Tron price rises as SunPump meme coins dive

Tron price held steady on Saturday, Sep. 21 as most SunPump tokens retreated.

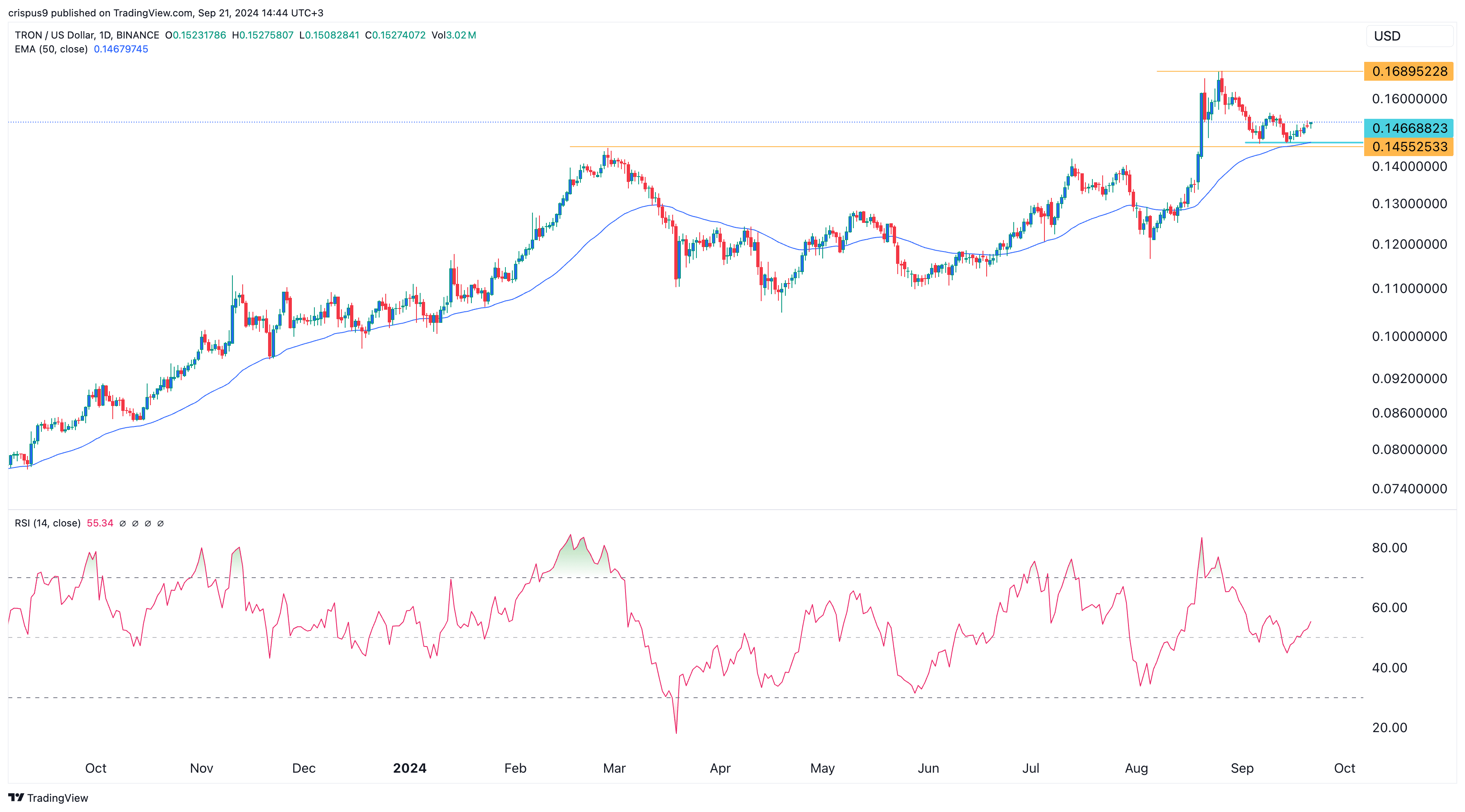

Tron (TRX) rose to $0.1520, a few points above this week’s low of $0.1467, and 11% below its highest point this year.

SunPump tokens crash

Data by CoinGecko shows that most SunPump meme coins have retreated in the past few days.

- Sundog (SUNDOG), the biggest coin in its ecosystem, has dropped by 11.1% in the past seven days to $0.30, bringing its market cap to $305 million.

- Tron Bull retreated by 8%

- Muncat, 35%,

- SunWukong, 10%,

- Suncat tokens, 37% in the same period.

Altogether, the total market cap of all meme coins in Tron’s ecosystem has dropped from over $560 million to $514 million.

This performance has affected Tron’s DEX volume, which has dropped by 10% in the last seven days to $453.6 million. Other chains like Solana (SOL), Binance Chain, and Sui have seen their DEX volumes jump by 11%, 22%, and 70% in this period.

On the positive side, the number of transactions in Tron has risen, according to Nansen. These transactions rose to over 8.2 million on Saturday, its highest point since Aug. 27 and much higher than this month’s low of 6.14 million.

Tron is also one of the most profitable networks in the crypto industry.

Data by TokenTerminal shows that its network fees this year stand at over $1.2 billion, second only to Ethereum’s $1.86 billion.

SunPump tokens have generated over $44.8 million in fees since inception.

Another positive is that Tron’s staking yield has bounced back to 4.97%, higher than last month’s low of 4.35%. This rebound happened as the volume of Tron burn and gas fees rose during the month.

Tron’s technicals are supportive

Technically, Tron has some encouraging metrics. It formed a double-bottom pattern at $0.1466 between August and September. This bottom was a few points above the key support at $0.1455, its highest swing in February this year.

Tron has also held steady above the 50-day moving average while the Relative Strength Index has risen above 50. That is a sign that it may continue rising as bulls target the year-to-date high of $0.1690.