Traders could push Bitcoin to $80,000 in US election frenzy

Bitcoin has experienced wild price swings since Vice President Kamala Harris announced her candidacy for the U.S. Presidential election in July 2024.

Table of Contents

The largest cryptocurrency attempted to test its previous all-time high of $73,738 on Oct. 29, 2024, with no success. Traders expect higher volatility closer to elections and in the aftermath of the event. Crypto prediction markets like Polymarket and Kalshi provide insight into crypto traders’ views.

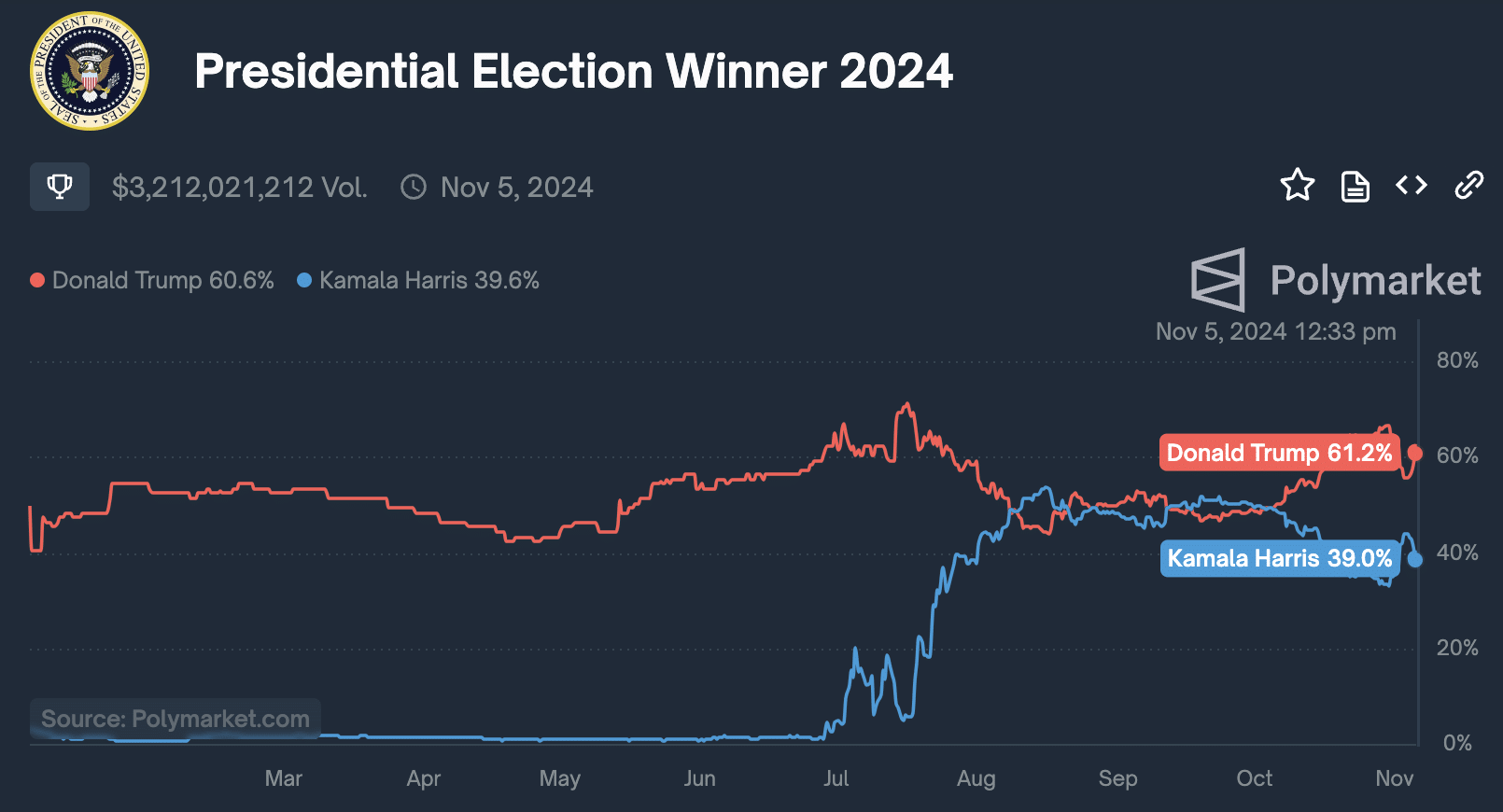

Polymarket sees about $3.21 billion in trading volume as participants wager on the winner of the November elections. Harris’ opponent, former U.S. President Donald Trump, is a clear favorite, with 61.1% bets in his favor, on Polymarket.

