Top 3 cryptos to gain from Trump tariffs and changing world order

The United States’ first Bitcoin President is presiding over a crypto market crash. Crypto proponents and firms funded Trump’s campaign with hopes of pro-crypto regulations and policies in the U.S. While initial progress was made on the stablecoin bill and the Strategic Bitcoin Reserve, Trump is changing the world order with his Liberation Day tariff announcements.

Bitcoin (BTC) and altcoins have crashed alongside currencies and equities in the global markets, losing the edge as “digital gold.” While traders may have treated Bitcoin and crypto as a hedge against declines in global market crashes, Trump’s tariffs have leveled the field for all assets.

Table of Contents

US Crypto President’s tariffs erase Bitcoin gains

US President Donald Trump faced several lawsuits in 2024, the first crypto President now has a net worth of $5.1 billion, according to the 2025 Forbes Billionaire List. Trump has managed to turn around his legal troubles and a $454 million fraud judgment, crash global markets and erase Bitcoin gains in less than 100 days of his term at the Oval Office.

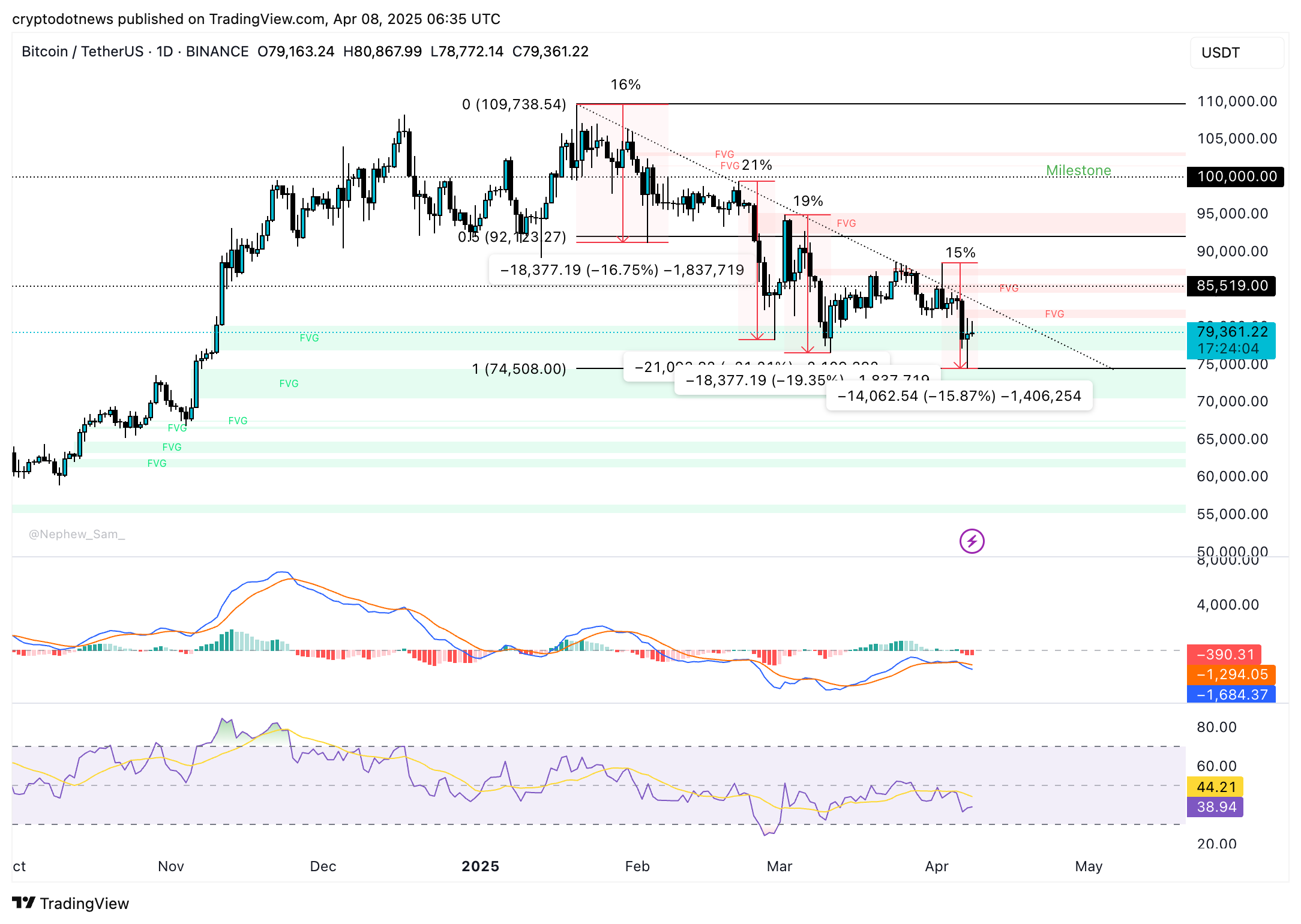

Crypto proponents funded Political Action Committees to back the first pro-crypto President less than six months ago. Bitcoin holders and traders are now faced with pain as BTC faces one round after another of a flashcrash. BTC slipped to a new cycle low of $74,500 on Monday.

