U.S. to Postpone Re-Opening May Take Bitcoin Lower

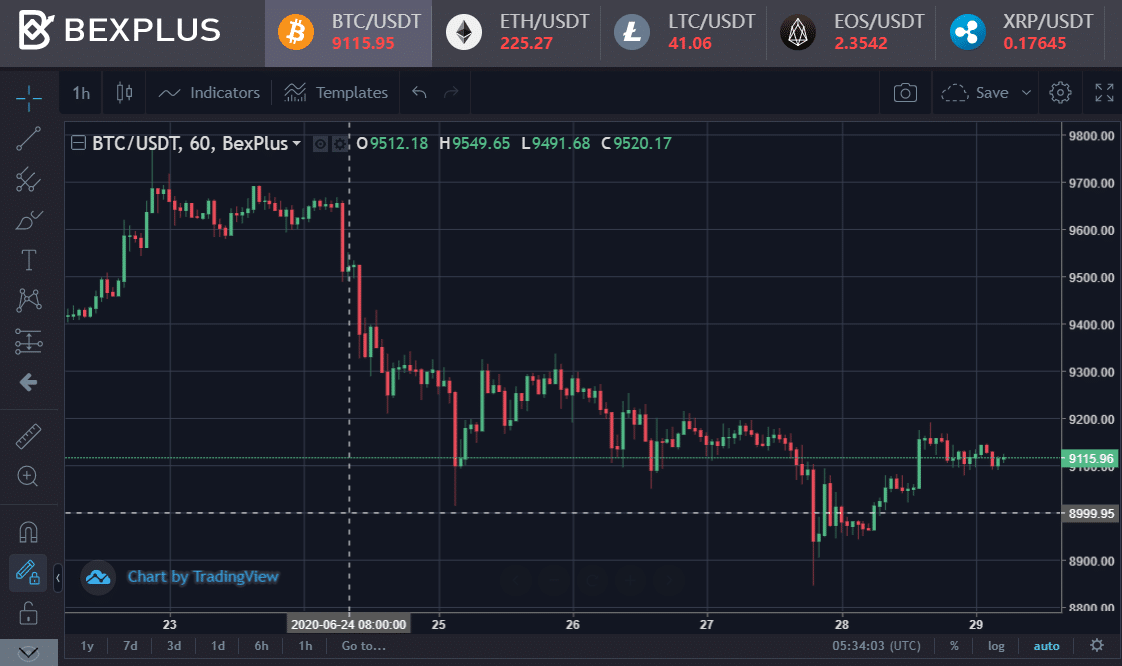

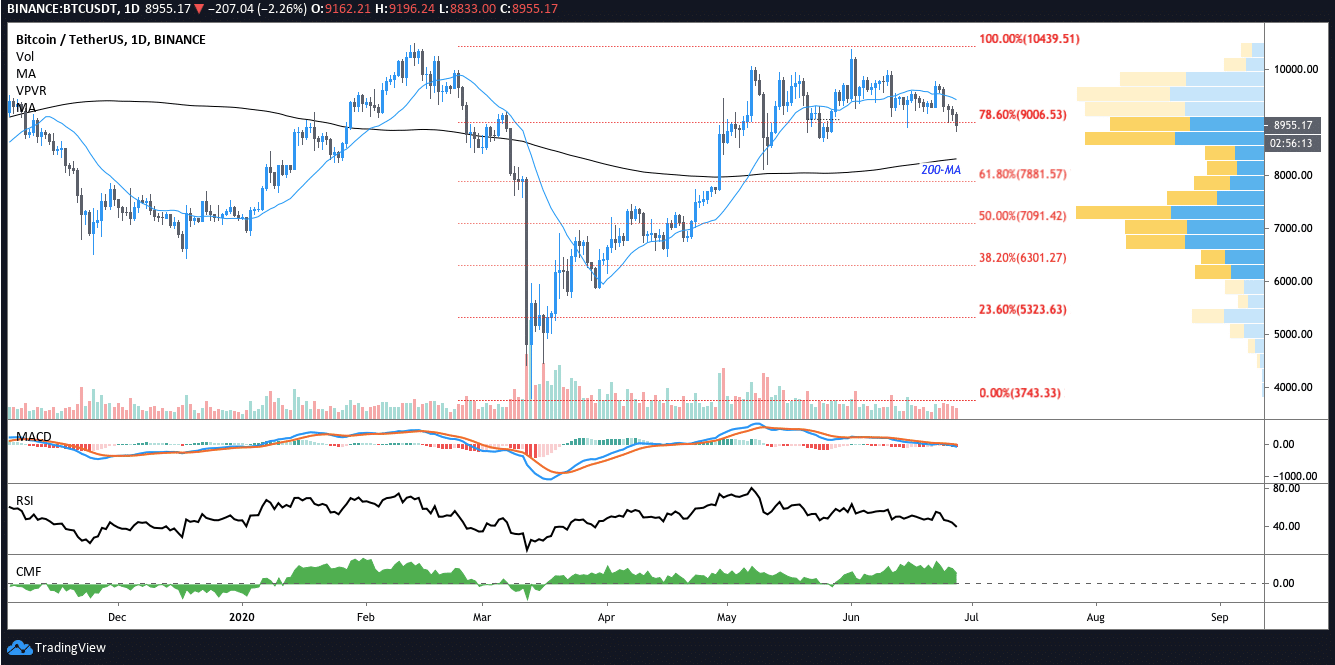

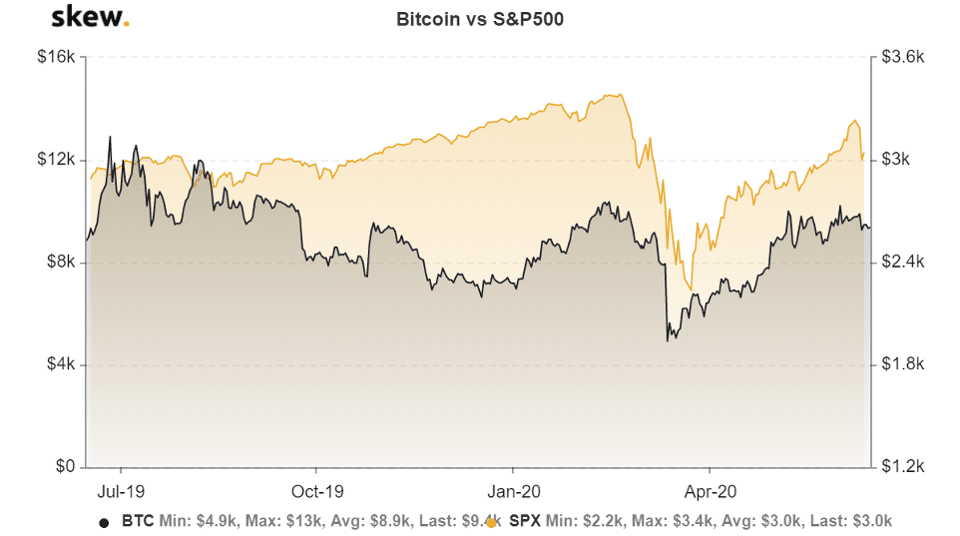

Bitcoin failed to protect the $9,200 zone on Wednesday and plummeted all the way from $9,600 to $8,900, recording a 12.7% fall since the month’s peak. The sudden drop in price could be attributed to the bearish performance of the S&P 500, which declined by 9.27% on June 26 alone.

The stock market has been trading lower for the past few days. On June 28, the Dow Jones recorded a 3% loss while the S&P 500 depreciated 2.4%. Bearish mood is looming above traditional markets as an upsurge in coronavirus cases deters the country from re-opening.

On June 27, five states recorded new highs in daily cases. Now more than 2.5 million U.S. citizens are confirmed to get infected, and the U.S. has the highest death toll in the world. In response to the pandemic spike, Texas closed down bars across the state. As for Florida, where 9,585 new cases were reported on Saturday, tighten restrictions on business. Although Florida is a key swing state in the election, Mike Pence chose to cancel his campaign bus tour amid the pandemic spike.

