Trump survives assassination attempt: Bitcoin soars, what’s next for crypto?

What unexpected twists in the crypto market are unfolding after Trump’s shooting, and how might this event alter the course of events?

On a sunny Saturday in Pennsylvania, an unexpected event unfolded: Donald Trump, the former president of the United States and a prominent supporter of crypto, was shot in the right ear during one of his political rallies.

In the immediate aftermath of the attack, Trump’s campaign assured the public of his well-being, stating that he was “fine” and eager to attend the Republican National Convention in Milwaukee.

This surge in attention and the dramatic nature of the incident have led to a significant shift in market sentiment. Trump, known for his pro-crypto stance, now finds his odds of a political comeback greatly increased.

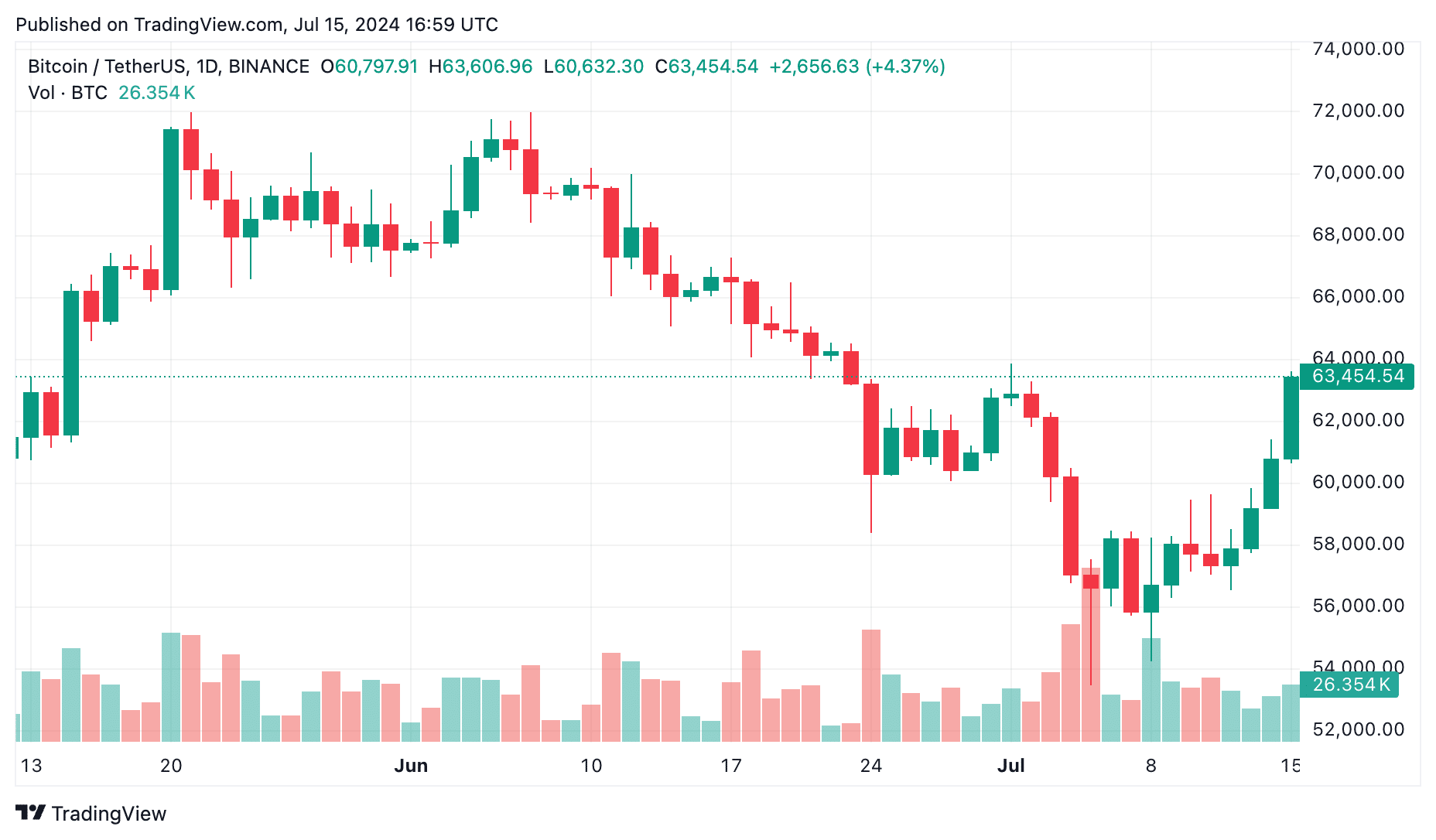

As a result, the crypto market has surged with optimism. Bitcoin (BTC), which was trading at around $58,000 before the incident, surged to a high of $63,218 shortly after the news broke. As of July 15, BTC is holding strong at $63,154, marking a 5% gain in the last 24 hours.

