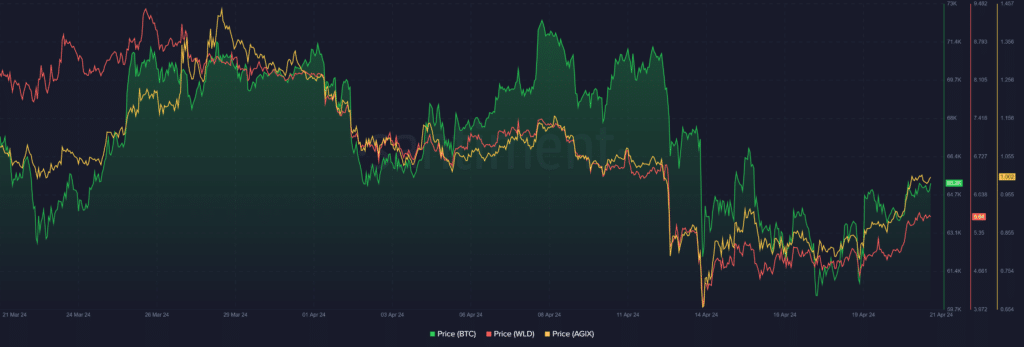

Top cryptocurrencies to watch this week: BTC, WLD, AGIX

Bitcoin (BTC) witnessed mild losses despite a late comeback to the week-long bearish pressure. Meanwhile, artificial intelligence-focused altcoins Worldcoin (WLD) and SingularityNET (AGIX) recorded modest gains.

In contrast to Bitcoin’s downward trend this week, the global cryptocurrency market capitalization experienced a slight 1.26% uptick, adding over $30 billion to reach $2.4 trillion at the last check.

This rise was primarily fueled by the performances of prominent altcoins during the late-stage market resurgence.

This is how most of the mainstream cryptocurrencies performed this week:

Bitcoin retests $59k

Bitcoin began this week with the prevalent downtrend from the previous week, which saw it drop by over 5% in seven days.

Despite holding above the $65,000 threshold at the start of the week, the firstborn crypto immediately recorded steep declines, eventually closing below the 50-day EMA on April 16.

This marked the first time Bitcoin witnessed an intraday close below the 50 EMA since January, marking a shift in sentiments from bullish to bearish.

Amid the bearish pressure, BTC retested the $59,000 territory on April 17 for the first time since March 4, closing the day with a 4% drop despite summarily recovering the $60,000 zone.

Interestingly, the $59,000 zone served as Bitcoin’s launchpad to a rebound, with the asset recording a 3.65% gain on April 18.

The resurgence of bearish pressure did little to impede this newfound growth, as BTC sustained its winning streak until April 20, the day of the halving.

Bitcoin hit a high of $65,450 hours after the halving, but still traded at a loss on a weekly timeframe. The uptrend has cooled at the reporting time, with BTC changing hands at $64,962 at press time.

While this marks a mild 1.19% drop from its value at the start of the week, Bitcoin now trades above the 50-day EMA ($64,577).

AGIX breaches 3-week symmetrical triangle

SingularityNET was one of the biggest victims of the previous week’s downtrend, eventually breaking below its 50-day EMA on April 12 and collapsing to a six-week low of $0.6070 the day that followed. The downtrend spilled into this week despite a mild rebound, with AGIX dropping 5.41% on April 15.

Chart data confirmed that AGIX had been trading within a symmetrical triangle for the past three weeks, with the bears hedging against any upward breakout and the bulls leveraging the lower trendline as support. The AI-focused token continued to slump until it retested the support at $0.7666 on April 18.

Following this retest, AGIX staged a comeback with the rest of the market, but its bullish momentum was not apparent until April 20, when it spiked by 15.40% to eventually breach the upper trendline of the symmetrical triangle. This breach coincided with a push above the 50-day EMA.

Despite a mild decline today, AGIX remains in an uptrend, leveraging the 0.382 Fibonacci retracement level ($0.9291) as support against any declines back into the symmetrical triangle. At its current position, AGIX must conquer Fib. 0.5 at $1.030 to reclaim and secure a position above the $1 mark.

WLD faces stern resistance at $6.09

Worldcoin, another AI-focused token, made some notable moves this week. Interestingly, despite starting the week with a 6.88% drop on April 15, Worldcoin remained in a consolidation phase, as it immediately recouped most of these losses in a 6.16% rebound the next day.

This tug-of-war between the bulls and the bears persisted until April 19. Going into the weekend, Worldcoin witnessed a massive 14.19% intraday gain on April 20 amid bullish sentiments from the Bitcoin halving. The Saturday rally saw it hit a one-week high of $5.66 before it faced a roadblock.

On-chain data from IntoTheBlock (ITB) shows that WLD might have difficulties recovering the $6 psychological threshold, which it gave up last week when it dropped 14.12% on April 12. To reclaim this level, WLD would need to breach a potent sell wall where 448 addresses purchased 268,340 tokens at an average price of $6.09.

Despite being 7% up this week, Worldcoin maintains short-term bearish sentiments. However, its daily relative strength index (RSI), currently at 42, suggests the cryptocurrency has more room for growth.

Currently trading for $5.5 at last check, WLD would need strength from the broader market to push above $6.