In view of the gloomy economy prospect, people naturally turn on their “risk-off” mode. Although bitcoin has had a great start at the beginning of 2020, the sudden crash in March and the lackluster weeks following the third halving had many traders wonder whether now is a good time to invest in bitcoin. Currently, bitcoin has lost the $9,200 resistance mark, without a strong support at $8,325, a pullback to $7,000 is not impossible.

Bitcoin has been in sync with the S&P 500 since March, and the sluggish stock market is very likely to threaten bitcoin from rallying.

Meanwhile, traders are trying to boost the stock market, as many believe the U.S. is better prepared for the pandemic than it was a few months ago. Furthermore, there has been some good news lately that gives a confidence boost to traders. The U.S. unemployment initial jobless claims are declining, and the consumer spending in May has had a record jump of 8.2% in May. The U.S. economy is expected to return to normal in the intermediate-term, and with the implementation of QE, both the stock market and bitcoin can get a big boost. But in the short-term, bitcoin is still trading in a dangerous zone as the $9,000 support level has been worn out.

How to Benefit from the Bear Market

If you are a hodler, bitcoin depreciation is certainly bad news, and you might regret buying bitcoin when it was trading $8,000 or even above. But with leveraged trading, we can earn more bitcoins even in the bear market.

Leveraged trading is a popular and mature instrument in crypto trading. You can long or short bitcoin and earn profits as long as your speculation is correct. Another feature of leveraged trading is that you can borrow leverage from exchanges to open a position far greater than your initial funds, thus enhancing your chances of making profits.

Let’s see how we can benefit from the price drop of bitcoin:

Assume we used 1 BTC to open a short contract on June 24 when it was trading at $9,600. Please note that with 100x leverage, 1 BTC can open a contract worth 100 BTC.

On June 27, the price of bitcoin dropped to $9,100.The profit will be ($9,600 – $9,100) * 100 BTC/$9,100 *100% = 5.49 BTC, making the ROI 549%.

On June 28, the price of bitcoin got another hit and dropped to $8,900. The profit will be ($9,600 – $8,900) * 100 BTC/$8,900 *100% = 7.87 BTC, making the ROI 787%.

What if the pandemic aggravates and bitcoin drops all the way to $8,000? If we invested that 1 BTC in spot trading, we will lose ($9,600 – $8,000) = $1,600 = 0.2 BTC. But since we are shorting BTC, our profit will be ($9,600 – $8,000) * 100 BTC/$8,000 *100% = 20 BTC, and our ROI will be 2000%. Obviously, leveraged trading can help us generate much more profits compared with spot trading.