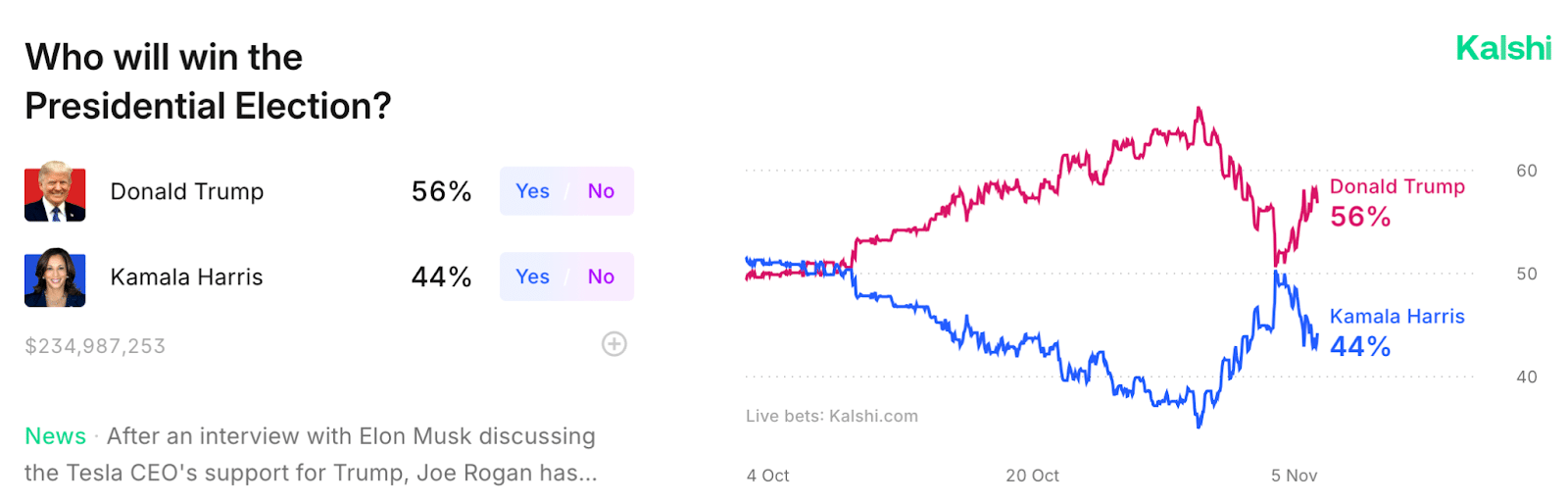

Kalshi, a prediction market regulated by the U.S. Commodity Futures Trading Commission places the odds of Trump’s win at 56.8% against Harris’ 43.2%. The betting contract has drawn $234.98 million as of November 5, 2024.

The efficacy of betting markets in predicting a winner in the election remains debatable, however it sheds light on the sentiment among crypto traders.

Trump rallied crypto traders’ support with his pro-crypto approach to regulation, and speech at the Nashville Bitcoin Conference. The former U.S. President shared his plans for a national Bitcoin reserve and proposed making the States a world leader in BTC mining. The former President’s plan is that the U.S. will hold 100% of the Bitcoin in its possession.

Harris’ “Opportunity Agenda for Black Men” is a proposal that reflects the Vice President’s stance on crypto, while much detail is left out, it points at a measured approach to the asset class.

U.S. markets won’t be open late on Tuesday, as states tally votes, however crypto is a major exception and a Trump win could push Bitcoin closer to the $80,000 level according to data from BTC derivatives markets.

