Top cryptocurrencies to watch this week: BTC, LTC, TRX

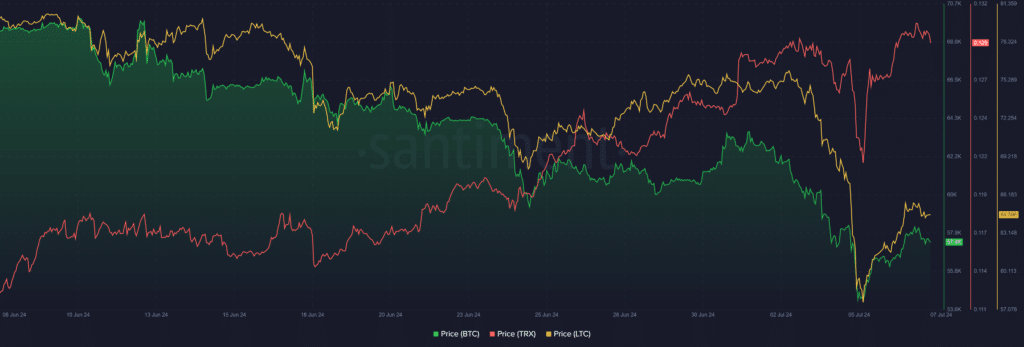

The first week of July introduced bearish pressure, leading to massive losses in the crypto market. Bitcoin (BTC) led the downtrend, as it consistently recorded lower lows amid sustained selling pressure.

Notably, the rest of the market experienced similar losses. Consequently, the global crypto market cap lost $140 billion, as it dropped further to $2.11 trillion, its lowest level since late February. While most assets remained down, a few witnessed remarkable recoveries.

Here are our top picks for cryptocurrencies to watch this week following their noteworthy performances during the downtrend last week:

Bitcoin drops to 5-month low

Bitcoin’s start to the week was mildly bullish following a consolidation phase two weeks back. However, bearish pressure emerged as the leading crypto asset maintained a divergence from U.S. equities, currently in their bullish stage.

BTC was subjected to its toughest bearish selling pressure this year, as bankrupt exchange Mt. Gox began creditor repayments, the German government distributed thousands of BTC tokens, new holders began selling off their assets and miners showed signs of capitulation.

Last week alone, Bitcoin gave up multiple psychological thresholds from $63,000 to $58,000. The asset slumped to a 5-month low of $53,485 on July 5 but immediately rebounded from this position. Despite the mild recovery, BTC ended last week with a 4.5% drop, slightly above $58,000.

At press time, the asset has again forfeited the $58,000 threshold amid an additional 1.13% drop. Nonetheless, it has maintained a position above the lower Bollinger Band ($56,347). Bitcoin’s hopes of a full recovery hinge on its ability to reclaim the 20-day SMA ($61,509) and the upper Bollinger Band ($66,676).

LTC slumps 12%

Litecoin (LTC) was one of the numerous victims of last week’s market collapse. The asset showed resilience at the start of the week, largely consolidating from June 30 to July 2.

However, as pressure mounted, LTC recorded three consecutive intraday losses from July 3 to 5, dropping 18.6% within this period. When the market staged a mild rebound on July 6, LTC gained 5.72% but closed the week with a 12.7% loss.

Litecoin’s MACD line crossed below the Signal line on July 4, confirming the bearish momentum.

With both lines currently sloping downward, this suggests the bearish momentum is increasing. LTC needs to decisively close above Fib. 0.236 ($64.60) to mount a formidable defense against any more declines this week.

TRX bucks the trend, hits 4-month high

Tron (TRX) was one of the few assets that bucked the overall bearish trend last week.

TRX started the week with an indecisive bearing, but eventually increased 3.5% over four days to $0.12997 on July 3, looking to recover the $0.13 territory. The last time Tron saw this level was on March 13.

The retest of the $0.13 region coincided with the widespread drop in the market. Tron crashed 6.7% to a low of $0.12117 on July 5, but immediately rebounded.

A recovery push on July 6 helped it reclaim the bullish momentum, leading to a four-month high of $0.13028. Tron closed last week with a 3.5% increase.