Traders liquidated $193m in crypto amid Bitcoin’s surge

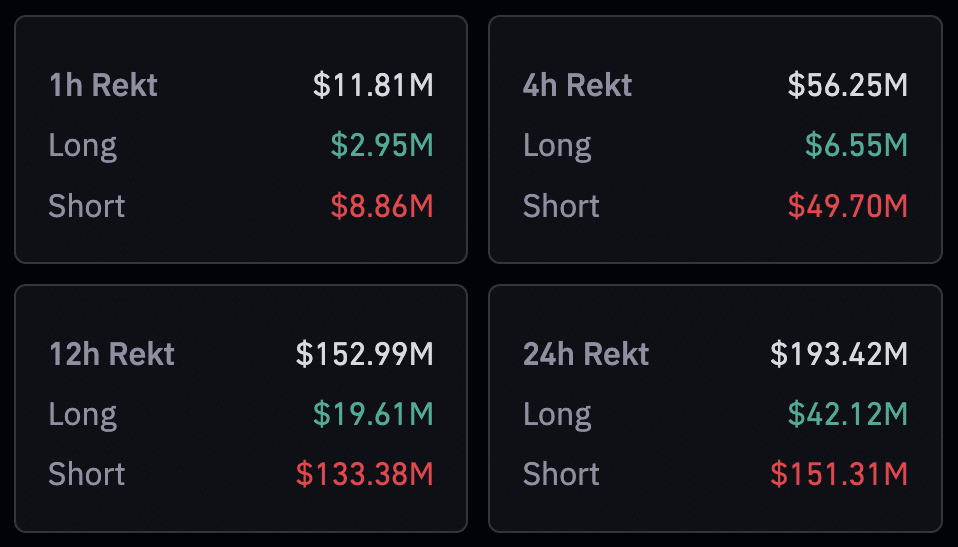

Cryptocurrency traders liquidated almost $193 million over the past 24 hours as Bitcoin hit a 20-month high.

According to Coinglass data, traders closed orders worth $74 million for Bitcoin (BTC) and $29 million for Ether (ETH), with several alt-coins also witnessing notable gains.

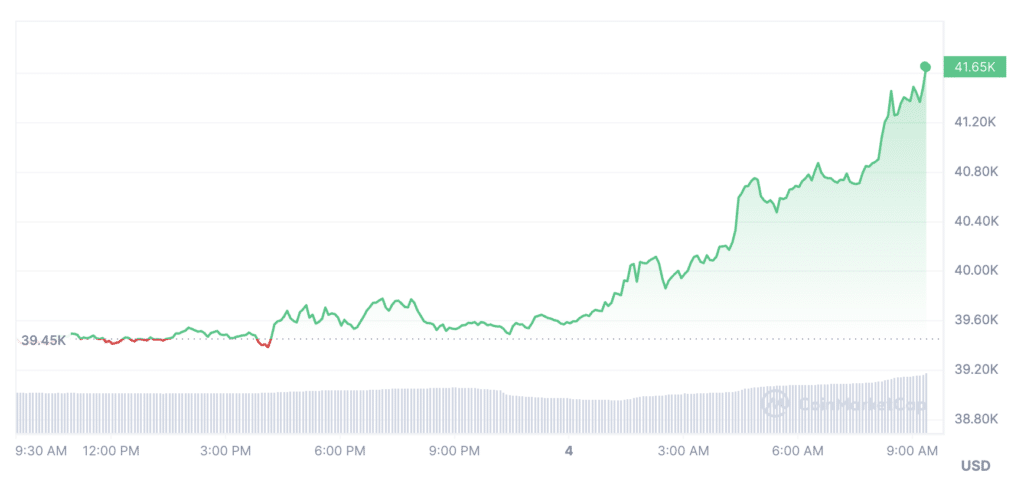

On Dec. 4, BTC crossed the $41,000 mark an increase of 5.5% over the past 24 hours. ETH followed as did the other largest alt-coins by market capitalization.

Notably, the price of Dogecoin (DOGE) was up 6%, Ripple (XRP) was up 2%, and Solana (SOL) was up 1.5%. In total, traders liquidated $2.3 million in DOGE, $1.38 million in XRP and $4.6 million in SOL.

The largest number of positions were liquidated on Binance, which saw 38.82% in liquidations. In second place was OKX with a share of 27.04% and in third place was Huobi with a share of 11.39%.

On Dec. 4, BTC shot above $41,000, reaching a 20-month high. In just the past year, Bitcoin has increased by more than 145%.

Noticeable changes in the cryptocurrency market are associated with two factors. The first is the hotly anticipated approval of a a spot Bitcoin exchange traded fund, or ETF, which is an open-ended fund with a more dynamic share issuance system allowing institutional investors to enter the market. The second is the situation with U.S. Federal Reserve interest rates, which currently stand at 5.25%-5.5%. When the Federal Reserve raises interest rates, it generally signals a tightening of monetary policy. Higher interest rates can reduce liquidity in the market, making riskier assets like Bitcoin less attractive.