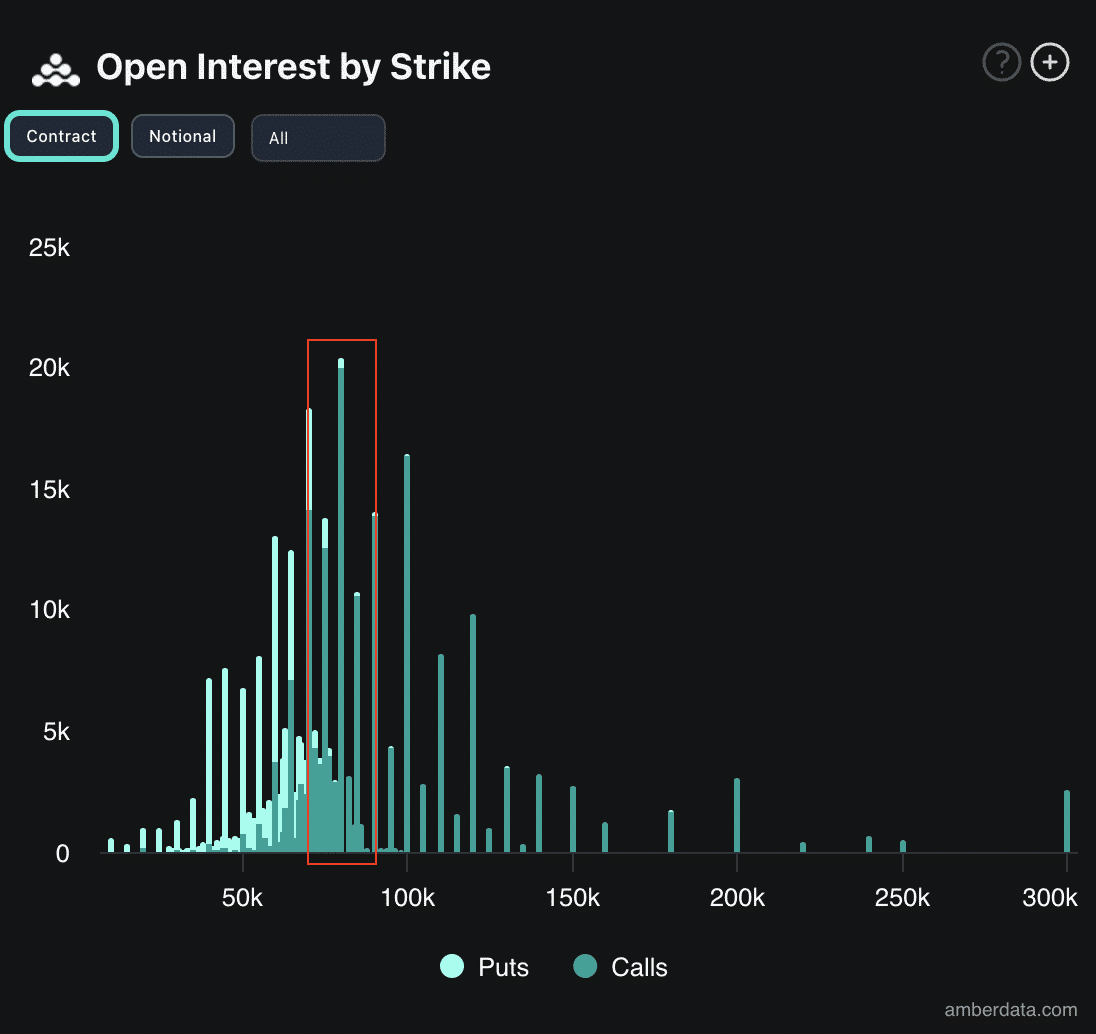

Derivatives data points at a run to the range between $60k – $80k

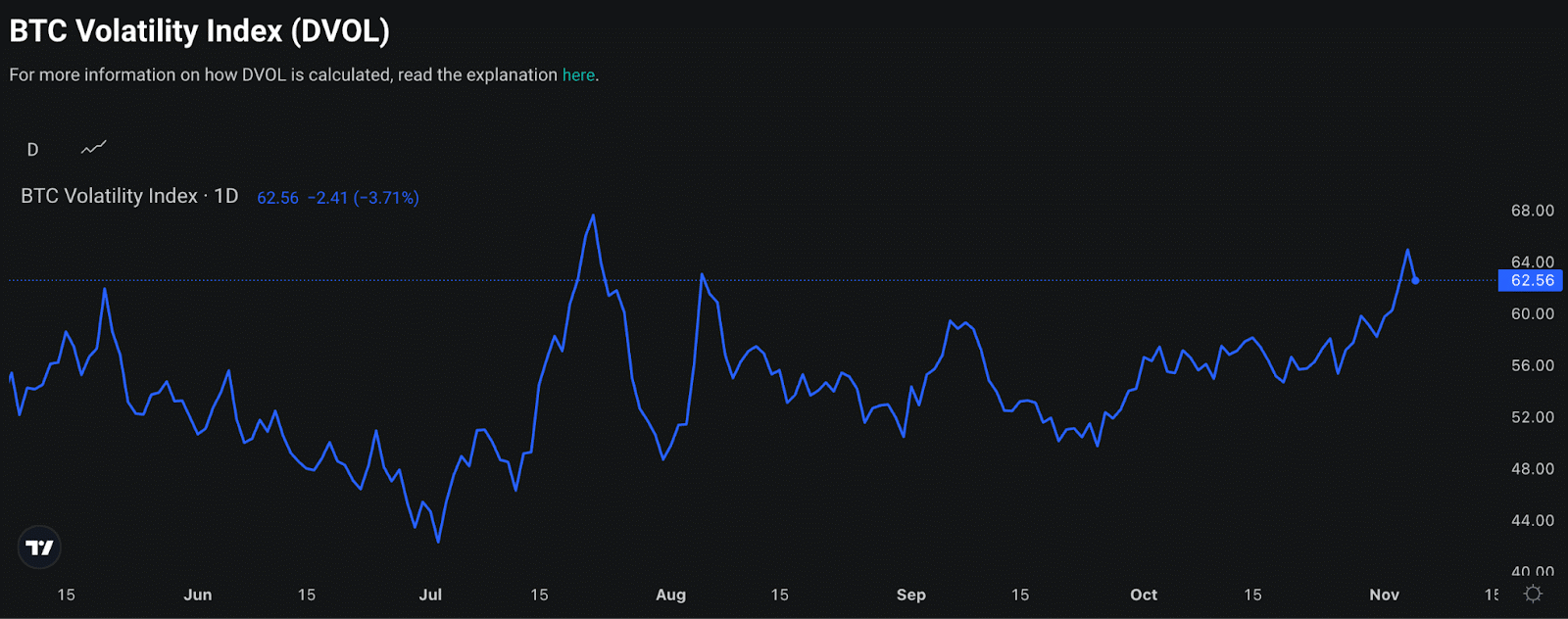

Deribit’s Bitcoin Volatility Index shows a consistent rise in volatility since September 26, 2024, however the metric failed to see a major move like one noted during President Joe Biden’s exit from the Presidential election, in July, and the U.S. markets correction in August.

For the weeks following the elections, data from Deribit exchange highlights the $60,000 to $80,000 range, as the one that collects the peak open interest, or outstanding futures contracts for both bullish and bearish bets of traders.