The rebound in Bitcoin’s price is particularly crucial as it has surpassed the critical 200-day simple moving average (SMA), a key indicator for long-term trends, suggesting positive momentum for traders.

This bullish sentiment isn’t limited to Bitcoin alone; the entire crypto market has seen a resurgence, with the total market cap climbing nearly 5% to reach $2.29 trillion.

Ethereum (ETH) also witnessed a rise of nearly 5.5%, trading around $3,350, and several altcoins, including Mogcoin (MOG), Pendle (PENDLE), and Stacks (STX), experienced double-digit gains.

Let’s delve deeper into the current sentiment surrounding this event, explore upcoming trends, and examine the reactions from analysts and market participants.

Trump’s resurgence and Crypto’s fate

In recent months, Trump has shifted his stance towards crypto, positioning himself as a pro-crypto candidate to outmaneuver his rival, Joe Biden, aiming to attract the crypto community, which seeks a more favorable regulatory environment.

Trump has not only voiced support for the local blockchain and crypto sector but has also integrated crypto into his campaign. His campaign accepts crypto donations, and he has pledged to support Bitcoin mining if he returns to the White House.

Even after the assassination attempt, Trump remains undeterred in his efforts to engage with the crypto community. He is scheduled to speak at the Bitcoin 2024 conference in Nashville later this month, as confirmed by the organizers.

According to reports, Trump’s attendance at the conference is expected to help him raise $15 million from donors, with Bitcoin Magazine CEO David Bailey having lobbied for the event multiple times with Trump and his team.

Meanwhile, the sentiment around Trump’s resurgence is evident on the decentralized prediction market platform Polymarket, where 71% of users now bet on Trump’s victory in the upcoming presidential election—a large increase from about 60% around the time of the shooting.

In contrast, President Joe Biden’s chances of winning stand at 18% on the same platform, 4 times lesser.

Amid this, Bitcoin ETFs saw $1.4 billion in inflows last week, marking the fifth-largest weekly inflow since their inception in January 2024, closely aligning with the potential return of Trump to power.

Speculations and support on social media networks

In the wake of the assassination attempt on Donald Trump, the crypto market has been buzzing with new developments, especially on the Solana (SOL) blockchain.

Solana has been a breeding ground for meme coins lately, with platforms like Pump.fun making it easy for users to launch their own tokens.

Following the incident, a surge of new meme coins inspired by the event has emerged. Coins such as “The Ear Stays On,” “Trump Fights Gun,” and several others have captured the market’s attention, achieving millions in market cap within hours of the attack.

Michaël van de Poppe, a well-known crypto analyst, highlighted that Germany has finished selling its Bitcoin holdings, which could remove some downward pressure on the market.

He also mentioned that the current global uncertainty, amplified by the assassination attempt, creates a favorable environment for Bitcoin to rise, and the upcoming Ethereum ETF launch, could further boost the crypto market.

Stockmoney Lizards referred to the Trump assassination attempt as a “black swan event,” an unexpected occurrence that typically has severe consequences. However, they noted that this event is unique in potentially driving gains in the crypto market.

According to their analysis, the possibility of Trump’s return to the presidency has not yet been fully factored into Bitcoin’s price, implying room for further growth as the political situation evolves.

Bitcoin Magazine shared another shift in perspective from Larry Fink, CEO of BlackRock. Once a critic of Bitcoin, Fink has become a major believer after studying it closely, particularly since BlackRock launched its own spot Bitcoin ETFs in January.

His endorsement can be seen as a bullish signal, given BlackRock’s influence and the growing acceptance of Bitcoin among institutional investors.

While the market is experiencing a bullish wave, it’s essential to proceed with caution. The influx of meme coins can create bubbles that are prone to bursting, leading to sudden and exponential losses.

As always, it’s crucial to do thorough research and not rely solely on market sentiment driven by current events.