How to Trade Successfully Based on Open Interest in Bitcoin Futures

Bitcoin futures contracts allow traders to take advantage of the price movement of Bitcoin without necessarily having to own and hold the exact amount of it. They are a derivative product that gained serious popularity in the past years.

Traders often use Bitcoin futures open interest as an indicator to confirm trends and trend reversals for both the futures. Open interest is calculated by summing up all the opened positions, regardless of whether they are long or short, and subtracting those that have been closed.

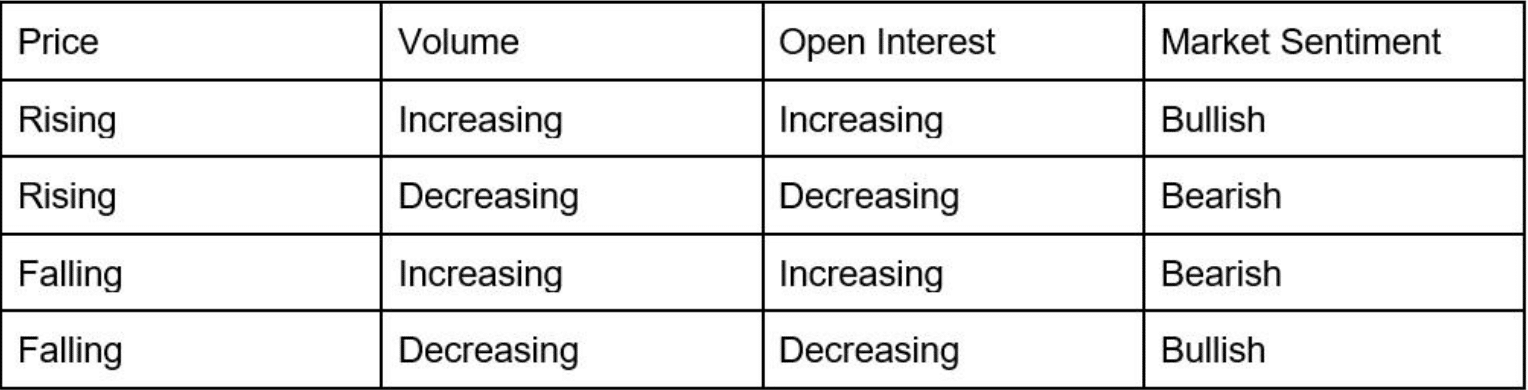

The following chart exemplifies how open interest (OI) changes as a result of user activity.

Open interest indicates the capital flowing in and out of the market. The more capital flows into the Bitcoin futures market, the open interest will be higher. Vice versa, the open interest will decline.

Bullish

-

An increasing open interest in a rising market

Price and open interest increasing during the uptrend means new money coming into the market, and new buying power is taking the control.

-

A decreasing open interest in a declining market

Price and open interest decreasing during the downtrend indicates that long position holders are being forced to liquidate their positions. And the downtrend will end once all the sellers have sold their positions.

Bearish

-

An increasing open interest in a falling market

It means all bulls who bought near the top of the market are now in a loss position. Their panic to sell keeps the price action under pressure.

-

A decreasing open interest in a rising market

If prices are in a downtrend and open interest is on the rise, this pattern shows aggressive new short selling, which will lead to a continuation of a downtrend and a bearish condition.

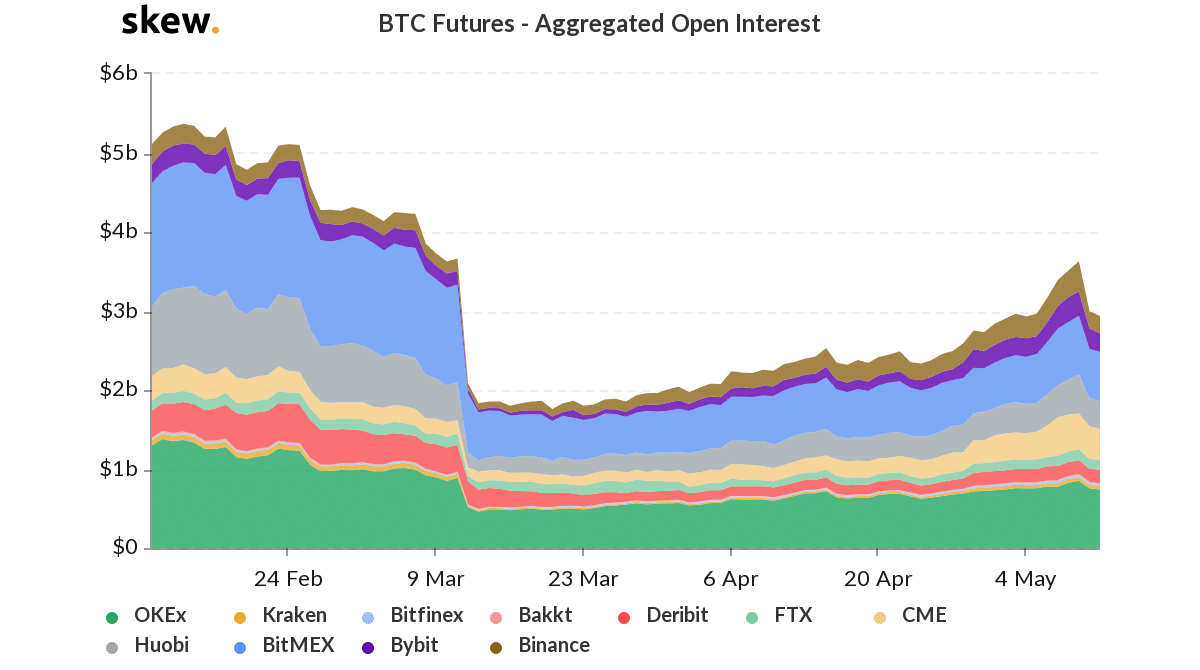

Data from the widespread monitoring resource Skew tracks the open interest for Bitcoin futures since the beginning of the year. Below is a chart that reveals how it relates to the price.

As seen in the picture, Bitcoin’s price tends to correlate to its open interest on the way down and when it’s increasing. The drop in both is particularly evident on March 12th – 13th when Bitcoin lost almost 40% of its value.

To conclude it, along with price and volume, open interest can determine the current market sentiment and signal a coming market trend. Take good use of it, you can easily make trading decisions and profit from the market fluctuations.

Bexplus is a bitcoin-based exchange that offers you the opportunity to get profits by speculating on the price rising and falling. In Bexplus, you can trade perpetual contracts of Bitcoin, ETH, LTC, EOS and XRP with 100x leverage. Join Bexplus, No KYC is required and you can enjoy 100% deposit bonus.

Place orders boldly based on Open interest data, you are prone to make profits in 100x leverage BTC margin trading in Bexplus!