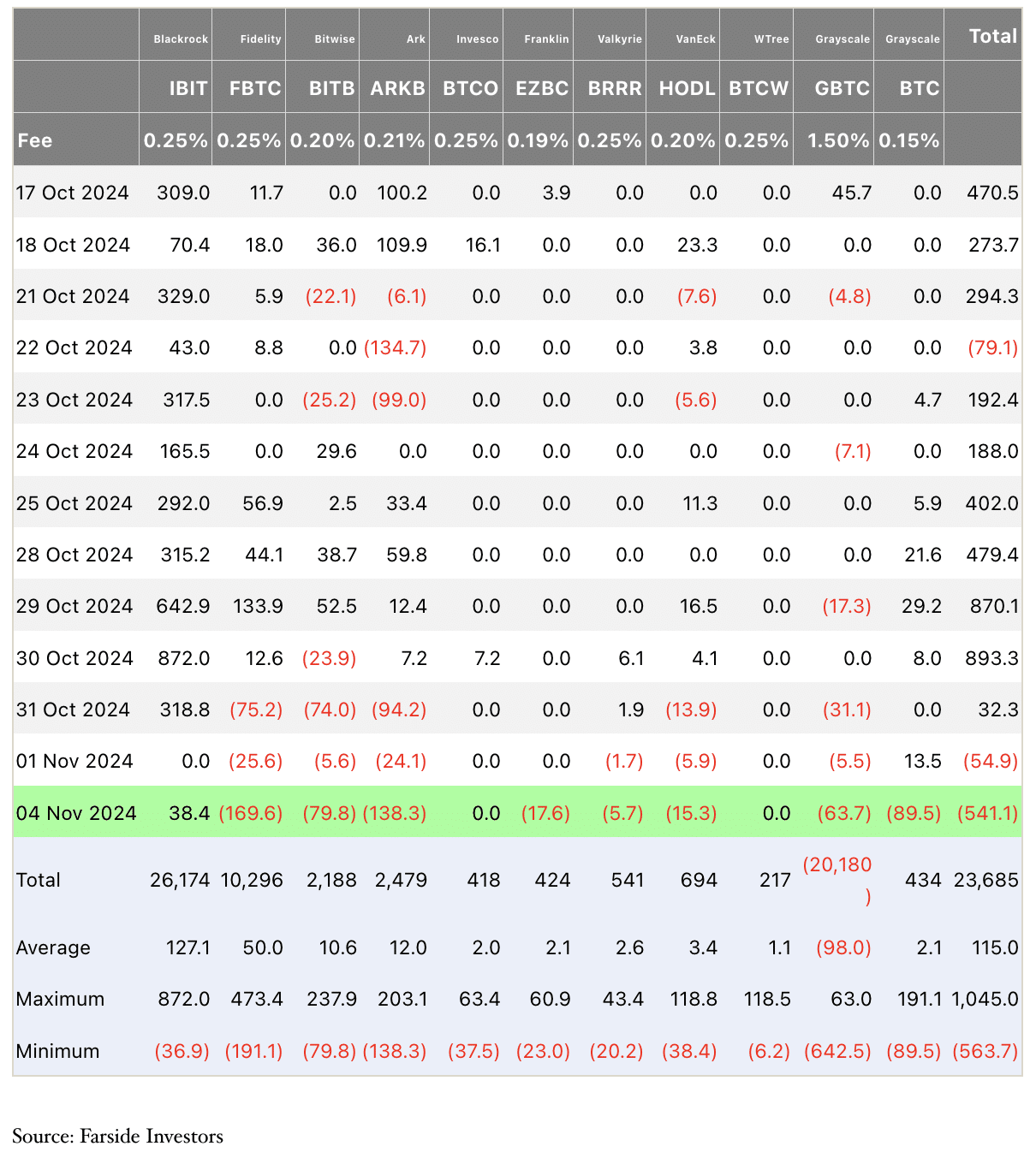

Bitcoin Spot Exchange Traded Fund inflow data from Farside Investors shows a net outflow of $541.10 million on Nov. 4. This marks the second consecutive day of institutional investors pulling capital from the asset, likely preparing for the volatility in the aftermath of the election.

Combining data from the prediction market and Farside Investors’ BTC ETF flows, it is observed that institutional investors expressed confidence in Bitcoin and increased their capital flow when the odds of a Trump win were higher, nearly 67%, on October 30. Bitcoin ETFs received a net of $893.3 million in inflows on the same day.

In March, (BTC) Bitcoin hit its all-time high of $73,738 in response to the large volume of capital inflow to U.S. based Spot Bitcoin ETFs. At the time of writing, on Tuesday, November 5, Bitcoin hovers around the $69,000 level, less than 10% away from the all-time high.

