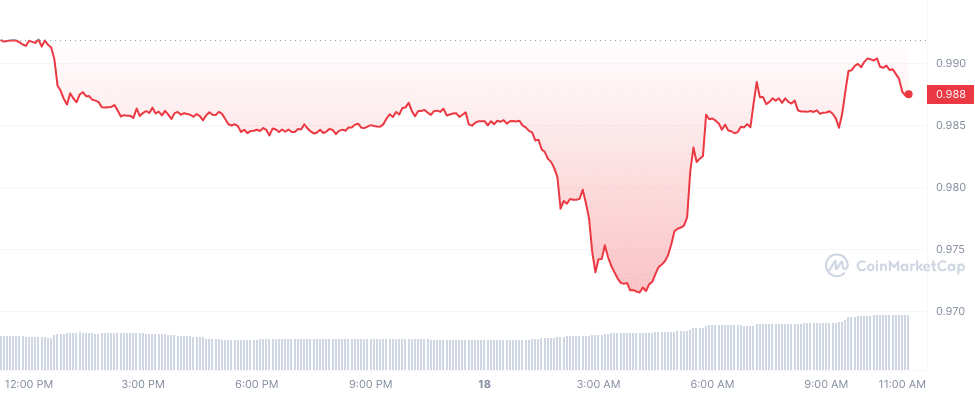

TrueUSD on a wild ride: down to $0.97 and back to $0.99

Stablecoin TrueUSD has fallen from its expected one US dollar peg after recent issues with its reserve attestation.

TrueUSD (TUSD) has seen a low of just over $0.97 per token earlier today, 3% down from its expected value of one dollar. The token has regained most of its value and is currently trading at just under $0.99. This value is just under 99% of its expected peg, a degree of deviation that this stablecoin sees often.

The instability in TrueUSD’s price follows Jan. 11 reports that the stablecoin has found difficulties with attestations for its underlying reserves. At the time, the system encountered API issues or did not receive a response from the source that provides pricing, resulting in its inability to assign a U.S. dollar value to the collateral assets at that specific moment.

As of press time, the same source indicates $1.93 billion of collateral backing $1.911 billion worth of assets for a collateralization of about 101%. The fall was also preceded by Binance announcing support for Manta farming by staking both BNB and First Digital USD (FDUSD) with lacking TUSD support on Jan. 15.

Binance data reported earlier today by Lookonchain shows that TUSD orders were mostly large, which the firm suggests is a sign that whales are selling TUSD. On-chain data also indicates that the total circulating supply fell to 1.881 billion at the time of the Lookonchain analysis, down by 43% over the last three monoths.

Of all this TrueUSD, 1.7 billion is held on Binance wallets — accounting for 90.4% of the circulating supply. On-chain data also shows that a whale who had been dormant for about 560 days deposited 2.5 million TUSD to Binance on Jan. 16. An address suspected to be controlled by Tron (TRX) co-founder with TrueUSD links Justin Sun has burned 104M of TUSD after the depegging and deposited 200M USDT to Binance shortly before withdrawing nearly $140 million worth of TUSD.

Similarly, another whale withdrew 31.6 million TUSD from Binance and deposited it to Tron-based DeFi protocol JustLend after the depegging. Then the user borrowed nearly 19 million USDT to deposit into Binance.

The last dip in the percentage held by the top 10 holders down from 79.54% to 78.78% happened from Jan. 15 to Jan. 16. This does not correspond to any major price dip and instead seems to be correlated with Jan. 16 reports started circulating that TrueUSD client data, including names and blockchain wallet addresses, having been exposed following a security breach involving a third-party vendor.