Top EU regulator points out crypto opposes regulation

European commissioner for financial services Mairead McGuinness said that some actors in the crypto space are opposing regulation — but they are only true to crypto’s cypherpunk origins.

McGuinness said that while some firms approve of upcoming cryptocurrency rules, others oppose regulation, during a recent CNBC interview. She said:

“Some of those who were involved in crypto, from the very outset, were doing it because they didn’t want to be part of the regulated, managed system. […] They want it to be separate from and in parallel to it. That’s a very dangerous path.”

McGuinness rightfully recognizes that such a point of view is more common among those who have been in crypto since its first few years. The reason is that Bitcoin (BTC) — and consequently cryptocurrencies — were created as a way to oppose regulation of any kind, including not only monetary policy and capital controls, but also other laws.

Bitcoin’s creators integrated into its first-ever block — the so-called “genesis block” — the headline of the Jan. 3, 2009 issue of The Times which read “Chancellor on brink of second bailout for banks.” This information had the double purpose of proving that the block did not exist before that day and further cementing the idea that Bitcoin was meant to oppose the traditional financial system and monetary policy.

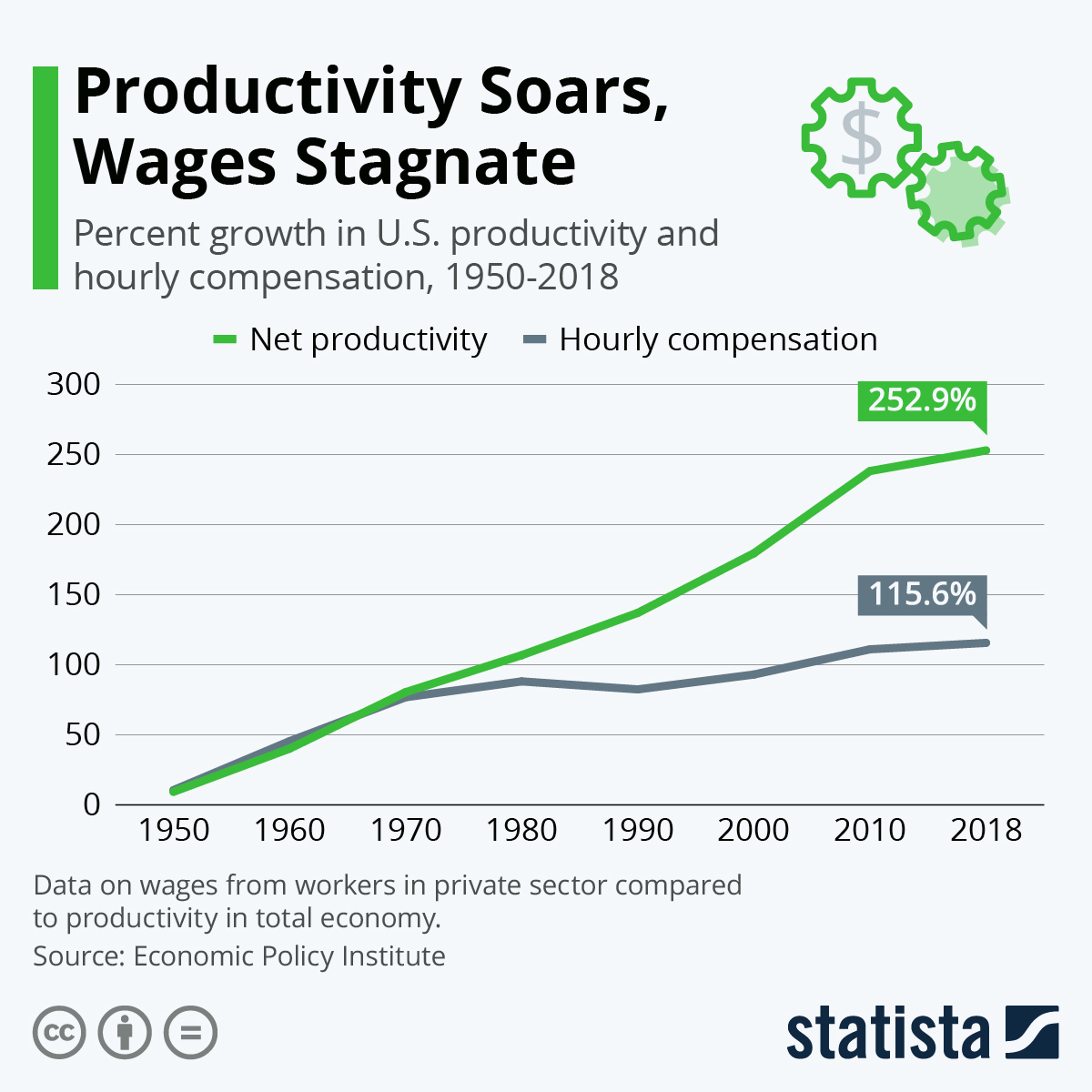

Bitcoiners worldwide often speak out about the issues brought by fractional reserve banking, fiat currency, capital controls, and governmental power in general. In August 2021, Bitcoin proponents explained their points well in the “WT* Happened in 1971” campaign — spreading awareness of the consequences of Nixon’s introduction of fiat money on the economy.

Bitcoin is the brainchild of the cypherpunk movement which was born in the early nineties and advocated for technologies that protected privacy and individual freedoms against governmental oppression. The movement worked tirelessly to help internet proponents win the so-called “first crypto war” and abandon the needless controls on encryption controls.

While many in the space today often claim that the infamous deep web black market Silk Road was a misuse of Bitcoin, archives of cypherpunk conversations clearly show the coin was created to allow for such marketplaces. Timothy C. May — one of the most notable cypherpunks and author of the crypto-anarchist manifesto — wrote on Sept. 3, 1994, in the cypherpunks mailing list:

“The study of anonymous markets, in which conventional sanctions are difficult to apply, should be an exciting area to explore.”

Timothy C. May, cypherpunk

In his manifesto, he went even further and predicted much of what we see happen with cryptocurrency long before they were created — back in 1988. He explained that “two persons may exchange messages, conduct business, and negotiate electronic contracts without ever knowing” each other’s identity. May predicted:

“The State will of course try to slow or halt the spread of this technology, citing national security concerns, use of the technology by drug dealers and tax evaders, and fears of societal disintegration. Many of these concerns will be valid; crypto anarchy will allow national secrets to be traded freely and will allow illicit and stolen materials to be traded. An anonymous computerized market will even make possible abhorrent markets for assassinations and extortion. Various criminal and foreign elements will be active users of CryptoNet. But this will not halt the spread of crypto anarchy. “

Timothy C. May, cypherpunk

May believes that “just as the technology of printing altered and reduced the power of medieval guilds” now cryptography will “fundamentally alter the nature of corporations and of government interference in economic transactions.”