook

The Relative Strength Index further supports a cautious outlook. With an RSI value of 55.58, TON is neither overbought nor oversold. This neutral reading means there’s no immediate risk of a sharp reversal due to overvaluation.

The current RSI for Toncoin does not clearly indicate that the recent upward trend will persist. The RSI is at a level that suggests the price could move in either direction without being considered overextended.

Toncoin’s recent price increase has coincided with higher trading volumes, indicating significant buyer interest. However, a future decrease in trading volumes while prices remain elevated might suggest that the upward momentum is losing strength, potentially leading to a price correction.

It’s crucial to monitor trading volume and the Directional Movement Index lines as a notable reduction in volume or a situation where the negative directional indicator -DI exceeds the positive directional indicator +DI could signal a forthcoming correction.

On the other hand, if trading volumes remain high and the +DI continues to rise, this could bolster further price increases. Although the rally has been impressive, the mixed signals from these technical indicators call for careful observation for any signs of a potential reversal, suggesting that while the rally may not be over, caution is warranted.