Bitcoin made a swift recovery and BTC is consolidating under the key $80,000 level on Tuesday.

Top 3 tokens to navigate the crypto market crash

Monday’s crypto crash wiped out nearly $300 billion in market capitalization, however three categories of tokens held steady. Liquid staking derivatives finance category of tokens, LSDFi, top payment solutions coins, and the Bittensor ecosystem tokens held onto their gains from last week.

Data from CoinGecko shows the top tokens in the three categories are Pendle (PENDLE), Telcoin (TEL) and Bittensor (TAO).

PENDLE is the native token of the Pendle Finance ecosystem. PENDLE holders can use the token for incentives and governance. Users who provide liquidity to the platform receive rewards and rebates on a percentage of trading fees.

Telcoin enables payment solutions on mobile, and Bittensor’s TAO is part of an ecosystem that powers subnets for AI protocols built on the chain.

PENDLE price formed higher highs and higher lows since mid-March. The token could extend gains by another 18% and test resistance at $3.377. RSI reads 51, above the neutral level and MACD flashes green histogram bars above the neutral line, supporting a bullish thesis for the token.

TEL has been consolidating under resistance at $0.005363 for nearly a week. The mobile payments token ended its downward trend and continues to trade sideways. The daily price chart shows a likelihood of gains in TEL, 18% rally to test resistance at $0.005363.

RSI reads 38 and remains above the oversold zone at 30, MACD shows consecutively smaller red histogram bars, meaning the underlying negative momentum in TEL price trend could end soon. A reversal is likely. If TEL suffers a crash, it could find support at $0.003444.

In the last seven days of March and in April, TAO has been consolidating, stuck under resistance at $284. TAO’s momentum indicators, RSI and MACD show potential for gains. RSI is sloping upwards and reads 39, MACD shows green histogram bars.

An 18% price rally could push TAO to retest resistance at $245.50, a correction could see TAO test support at $167.80, a key level for Bittensor.

Bitcoin Price Forecast

Bitcoin has consolidated since its drop under support at $85,500. BTC continues to hover close to support at $80,000. On the daily time frame, momentum indicators signal a likelihood of decline in BTC price.

The largest cryptocurrency could test support at $76,900, a 2.69% decline in price. A 4% increase could push BTC closer to resistance at $82,379, the first hurdle in Bitcoin’s path to $85,000.

MACD flashes red histogram bars under the neutral line and RSI is sloping downwards and reads 38, supporting a bearish thesis.

Is altcoin season coming?

The altcoin season index, a tracker to determine whether it is altcoin season, a period where 75% of the top 50 altcoins outperform Bitcoin in a 90-day timeframe, read 65 on March 65. The indicator has dropped to 33 on Tuesday, as traders digest the developments surrounding Trump’s tariff announcements and the retaliation from its trade partners.

As tariff wars brew, Bitcoin attempts to regain investor confidence as a hedge against uncertainty and maintains its dominance, pushing an “altcoin season,” further away. Typically, capital rotation from Bitcoin to altcoins fuels gains in tokens every cycle. Traders may have to wait longer for the phenomenon to occur in this market cycle.

Expert commentary

Dan Greer, CEO of DeFi App told Crypto.news that he sees a bounce coming in Bitcoin. Greer said:

“Bitcoin’s drop today is part of a broader risk-off move. When macro stress hits, everything sells off. But unlike equities, Bitcoin isn’t tethered to earnings or central bank policy. Historically, it’s bounced back stronger from macro shocks, especially when trust in traditional systems is shaken. What we’re seeing isn’t a failure of crypto but a flight to liquidity.”

Ian Balina, CEO of Token Metrics believes the meltdown in crypto is part of the plan. Balina told Crypto.news:

“The market has been very volatile due to the ongoing Trump tariff wars. All risk assets from stocks to crypto have had liquidity flushed to the sidelines.

There’s been speculation that an emergency FED meeting is being scheduled, Trump saying the tariffs will be temporarily paused, and the EU saying they are willing to negotiate tariffs. All this volatility seems to be going according to plan for Trump’s administration as we get closer to having to refine the national debt.”

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.