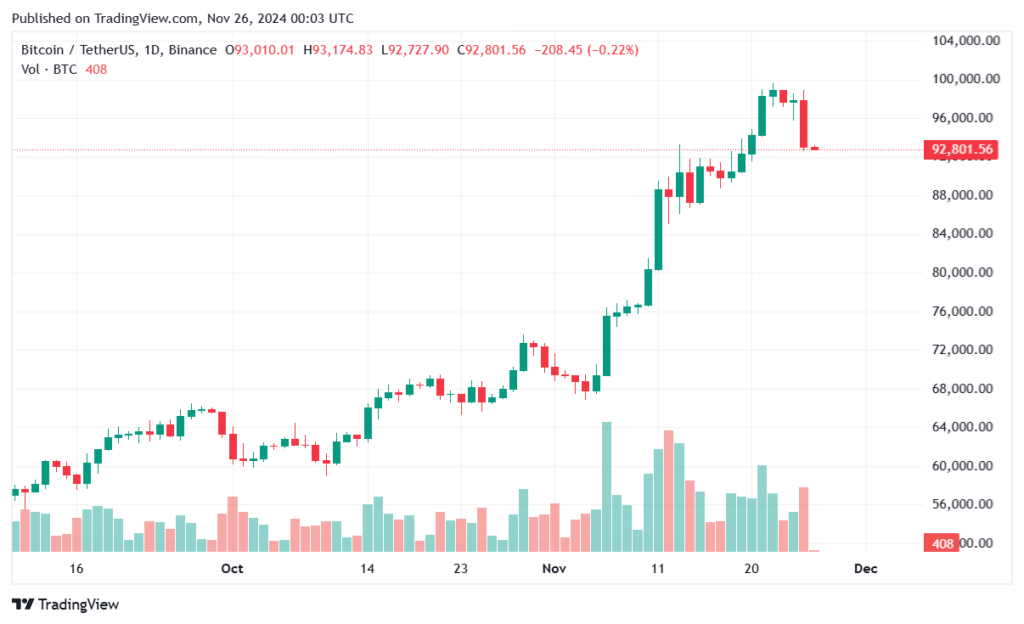

Traders seen $553 million crypto liquidations as Bitcoin dropped $92k

Traders have witnessed a massive half-billion dollar amount of crypto liquidations in a day after Bitcoin dropped to its lowest price in the past week.

According to Coinglass’s data on Nov. 25, crypto traders have seen massive liquidation of about $553 million in the past day of trading. Traders with long positions have liquidated $413 million as Bitcoin price dropped to $92k, decreasing almost 5% in a day.

The long positions in the last 12 hours and 4 hours have seen major crypto liquidation with $344 million and $140 million, respectively. The short positions in the past day also raised into triple digits, $138 million.

Bitcoin (BTC) and Ethereum (ETH) are the most significant contributors to crypto liquidation. At the time of writing, Bitcoin recorded $24 in both positions, while Ethereum recorded $11 in the long positions and $3 million in the short one.

Around 169,879 crypto traders have liquidated in the past day, and traders from the Binance exchange are the most significant number of liquidations with $4.67 million in BTC/USDT pair.

The crypto market capitalization in amount also dropped almost 3% to $3.23 trillion, and the trading volume is around $240 billion.

Crypto liquidations continue

Small market capitalizations of altcoins have seen a significant impact due to the crypto liquidations; around $100 million have been lost in the market. A total of $494 million was liquidated on Nov. 24.

This market-wide correction is considered normal conditions after the Bitcoin rally in the past month. Based on CoinMarketCap data today, Bitcoin still dominates the market at 57.4%, and the crypto fear-greed index showed 82 points, which indicates the market is in a highly greedy position.

This wave momentum also potentially triggered further bullish as macro-economy conditions, specifically in the United States, are promising the future of crypto. It would also bring a positive sentiment towards the market after Bitcoin’s dominance dropped and impact the altcoins rally.