Bexplus: A Go-to Crypto Exchange in The Depressed Market

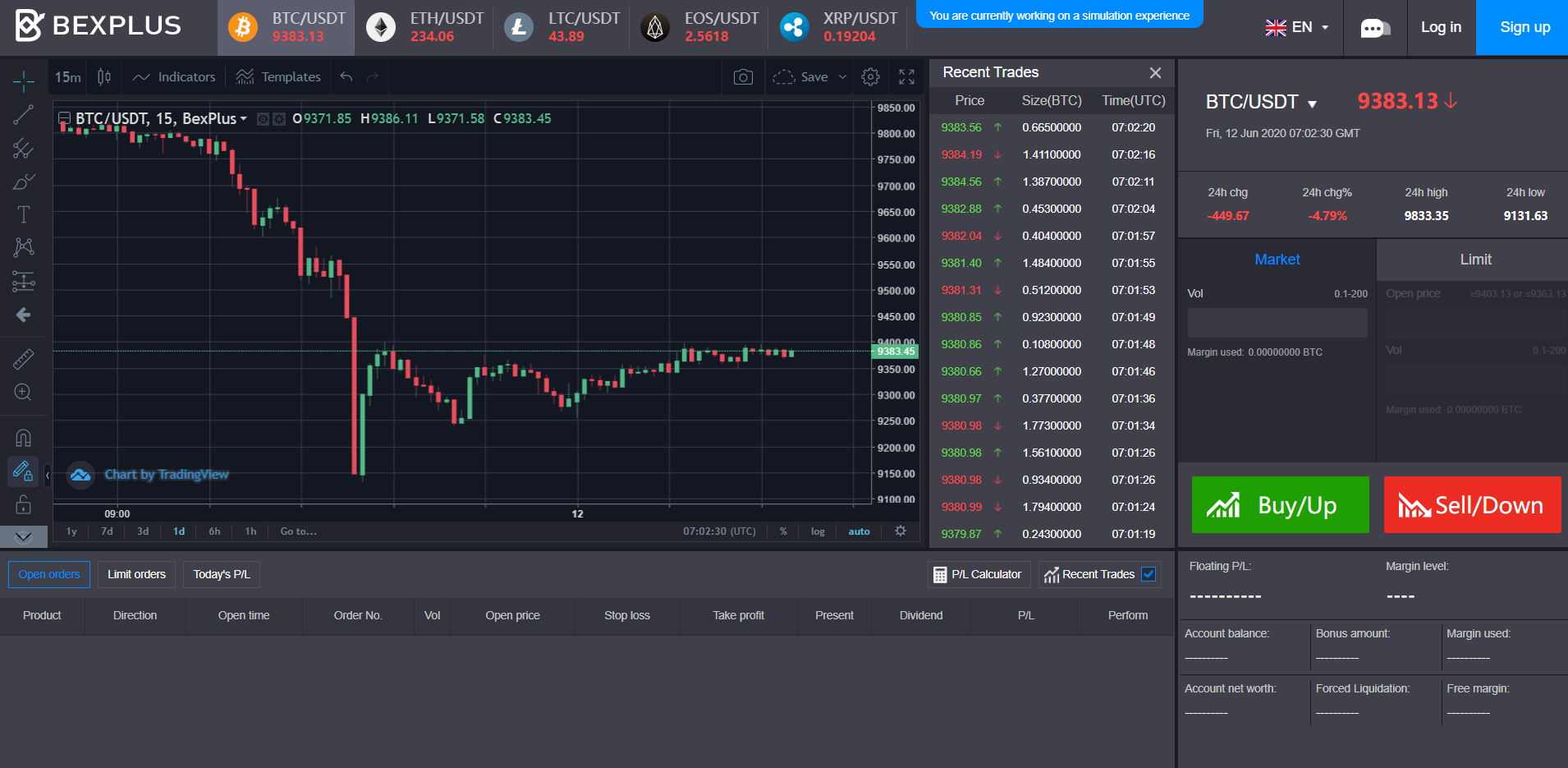

Registered in Saint Vincent and the Grenadines, Bexplus is a leading crypto derivatives trading platform offering 100x leverage futures trading on BTC, ETH, LTC, EOS, XRP and etc.

Easy registration with no KYC

Anonymity is highly valued in Bexplus, hence the no KYC policy. Only email verification is needed and the registration process only takes one minute.