Technical analysis: Bitcoin eyes rally to new ATH

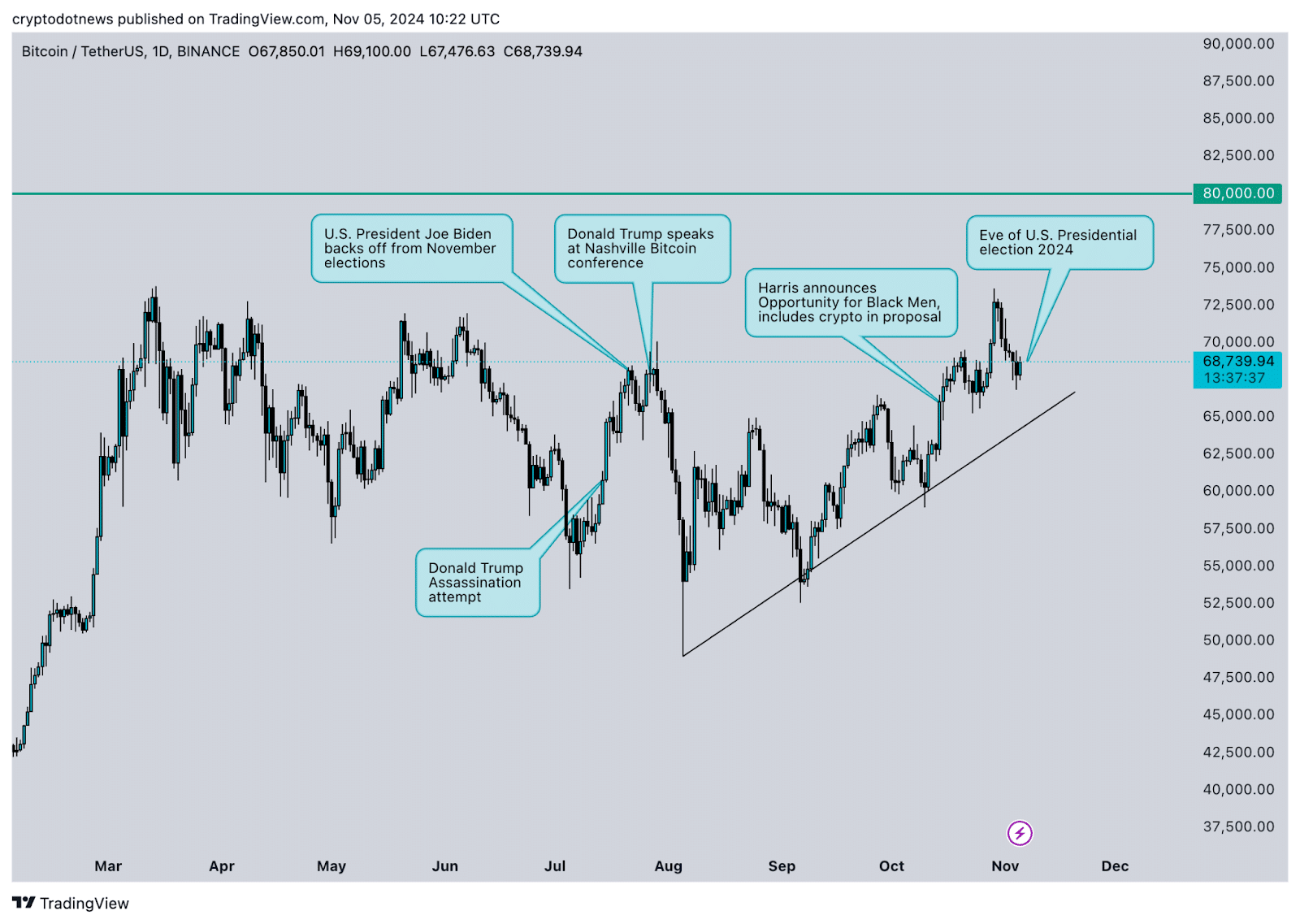

Key events since July 2024 have aided the price swings observed in Bitcoin. The BTC/USDT daily chart from TradingView shows BTC’s attempt to test its previous all-time high post Harris’s announcement of her proposal for crypto.

Derivatives data highlights the importance of the $60,000 to $80,000 range for Bitcoin price. The asset traded within this range throughout the events since July, with the exception of its August 5 decline to $49,000.

BTC is in a short-term uptrend, starting Aug. 5 and the token could extend its gains, forming higher highs and higher lows, post the eve of the elections, in the aftermath. Bitcoin’s previous all-time high at $73,738 is a key resistance and a successful break past this level could push BTC closer to its $80,000 target.

Bitcoin is still undervalued ahead of the election

Crypto.news talked to experts ti get insights on Bitcoin price.

“With the US Election taking place today, many believe that the price of crypto will be immediately swayed by the candidate who wins, since they have varying stances on the future of digital assets, with Trump historically being more inclusive of digital assets than Harris. While this may be true in the short term, traders should also consider that the price of crypto goes beyond what party directly supports and relies more heavily on policies they will implement around inflation, global political discourse, and the availability of investment opportunities within the digital assets space.”

BingX spokesperson

The BingX executive believes that the current cycle is one of the worst-performing ones, post the Bitcoin halving, leading to the belief that BTC is still undervalued.

“If we look at other market sentiment indicators, crypto-related stocks have been climbing, with MicroStrategy, and Robinhood both up in the month before today’s election. In general, the digital asset community should expect to see the price of digital assets rise solely based on historical indicators.”

“If the elected candidate is supportive of crypto, it could boost market confidence; if not, it could introduce some uncertainty. The uncertainty surrounding the election outcome could trigger market fluctuations. Investors should closely monitor election developments and market reactions and be prepared to manage risks accordingly.”

Ryan Lee, Chief Analyst at Bitget Research

“Politics is a secondary factor, and historical analysis suggests that one or two major catalysts typically drive bull markets.” Thielen explains how it would be absurd, “to assume that when Fed Chair Bernanke maintained low interest rates in 2011, your neighbor suddenly decided to use Bitcoin to buy contraband on the Silk Road exchange,” meaning looking for direct correlation between election outcomes and Bitcoin price reaction may be less than ideal.

Markus Thielen, CEO at 10x Research

The executive argues that the primary driver of the Bitcoin rally is the institutional adoption of BTC, sparked by BlackRock’s application for a Spot BTC ETF earlier this year.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.