Demo account for beginners

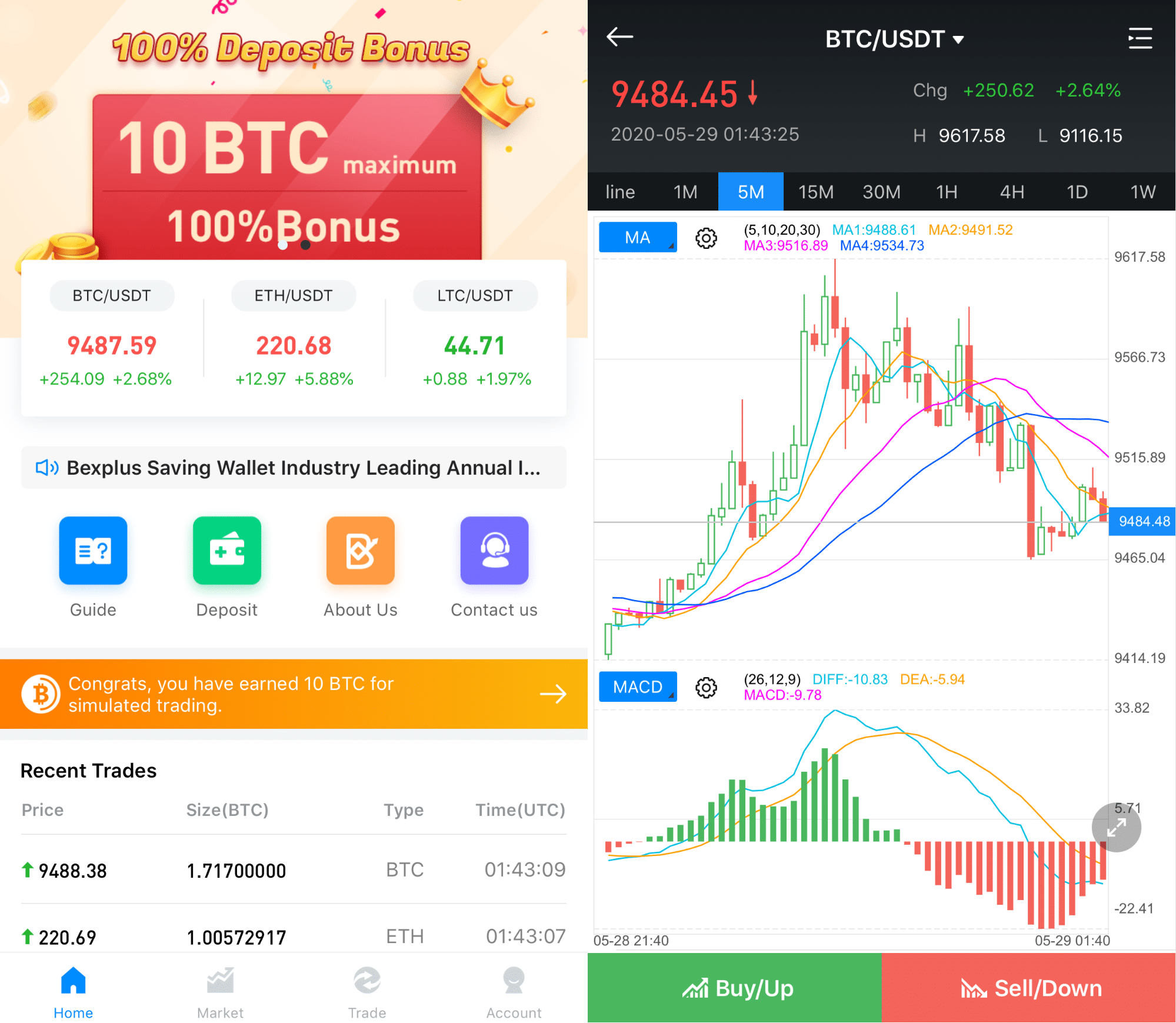

If you are new to leveraged trading, don’t worry. Bexplus is one of the most user-friendly platforms with its intuitive trading interface and demo account. Upon registration, each user will get a demo account with 10 replenishable BTC. You can practice to your heart’s content. For advanced traders, there are a variety of analytical tools in the trading engine to analyze the market.

Powerful mobile support

How to take a break from trading when bitcoin trades around the clock? The top-ranking Bexplus app helps you better manage your account. With the 24/7 notification, you can stay updated with the market. All data and assets can be accessed through all kinds of devices including desktops, mobile phones, and tablets.

No deposit fee and super-fast withdrawal

Bexplus requires no deposit fee, you can start your deposit from 0.001 BTC and begin your accumulation. You can file a withdrawal request 24/7, and withdrawal usually takes 30 minutes during work hours.

Bexplus now offers a 100% deposit bonus to each trader. You can earn up to 10 BTC each deposit. With double funds, your profits will be doubled. Now active users can get 10% off of their transaction fee.

Follow Bexplus on:

Website: https://www.bexplus.com/

Telegram: https://t.me/bexplusexchange

Apple App Store: https://itunes.apple.com/app/id1442189260?mt=8

Google Play: https://play.google.com/store/apps/details?id=com.lingxi.bexplus